Are you looking for a top stock to buy? Have you been holding onto some cash, waiting for a better entry point? Well Health Technologies Corp. (TSX:WELL) stock is down almost 25% in the last month. This is a good place to start. We’re seeing some weakness in Well Health and the TSX as markets take a breather.

So why did Well Health stock fall so much? And what makes it a top stock to buy in April?

Well Health is a top stock poised for continued long term growth

Well Health Technologies is an omni-channel digital health company. It’s leading the healthcare revolution in Canada. In short, Well Health “..aims to positively impact health outcomes.” They plan to do this by “leveraging technology to empower and support patients and doctors.”

So how does this look? Well, the primary healthcare system in Canada is infamous for its archaic systems. The lack of digital records and long patient wait times have frustrated everyone involved. Well Health Technologies envisions a primary care system that is proactive in preventing disease. Today, it feels unable to effectively do so.

But with Well Health Technologies, they can step up the level of care. Virtual care will ensure quick and easy access to doctors. And waiting room automation allows for shorter wait times for patients. And there are even more significant advantages that technology can bring.

Well Health Technologies facilitates “precision medicine”

Precision medicine “…proposes customizing healthcare decisions, treatments, practices, and products to suit individual patient needs.” It essentially means identifying best approaches for each patient given genetic factors and environmental and lifestyle factors. A digital database of information on each patient compiles all of this information.

This is a more proactive approach to healthcare — an approach that attempts to prevent disease rather than just treat it after it develops. The fact is that the technology is available to take healthcare to the next level. It’s an extremely exciting time, and Well Health is aiming to make these advancements a reality.

Exceptional growth and financial strength

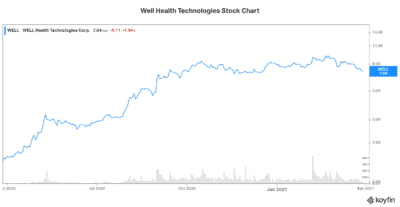

Well Health Technologies stock has been on a tear since last year. It’s a top stock that has rallied over 350% since the beginning of 2020. And although it has shown some weakness recently, it shows no signs of stopping its upward climb. The weakness is a reflection of the fact that markets are stretched. It’s not a reflection of any bad news from Well Health.

In its latest quarter, Well Health Technologies reported a 75% increase in revenue. The company continues to consolidate and modernize clinical assets within the primary healthcare industry. To this end, Well Health completed seven transactions during the quarter, putting Well Health in an enviable position. These transactions will positively contribute to Well Health’s results. Also, they are expanding the company’s geographic reach. All of this translates to its top stock status.

The bottom line

Recent stock market weakness has given rise to some quality bargain stocks. And Well Health Technologies stock really stands out as a top stock to buy in April. The digitization trends in the healthcare sector is a strong long-term growth trend. It was way overdue and now that it has begun, there’s no stopping it. Well Health Technologies is well positioned to continue to benefit from this.