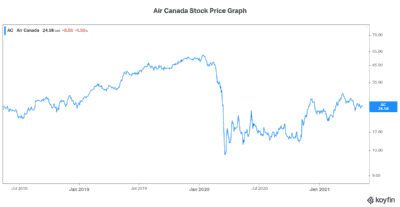

Air Canada’s (TSX:AC) stock price has had a disastrous 2020. The COVID-19 pandemic all but ended Air Canada’s rise. It brought massive disruption to this once high-flying stock and massive uncertainty. But 2021 is shaping up to be a far better year. Have we finally come full circle? Is Air Canada stock one of the best Canadian stocks to buy now?

Air Canada stock: Range-bound but ready to take off

Air Canada reported its first-quarter results last week. The quarter was quite brutal once again. Revenue declined 80% and capacity and traffic plummeted. But all of this was pretty much expected. We know the state of things. And the market has priced much of this into Air Canada stock.

The stock market is forward-looking. It really does not care all that much about the past. It’s concerned with the future. Air Canada’s stock price has stabilized in 2021. It seems to have brushed off its disastrous 2020. And it seems to be in a waiting pattern — waiting for news about an easing of COVID-19 restrictions and a return to some kind of normal.

In the meantime, Air Canada isn’t just sitting back. The airliner is making progress on different fronts. The goals are to be better positioned when things return and to take the business to another level.

From cargo flights to cost cutting to ambitious ESG targets

Air Canada is positioning itself for the future. For example, all cargo flights are increasingly in demand. Over 2,000 cargo flights took flight in the last quarter alone. Air Canada is building this program in order to better serve this market in the future.

Also, Air Canada is getting ambitious with its aim to reduce its impact on the environment. In fact, the airliner has plans for net zero emissions by 2050. Now, whether you believe this is achievable or not, this is a big goal. It’s something that Air Canada has not really discussed much — ever. To this end, Air Canada is building a better fleet. The Airbus 220 provides optimal aerodynamic performance and efficiency. In fact, it burns 25% less fuel per seat. It has half the noise footprint and decreased emissions. Low operating costs are the cherry on top.

Finally, reduced costs and cash burn are hallmarks of Air Canada’s improvements. This last year has been brutal. But we can at least say that Air Canada has used this time to make improvements. The airliner is planning for a better, leaner future. Cash burn in the quarter was $14 million per day. This was lower than expected. And it was a big improvement over prior quarters when cash burn was over $20 million per day.

Motley Fool: The bottom line

The tone on Air Canada’s Q1 conference call was better than it has been since the COVID-19 pandemic hit. Management seems optimistic that vaccines will start to make a difference — and soon. In fact, hopes for the return of domestic travel this summer are high. As the macro environment improves, Air Canada is positioning itself to come back as a leaner airliner with a better environmental record. This makes it one of the best Canadian stocks to buy now.