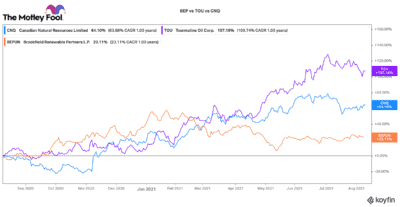

Over the past few years, Canadian investors have debated between owning traditional energy stocks and renewable stocks. Yet, right now, I believe both segments have merit.

Oil or renewable stocks or both?

Oil-related energy stocks still look pretty undervalued. Oil and natural gas production across the world is down. Yet, demand could skyrocket once the COVID-19 pandemic fully subsides. Many Canadian energy stocks are in the best financial position they have ever been in. As a result, they are yielding tons of free cash flow at today’s commodity prices.

On the flip side, renewable energy stocks have taken a hit in 2021. They had a strong run-up over the pandemic and many have fallen back to earth. In a world that is steadily decarbonizing, these are stocks that have merit long into the future. Many have very strong growth pipelines and generally produce stable, growing streams of cash.

Considering these two dynamics, here are three Canadian energy stocks I would not hesitate to buy and hold for the short and long term.

A top Canadian natural gas stock

Tourmaline Oil (TSX:TOU) is one of Canada’s largest natural gas producers. This stock has recently pulled back 10% from hitting 52-week highs. I think it looks pretty attractive for a short and long-term bet.

It has a dominant position in the largest natural gas plays in Alberta and British Columbia and ample reserves and incredibly efficient operations. Right now, it is producing so much free cash flow that it could be debt-free and in a net cash position by early next year.

As free cash flow continues to accumulate, acquisitions, increased production, share buybacks, and dividend rate increases could all be on the menu for Tourmaline. The stock pays a nice 2% dividend right now.

A top Canadian integrated energy producer

The other most dominant natural gas producer in Canada is Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ). Like Tourmaline, this Canadian stock has recently pulled back from highs. Trading with a 4.6% dividend yield, it too looks pretty attractive.

This company produces oil and natural gas with factory-like efficiency. It has very large reserves and low decline rates. Once in production, its assets can produce at an incredibly low cost. With oil prices at or near $70 per barrel, it is able to produce significant free cash flow yields.

In the second quarter alone, it produced $1.5 billion of free cash flow after paying dividends and capital expenses. The company continues to buy back stock, so it too has multiple avenues to accrete strong results for shareholders.

A top Canadian renewable power stock

If you are looking for long-term exposure to the renewable energy sector, then you can’t go wrong with Brookfield Renewable Partners (TSX:BEP.UN)(NYSE:BEP). It is not the cheapest Canadian renewable stock. However, in terms of quality, it is difficult to challenge Brookfield.

It owns one of the largest pure-play renewable power portfolios in the world. It currently owns 20,400 megawatts (MW) of power capacity. This portfolio is anchored by its irreplaceable hydropower assets. BEP has been rapidly diversifying into wind, solar, and distributed generation. Given its scale, it has built development and off-take relationships with some of the world’s leading technology companies like Amazon and Apple.

Every quarter, BEP’s development pipeline gets larger. It now has 31,000 MW of projects in the works across the world. The company has a strong balance sheet with $3.3 billion of liquidity. Consequently, with the support of its parent company, Brookfield Asset Management, BEP should continue to be a leader in the energy transition trend. This Canadian stock pays a 3% dividend. However, it has a strong history of raising that payout as it brings cash-yielding projects online.