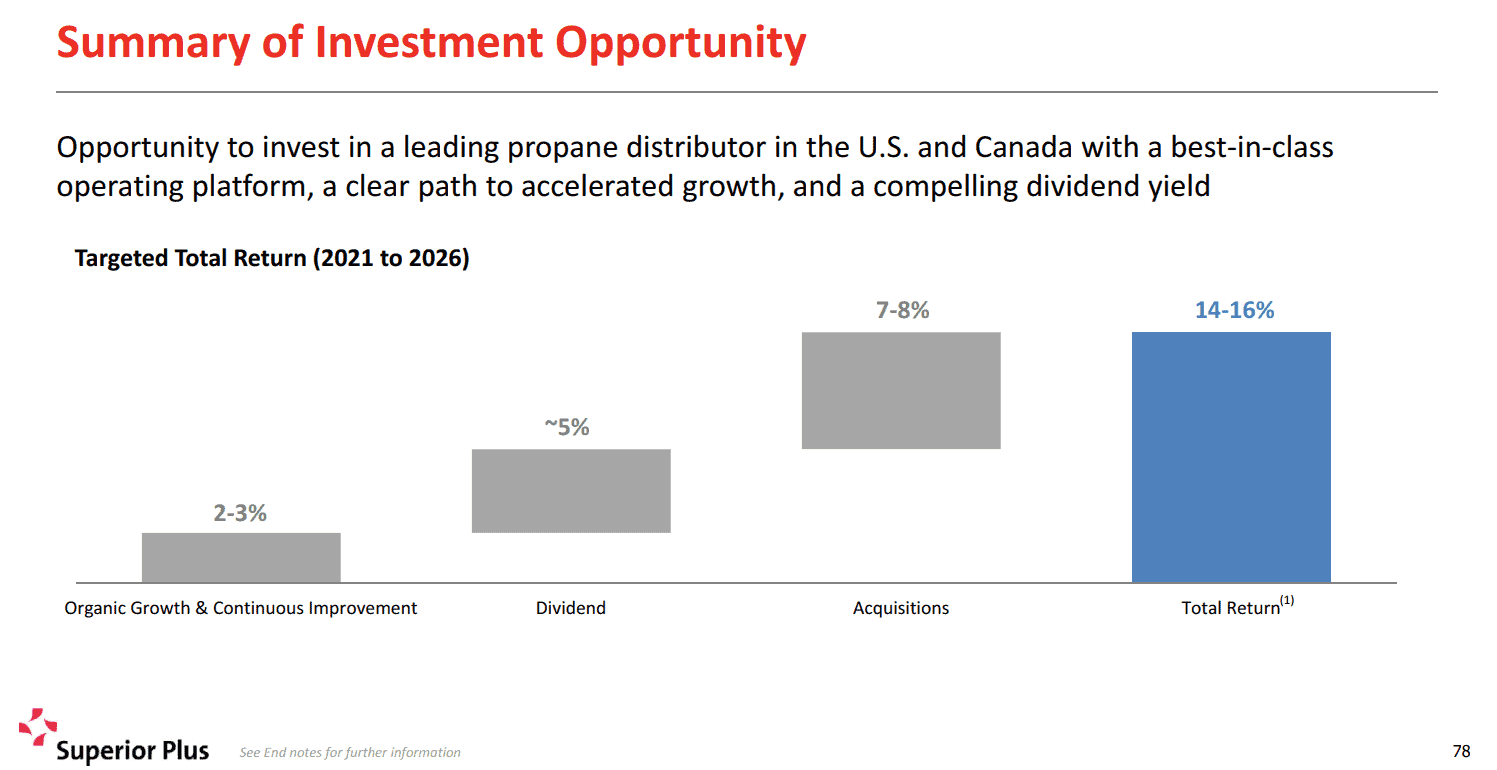

After a recent divestiture from a slow-growth specialty chemicals business line, Canada-based Superior Plus (TSX:SPB) is a growing $2.7 billion business that promises to generate superior double-digit total returns for stock investors over the next five years. If the goal is attained, investing in Superior Plus stock could double your capital in under eight years. Could the TSX stock deliver its 14% to 16% annual returns over the next five years?

Superior Plus is Canada’s largest single distributor of propane, boasting a 38% market share, and the company is the fifth-largest retail propane distributor in the United States. Its management is embarking on an acquisition-led growth spree that promises to unlock significant synergistic benefits.

Superior stock’s total return promise to shareholders

Divesting from construction materials and specialty chemicals business lines revealed a pure-play energy distribution company that has better future growth prospects than the old business. This gave management to reveal an ambitious returns potential for shareholders in a May 2021 investor presentation.

Here’s what the company believes Superior stock’s annual returns could be like between 2021 and 2026.

Total returns for investors are in the form of a dividend yield and share price growth. Superior Plus pays a $0.06 per share monthly dividend that yields a handsome 4.6% today. Therefore, a new investment in the company’s shares today only requires a 5.4% annual increase in the stock price over the next five years to generate a 10% total annual return for investors.

Assuming a 10% total return, and using the Rule of 72, an investment in Superior stock could require just 7.5 years for you to double your money if you reinvest all the dividends received.

That said, share price growth is a result of either an expansion in the company’s valuation multiples or an increase or improvement in the company’s key fundamental data points. Such fundamentals include sales per share, free cash flow per share, or adjusted earnings before interest, taxes, depreciation, and amortization expenses (adjusted EBITDA) per share.

Can SPB stock deliver double-digit returns from here?

A near 5% dividend yield on Superior stock makes a double-digit return target easier to attain. The dividend has been sustainable at payout rates of 40-60% on distributable cash flow and it makes management’s job easier. However, double-digit return goals aren’t guaranteed to be attainable.

On the positive side, the company historically reported a respectable 2-4% annual organic growth rate in the U.S. market – its largest revenue segment.

The company continues to make accretive acquisitions in the American market. It has a good reputation for successfully consolidating new acquisitions. It usually exceeds its targetted synergistic benefits by 2% on each acquisition.

With more accretive acquisitions, the company could easily deliver on double-digit stock investor returns, holding other factors constant.

Most noteworthy, we have seen an expansion to the company’s valuation multiples lately. If sustained, higher price cash flow and expanded enterprise value multiples on adjusted EBITDA make it easier for management to deliver targetted double-digit returns to shareholders.

Expansions in valuation multiples result from improved market sentiment and lower perceptions of the company’s equity risk.

Potential risks

Propane distribution volumes were badly hit in Canada during the coronavirus pandemic. The company’s Canada segment has performed poorly over the past six months and sales will be sequentially lower in 2021. If sustained, shrinking volumes in the local market could put a dent in cash flow growth and profitability targets.

Once investor confidence is shaken, valuation multiples may contract sharply and the stock may underperform peers. Double-digit returns may thus be unattainable under such a scenario.

Foolish bottom line

On a year-to-date basis, Superior has already rewarded its investors with a nice 28.% total return. If shares hold their valuation through to the end of December this year, a 30% annual return for 2021 is likely.

That said, it’s an uphill task for Superior Plus stock to sustain double-digit total returns over the next five years. More so given the recent rally. However, if valuation multiples remain intact at today’s levels, the company can make its shareholders happy during the period.