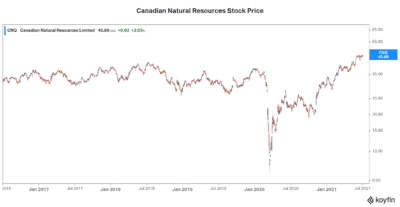

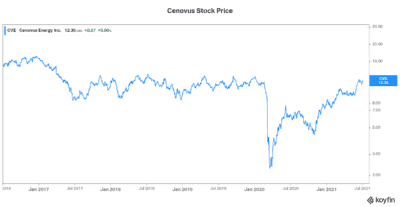

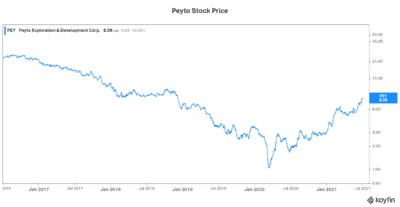

The top energy stocks to buy in July are all top operational performers. They’re also among the most-hated stocks out there today. You see, energy stocks have given Motley Fool investors like me big headaches. Over the last few years, they have been shunned. They have been villainized. Stocks like Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) were dead money. Stocks like Peyto Exploration and Development (TSX:PEY) and Cenovus Energy (TSX:CVE)(NYSE:CVE) hit rock bottom.

Today, these same energy stocks are soaring. Their cash flows and earnings are growing as oil and gas prices soar. In fact, these energy stocks look a lot like growth stocks. Let’s explore why these are the top energy stocks to buy in July.

Top energy stock to buy #1: Canadian Natural Resources is an impressive cash flow machine

Canadian Natural Resources stock is Canada’s best-in-class oil and gas stock. Its long-life, low-decline assets are gems. They require comparatively low capital expenditures. And they provide a high degree of predictability. This asset base is resilient, diversified, and flexible.

So far in 2021, Canadian Natural Resources stock has returned an impressive 50%. This is a reflection of the fact that oil and gas prices are soaring. It’s also a reflection of Canadian Natural’s top-quality operations and financials. It’s a rally that’s been a long time coming. But there’s more to come. Oil and gas prices continue to rise. Investors can’t ignore the positive fundamentals of energy stocks any longer.

Top energy stock #2: Cenovus Energy stock is a top energy stock to buy in July

Cenovus Energy is the third-largest Canadian oil and gas producer and the second-largest Canadian-based refiner and upgrader. This company has a history of operational excellence. It also has strong and relatively stable cash flows.

This is because Cenovus has recently snatched up Husky Energy. Husky Energy’s downstream assets will serve to diversify Cenovus’s business. It will also result in over $1.2 billion in synergies. It’s an acquisition that was completed when the energy sector was trading near its lows. And now it is benefiting from rising energy stock valuations.

So, Cenovus stock is now rallying from unsustainable, undervalued levels. And it’s rallying big. The graph below illustrates this. In 2021 alone, Cenovus stock has soared almost 60%. And there’s more where that came from. This is a new bullish cycle for oil and gas.

Top energy stock #3: Peyto stock is a top natural gas stock to buy as natural gas fundamentals dramatically improve

Peyto Exploration & Development is one of Canada’s lowest-cost natural gas producers. It operates in a very prolific resource basin. This translates into predictable production profiles. It’s also a basin that has low-risk exploration. Lastly, this basin has a long reserve life.

Lucky for Peyto, natural gas prices are finally soaring. In fact, they’ve risen almost 50% so far in 2021. And Peyto has soared almost 200% as natural gas prices have come to life. Again, as with the other top energy stocks to buy, there’s more to come for Peyto. Growing global natural gas demand will continue to drive natural gas prices higher.

Motley Fool: The bottom line

The top energy stocks to buy in July have all rallied significantly in 2021. But there’s more to come. This oil and gas bullish cycle has just begun. And it will continue to benefit stocks like Canadian Natural Resources, Cenovus, and Peyto Exploration and Development.