These days, if you have cash lying around, you’re going to want to do something with it, such as investing it in Canadian stocks.

With interest rates near zero and set to stay there for a while at the same time as the government is spending tonnes of money to stimulate the economy, Canadians need to invest their cash. Cash loses value with inflation, so when you save money for long periods of time, you’re actually losing money.

If you don’t need the money for a while, you can afford to take bigger risks and buy higher potential companies for the long term.

If you want to be more careful with your money, though, there are still several Canadian stocks to buy. These will most often pay a dividend. So, rather than lose 2% a year on your savings (the long-term target inflation rate), Canadians should strongly consider investing whatever money they have lying around.

One side note is that you should always have an emergency fund for spending. Having a small amount of cash you can use for emergencies is important. Besides that, though, all the other cash you have should be invested.

A top Canadian growth stock

If you don’t need the money anytime soon, consider a high-quality growth stock like Drone Delivery Canada (TSXV:FLT).

Drone Delivery Canada is one of the best long-term growth stocks you can buy. There is no question that drone technology will be used for several industries in the future. So, it’s not a question of if Drone Delivery will earn investors significant returns; it’s when.

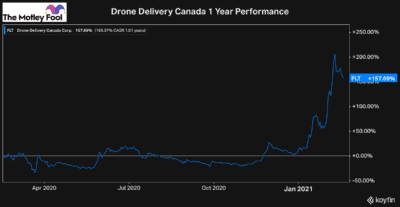

You can see that the stock was mostly rangebound for the last year before gaining a bunch of momentum as of late. In just a few short months, the stock is up over 150%. This goes to show how these high-potential growth stocks can take off without any notice. That’s why these stocks are great long-term investments.

If you’re worried that you missed out on Drone Delivery’s incredible growth potential, fear not. Even at these prices, the company is still worth just $420 million. That’s incredibly cheap for a Canadian stock with this much long-term growth potential.

But given its momentum lately, you may not want to wait any longer to gain exposure.

One of the best defensive stocks in Canada

If you want to be more careful with your cash and avoid volatility, one of the top Canadian stocks to buy is Algonquin Power and Utilities (TSX:AQN)(NYSE:AQN).

Algonquin is one of the best stocks to buy today, because it has incredible long-term growth potential. At the same time, though, its operations are extremely resilient.

Algonquin’s utility business, which makes up roughly 65% of its business, not only keeps cash flows robust for investors; it also keeps Algonquin’s stock less volatile.

The other 35% of its business is renewable energy assets, one of the best growth industries there is. So, with these two segments combined, investors can expect a generally low-volatility stock that should continue to grow slowly but consistently into the future.

The stock is so consistent and safe that it’s one of the top Dividend Aristocrats you can buy. Since 2016, the dividend has been increased by more than 50%. That dividend yields roughly 3.6% today.

Bottom line

Over the last year, we have seen just how much money investors can make in the stock market. So, with the Canadian dollar consistently losing value to inflation, and plenty of attractive stocks to buy, if you have cash today, these are some of the top investments to make.