Truth be told, given the massive rallies that keep recurring on selected Reddit stocks lately, there are times when I secretly wish that my favourite stocks could one day become Reddit meme stocks. Then there are times when I wish they never become meme stocks at all.

The thing is when you initiate a new position in a new company, sometimes you suddenly wish that everyone could see how wonderful your new stock is. You want it to get “discovered.” Most noteworthy, you want everyone to buy after you, and for the whole market to start talking about it, especially on WallStreetBets, or any other sub-Reddit investing/speculation platform. To be more specific, you want your new stock to instantly shoot “to the moon.”

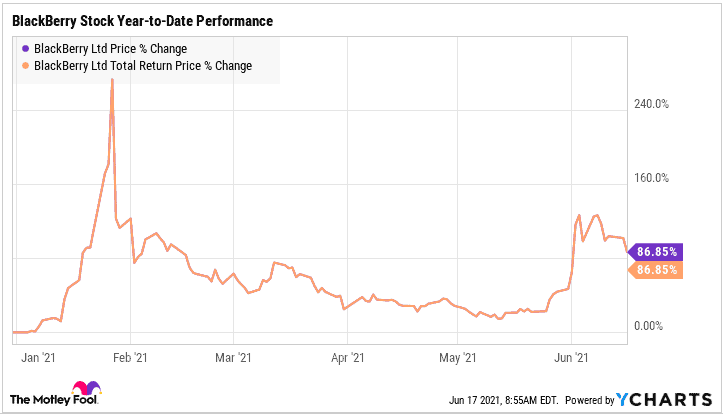

Sometimes you may get lucky, and it happens that Reddit meme stock finders suddenly fall head over heels in love with one of your portfolio companies, and it rallies by 100%, 200%, or even by 328% in three weeks, like what dear BlackBerry (TSX:BB)(NYSE:BB) stock did in January. Shares in BlackBerry rallied from $8.40 by January 4 to a multi-year high of $36 by January 26 on the TSX this year.

Chances are that you may fail to take advantage of the sudden surge in valuation to sell high. After all, the moon is still so far away. Unfortunately, the Reddit meme stock’s share price may plummet back to earth, as trader interest subsides. This happened on BB shares on January 27 when shares lost 40% of their value in a day.

After missing the chance to sell high, you may suddenly wish your company never became a meme stock (at least there wouldn’t be any cause for regret). Fundamentals-driven investors will be gleefully watching your company’s valuation correct back to its “fair price.” You will wish for WallSteetBets traders to come back again, so you can sell high — this time without fail. And the so-called degenerates did come back for BlackBerry in June.

The above scenario somehow depicts normal investor psychology. Our emotions of greed, fear, and regret, the fear of missing out, and other related investor biases challenge us, and sometimes we abandon our original portfolio investment strategies.

The meme stock challenge for long-term focused investors

Fundamentals-driven long-term investors do go through significant trials during a meme stock mania.

Foolish investors know well to buy stocks in high-quality companies with strong moats, growing addressable markets, companies with great management teams, growing cash flows, and healthy balance sheets. They buy stocks with the intention to hold for the longest time. They know that their time in the market produces steady and sizable returns without them unnecessarily timing the market. But their long-term buy-and-hold strategy feels threatened when one portfolio position becomes a meme.

When Reddit groups pounce on a portfolio stock and propel it to dizzying heights in a few short days, long-term-focused investors have an urgent task at hand. They have to reassess the company’s fundamentals quickly, and decide if they should sell overvalued positions right away. In short, investors are severely tempted to become traders and market timers when portfolio holdings become WallStreetBets and Reddit favourites. The temptation to take profits is just irresistible.

As I wrote before, this is one type of temptation I would willingly yield to. I would give in to the temptation to sell high and take some profit when valuation suddenly looks unjustifiable. To those that tried it, the tactical strategy seems to have worked beautifully on BlackBerry so far this year. That said, I wouldn’t let go of my Foolish buy-and-hold philosophy on all other favourite positions.