When it comes to investing, we all want to buy the best long-term Canadian growth stocks. These are companies we can commit to for the long-term that can grow our money consistently.

This means it’s just as important to find high-quality businesses as it is to find stocks trading with fair value today.

The absolute value of a share price doesn’t make that much difference from stock to stock. However, companies with smaller share prices often tend to be smaller market cap stocks with more potential to grow.

So if you can find high-quality companies with low share prices that can grow those to the hundreds or even thousands of dollars, such as Shopify, investors will realize a major return on their investment.

About a month ago, I recommended four stocks under $5 for Canadian investors. Since then, in just the last month, three of those four recommendations are up roughly 40%. This rapid growth shows just how fast some of these stock prices can increase.

So with that in mind, here are three of the top Canadian stocks to buy today for under $20 a share.

A top Canadian gold stock

Gold stocks have been out of favour the last few months as gold prices have sold off from their 2020 highs. Despite the recent selloff from highs, though, these stocks still offer investors major potential over the long-term. Gold prices are still considerably higher than they’ve been in the past, and gold stocks are as profitable as ever.

So if you’re looking for a high-quality gold stock to add to your portfolio, now is the time to do so. The one stock I would recommend today is B2Gold Corp (TSX:BTO)(NYSE:BTG).

B2Gold is one of the lowest-cost gold producers in the world. That means at these increased gold prices, the company is capable of making significant profits.

In fact, the company is so profitable that over the last 12 months it doubled its dividend on two separate occasions.

That dividend yields 3.4% today, which is extremely high for a gold stock. Furthermore, the stock trades roughly 40% off the average of analyst target prices.

This shows just how undervalued B2gold is today. So if you’re looking to add a gold stock to your portfolio, B2Gold is one of the top Canadian stocks to buy today.

Natural gas stock

Another stock to consider is a super low-cost natural gas producer, Peyto Exploration and Development Corp (TSX:PEY).

Peyto has always been a great long-term investment. Today, though, Canadian energy stocks are rallying with major momentum, so if there were ever a time to buy the stock, it would be now.

Natural gas, while still a fossil fuel, is much cleaner than oil or coal. This makes natural gas critical to the future of the energy industry, especially as we transition more to renewable energy.

That long-term potential gives stocks like Peyto a tonne of potential. And because Peyto is so great at keeping its costs low, it has the capacity to increase its profits exponentially as the price of natural gas is rising.

In just the last three months, Peyto has rallied more than 110%. Yet it still worth just over $700 million, significantly less than it has been in the past.

If natural gas can continue to rally, the sky is the limit for Peyto. So it’s definitely one of the top Canadian stocks to consider buying today.

Canadian real estate stock

Finally, one sector all investors should have exposure to is real estate, and one of the top residential REITs in Canada is trading at an exceptionally attractive valuation.

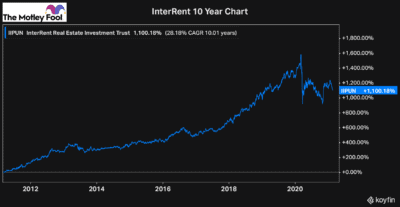

InterRent REIT (TSX:IIP.UN) has been one of the fastest-growing stocks in any industry over the last decade. In the last 10 years, InterRent has returned investors over 1,100%. That’s even including the significant impact the pandemic has had on share prices.

While InterRent’s business has remained robust through the pandemic, some of its short-term growth potential has been impacted, creating a major discount in the trust. It’s especially cheap when you consider its growth potential will return to normal as we emerge from the pandemic.

So if you’re looking to add a top Canadian real estate stock to your portfolio, InterRent REIT is one of the top choices today.