Canadian cannabis producer Hexo (TSX:HEXO)(NYSE:HEXO) has just surpassed former marijuana market giant Aurora Cannabis (TSX:ACB)(NYSE:ACB) in the recreational cannabis market in 2021, even as the former focuses on a U.S.-led growth strategy.

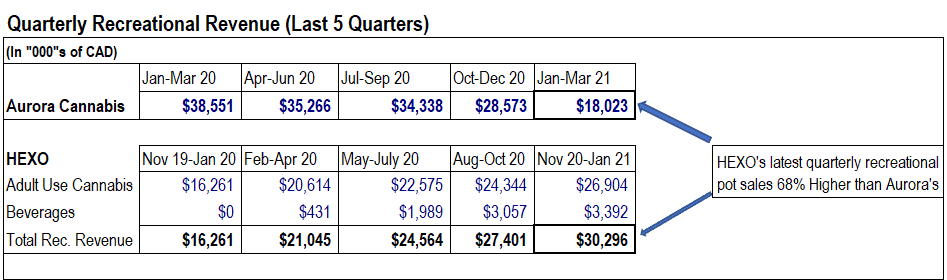

Since undergoing a major corporate restructuring exercise in 2019, HEXO has been aggressively growing its market share in the Canadian recreational marijuana market. Recreational cannabis sales grew from $16.3 million per quarter by January 2020 to $30.3 million by January this year.

Hexo overtakes Aurora Cannabis in the adult-use cannabis market

While Hexo was executing for growth, Aurora Cannabis was undergoing its own phases of restructuring. Unfortunately, ACB’s adult-use sales have been on an opposite trajectory during a period of fired-up Hexo growth.

At its low point recently, Aurora Cannabis reported about $18 million in recreational cannabis sales during the first calendar quarter of 2021. The company had some plausible reasons for that dismal performance. However, a sequential decline of 37% from December sales run-rates in the recreational marijuana segment was enough to make Hexo’s most recent comparable revenue rank 68% higher than ACB’s.

As Aurora let its segment sales slide sequentially over four consecutive quarters, Hexo stock investors witnessed the company grow its adult-use cannabis revenue segment quarter over quarter. This was helped by the launch of cannabis-infused beverages from the Truss Beverages partnership with Molson Coors.

A temporary lead?

It appears that Aurora Cannabis stock investors could see the company recover some lost ground as its product swapping program with the provinces reaches a conclusion. Further, ACB’s new distribution agent, Great North, must have sorted out the issue of too few sales representatives than necessary for Aurora products by now.

That said, Hexo is on the move and the company is integrating two brand new acquisitions: Zenabis and a more recently acquired 48North Cannabis will give the company a nice revenue boost during the second half of 2021. Actually, HEXO is keen on grabbing and holding the number two spot in Canada by recreational marijuana sales.

A quick check on analysts’ estimates for the respective companies’ upcoming quarterly reports reveals a not-so-encouraging comeback for Aurora’s part. Analysts expect Hexo to report $34 million in total net revenue for the quarter that closed last month. Nearly all of that will be recreational pot sales.

On the other hand, analysts expect ACB to report about $57 million in total net revenue for the quarter ending in June. Given how sticky and stable its medical marijuana sales have been, that revenue forecast leaves a small room for recreational sales at $21 million. That number is lower than the competition.

It appears that Aurora Cannabis may have lost market share for much longer.

Investor takeaway

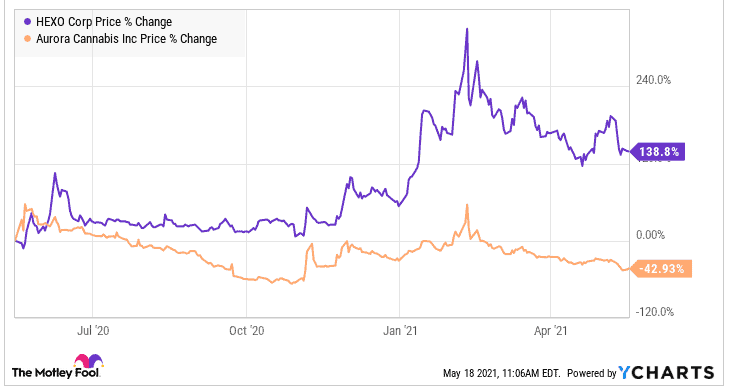

Although ACB still leads the competitor due to a massive and stable medical cannabis portfolio, recreational revenue is the future for any growing player. No wonder the competitor rewarded its stock investors with better returns over the past 12 months.

Aurora is upgrading product quality and potency, two selling points that could make it recover lost market share. However, recent weaknesses have allowed smaller competitors to outmaneuver it and lead the race, and its stock price has suffered in the process.

That said, Aurora remains the larger player among the two. ACB has a command of the national medical cannabis market with a sales run-rate of 36-38 million quarterly. Medical cannabis revenue hit a new record in March after three consecutive quarters of sequential growth. Clearly, there’s still value in ACB stock.