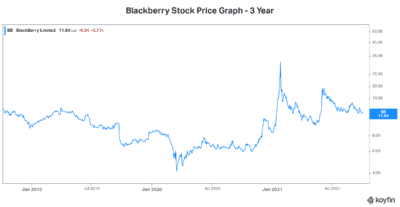

BlackBerry (TSX:BB)(NYSE:BB) is one of Canada’s best-known tech stocks. Formerly a handheld phone business, the company has worked hard in recent years to transform itself. After it pretty much crashed and burned, BlackBerry stock was dead money. But in 2021, things are changing. Motley Fool investors need to look no further than BlackBerry’s stock price action to see this.

So, why exactly has BlackBerry soared 37% in 2021?

BlackBerry’s stock price soars on potential

Yes, it’s true: BlackBerry hasn’t shown us the growth. Yet the potential is there. In fact, the potential is huge. But we’re still waiting, and this has been a long road. Thankfully, stock prices are a reflection of expectations. So, while we’re still waiting, rising expectations were enough to take BlackBerry stock higher in 2021.

Let’s start off by highlighting the obvious. That is that BlackBerry is working in two of the most lucrative industries of our time. The first is the cybersecurity industry. This industry has strong growth tailwinds. It’s increasingly needed as we all become more digital and as cyber-crimes become increasingly common. The second industry is the machine-to-machine connectivity industry. Connected and self-driving cars are the most well-known applications. But the opportunity runs far deeper than that.

Within these industries, there are many competitors. Some of them are far larger with far more resources. But, that doesn’t change the fact that BlackBerry’s technology across the board is game changing. It’s won awards. It’s gotten the seal of approval from numerous Fortune 500 companies. And it’s taking us into the future.

BlackBerry stock: What’s the deal?

BlackBerry stock has soared in 2021. It all began after a long road of setbacks. Some investors had lost hope. In fact, some were shorting the stock, even though it was already trading at the depths of despair. Then the Reddit crowd got their hooks into it. We’ve published many articles about this on our Motley Fool Canada site. In a nutshell, Reddit investors banded together to try to squeeze the shorts out. This drove the stock price above $30 at the beginning of the year. While this craze has subsided, the stock hasn’t gone back to 2020 levels. A new floor seems to have been formed — at least for now.

At this point, the stock is hovering at around $12. It shows no signs of a comeback. But I think it’s the calm before the “storm.” In its last quarter, BlackBerry beat expectations. This is a good sign and often proceeds a sharp rise in a stock’s price. Furthermore, the quarter was a cash flow positive quarter. And it seems that management is seeing better times ahead. For example, growth in billings and orders is strong.

Right now, consensus earnings estimates are calling for BlackBerry to swing to net earnings in 2023. Some are expecting this to happen next year. This would be an inflection point. We can wait for this to happen, but by then, the stock’s valuation will reflect it. While risks remain, we’re clearly already seeing the improvement in Blackberry’s financials. It’s early days, and patience is required, but the upside is huge.

Motley Fool: The bottom line

It’s certainly been an interesting year for BlackBerry. Its stock price has really soared in 2021. While this was due in part to increased attention and buying from the Reddit crowd, there is real potential in BlackBerry. If we begin to see signs of growth in the company’s results, 2021 will be the beginning of something big.