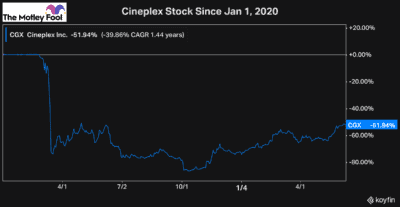

There is no question that Cineplex (TSX:CGX) stock has been one of the hardest-hit Canadian companies since the pandemic began. Its business has essentially been shut down for 16 months, and the resulting discount has many investors wondering if it’s one of the best stocks to buy now.

The stock was set to be taken private in late 2019. Cineplex was a top company before the pandemic, so there was no surprise it was going to be taken over. However, the nature of the pandemic impacting movie theatre companies caused its deal to fall through, and Cineplex stock subsequently lost a tonne of value.

Now, ever since the market pullback last year, it’s been one of the cheapest Canadian stocks. Many have compared Cineplex to Air Canada stock, as they have been two of the hardest-hit companies and stocks in Canada.

However, as I’ve said since late last year, Cineplex is the better stock to take a long-term position in, because it’s able to save more costs and therefore hasn’t lost nearly as much value.

As the stock has begun to recover lately, though, it’s no surprise investors want to know if it’s worth a buy today.

Cineplex stock: A top recovery pick?

Cineplex has a ton of potential these days as movie theatres will soon be able to open back up. Not only will there be a tonne of pent-up demand from consumers to see movies after all this time, but its entertainment locations such as Playdium and The Rec Room should see a rapid recovery as well.

Cineplex also owns a digital advertising business. These digital ads are placed in locations with high foot traffic, such as banks, malls, and quick-service restaurants. Over the last year, as many of those locations have been closed or capacity has been restricted, these operations would have lagged.

When the economy can finally open, though, its digital advertising segment, along with all of its other businesses, have the opportunity to recover quickly.

How much could the stock be worth?

At just over $16 a share today, Cineplex stock is trading at a more than 50% discount to its pre-pandemic price. And while I don’t expect it to recover to above $30 soon, it certainly has that potential over the coming years.

Before the pandemic, Cineplex was doing over $1.5 billion in sales each year and was able to generate roughly $150 million in cash flow annually.

So, it certainly has potential if it can recover substantially. However, because it never had the strongest margins to begin with, there is certainly some risk if its recovery lags.

That’s probably why most analysts aren’t bullish yet on the stock, with the average target price at just over $13.

Bottom line

Cineplex certainly has significant recovery potential and is a lower-risk investment than a recovery stock like Air Canada today. However, it still has considerable risk, and it looks like the market will want to see a sure sign of recovery before Cineplex rallies any further.

So, while Cineplex is certainly a decent stock to buy now, there are several other Canadian stocks that look even more attractive in the current market environment.