TSX dividend stocks have been on a bullish tear in 2021. Low interest rates and a reversion to value stocks has meant top Canadian dividend stocks have been going up. However, with interest rates potentially rising from here, some commentators are concerned the stock market could correct.

The TSX Index is near all-time highs, and it certainly could be due for a slight pullback over the summer. If you are concerned, here are three rock-solid TSX dividend stocks to look at. They all have solid operational models, safe dividend payouts, and strong histories of growing their dividends.

A top TSX Dividend Aristocrat

Fortis (TSX:FTS)(NYSE:FTS) is an absolute rock when it comes to dividend quality. This TSX stock started out as a small electric utility in Newfoundland. Now, it has operations across Canada, the U.S., and the Caribbean. It operates regulated electric and natural gas transmission assets, so it garners very predictable streams of cash flow.

Right now, the company is in the midst of a massive five-year $19.6 billion capital plan. Over that time frame, it is expecting to grow its rate base by a 6% compounded annual growth rate (CAGR). Likewise, it expects to keep growing its 3.6% dividend annually by about the same rate.

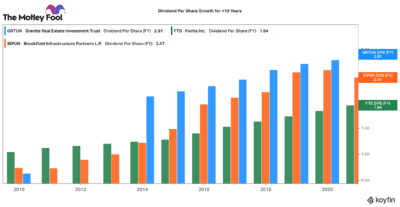

This TSX stock has increased its dividend annually for the past 47 consecutive years. While its payout is not massive, the rate of dividend compounding makes it an attractive stock to buy and hold forever.

A rock solid TSX real estate stock

Real estate is a great cash-yielding asset. Unfortunately, owning and managing your own real estate assets is both capital and time intensive. Therefore, owning a real estate investment trust (REIT) like Granite REIT (TSX:GRT.UN)(NYSE:GRP.UN) is a safe way to earn sleep-easy passive income. Granite is one of Canada’s largest industrial REITs.

It operates a high-quality mix of institutional quality logistics facilities and industrial properties across Canada, America, and Europe. Following the pandemic, it has enjoyed strong rental rate growth and rising demand for its assets. Granite has a best-in-class balance sheet, with a net leverage ratio of only 25%.

With its European debt exposure, it garners a very low cost of capital (sub-1% in some instances). This company has been growing its cash flows and distributions every year for the past nine years. Today, it yields 3.5%, but with a sub-80% payout that income is very well covered. This TSX stock has a top-quality management team, a great development pipeline, and exposure to one of the fastest-growing real estate asset classes today.

A great income diversifier

If you want exposure to a hybrid mix of assets, Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is a great TSX dividend stock. It owns and operates everything from natural gas pipelines to railroads to data networks. I like that investors get such a broad and balanced exposure to different assets in different geographies. It is a great hedge against volatility in any one market.

This is a great stock in an inflationary environment. Around 70% of its assets are contracted on inflation-indexed agreements. As the economy heats up so do its rates. Likewise, when economies strengthen, it gets the benefit of higher usage volumes and better pricing margins. Consequently, the company is growing both organically and by acquisition.

Like the TSX dividend stocks above, it only yields 3.6%. Yet it has grown its dividend payout by a 10% CAGR since inception in 2009. It targets a payout ratio of between 60% and 70%. That means its dividend growth is consistently supported by actual cash flow growth. Given the strong economic environment, I believe this stock will continue to spit out a growing stream of income for years to come.