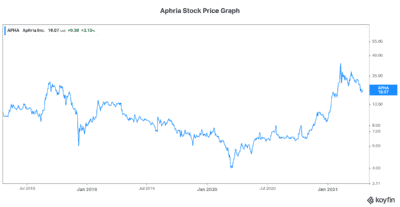

Aphria (TSX:APHA)(NASDAQ:APHA) stock has sure had a spectacular comeback in 2021. In fact, Aphria’s stock price is up more than 100% so far this year. And its rise seems to have only just begun. But the cannabis industry is not only a high-growth one. It’s also a highly competitive one. This means that not all of the cannabis companies around today will survive. I mean, the industry is in its infancy. Therefore, it remains highly volatile and difficult to forecast.

But what if I told you that, at this time, Aphria is doing all the right things? And what if I told you that this will ensure that it has an unmistakable place in the cannabis industry? Let’s dig in a little deeper. Here’s why I believe that Aphria may very well become a future cannabis king.

Aphria: World’s largest cannabis company?

Consolidation is happening. In fact, in every new industry, this is the one thing we can most surely count on. When the automobile was first invented, there were many companies trying to take advantage of this new market. But ultimately, only a few survived — and so it will be in the cannabis industry.

So, this implies that there’s much growth to be had. But it also implies other things. For example, in a consolidating industry, you must acquire or be acquired. Also, the industry is in its infancy. It’s therefore very often difficult to really forecast who will come out ahead in the end. The very nature of a new industry is that it’s riddled with uncertainties. It’s also highly precarious and volatile.

After having said all of this, I still want to look more closely at Aphria. This cannabis company is doing many things right. If approved, its acquisition of Tilray will address its market share here in Canada. It will also make it the largest cannabis company in the world, as measured by revenue. After the acquisition, Aphria will have over 30% market share in Canada. Also, with the acquisition of Sweetwater, Aphria has effectively entered the U.S. market in a big way. Sweetwater is one of the largest independent craft brewers in the United States. It has an extensive infrastructure. Aphria will benefit from its brewing innovation, manufacturing, marketing, and distribution expertise.

Aphria: A cannabis stock that stands ready and in wait for the global legalization tide

Right now, the U.S. is in the midst of legalizing cannabis across many states. In fact, the use of cannabis is legal in 17 states. In the last few months, another five were added to the list of states where cannabis is legal. And two more are expected to legalize this year. Similarly, many countries in the European Union are inching toward legalization. We can easily imagine the effects that this trend will have on the cannabis industry.

Aphria is increasingly well positioned. The company is achieving scale and brand diversity in Canada. It’s also setting itself up for the upcoming growth in the United States. With the Sweetwater acquisition, Aphria has gained access to the lucrative cannabis-infused beverage market. Sweetwater’s brands are coming to Canada. And Aphria’s brands are going into the United States. It’s a mutually beneficial arrangement.

Relatively low valuation and a strong balance sheet set Aphria stock up for strong momentum

Aphria stock has certainly been through hard times. But today, it looks more positive than ever. Aphria’s valuations are at the low end of industry valuations. Aphria stock is trading below the industry average by a lot. Its price-to-sales multiple is under 10, while the industry average is closer to 30.

Motley Fool: The bottom line

Cannabis stocks like Aphria stock operate in a highly volatile industry. After all, this industry is in its infancy. Aphria has taken some pretty dramatic steps recently that should boost results big time. At the same time, Aphria’s stock price trades at a meaningful discount to its peers. If you’re interested in the cannabis sector, continue to hold a basket of cannabis stocks to mitigate risk with. Within this basket, I would maintain an overweight position in Aphria stock.