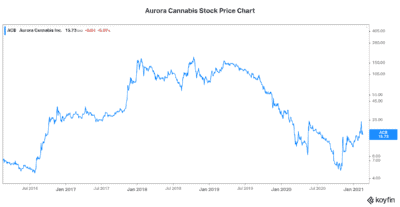

Aurora Cannabis (TSX:ACB)(NYSE:ACB) stock has plummeted 34% in just the last 10 days. This is a dramatic fall, but it followed a period of strength. And today, Aurora Cannabis stock is still 40% higher year to date.

So, what should we make of this? Why is Aurora Cannabis stock down 34% from its 2021 highs? And what does this mean for investors?

Aurora Cannabis stock: Volatility is just more of the same

Cannabis stocks are not the stocks to buy if volatility makes you nervous. They’re the stocks to buy only under certain circumstances. For example, buy them if you’re bullish on the long-term outlook of the cannabis sector. Also, buy them if you can handle extreme volatility. And lastly, buy them if you can afford to own a basket of cannabis stocks.

Aurora Cannabis’s stock price has certainly been the picture of volatility. For a company that’s in a new industry, this should come as no surprise. There are so many unknowns. And for a company that’s in a potentially very lucrative industry, this should also be no surprise. It’s very easy for investors to get excited about the cannabis industry. The potential for cannabis as a medical therapy is huge. The potential for cannabis as a recreational vice, like alcohol, is also huge.

So, how can investors make sense of all of this volatility? Well, we don’t have to. Many successful investors know this. Focusing on the long term is the best strategy. Short-term events are often just noise. They distract us from the big picture. It’s not that we shouldn’t know what’s going on. It’s just that we must be able to distance ourselves from distractions. In the case of Aurora Cannabis stock, profitability is still lacking. There’s still much uncertainty. That’s why I think owning a basket of cannabis stocks diversifies your company-specific risk. Yet it enables you to benefit from the cannabis industry boom.

Aurora Cannabis: Quarterly results disappoint

The potential is well known, I think. The cannabis market is huge. It’s a global market. And it’s a lucrative market that has existed forever — except it has been a black market. So, moving forward with legalization is bringing this market to all. Hopes are high for cannabis companies and cannabis stocks.

But the road to profitability is fraught with obstacles. We have seen this in the few years since legalization. Aurora Cannabis’s second-quarter fiscal 2021 results were a disappointment in general. Revenue came in below analyst expectations. Cash burn remains high. And the 11% year-over-year revenue-growth rate is nothing to write home about.

So, the key factor I would take note of here is expectations. Investor expectations for cannabis companies were always high. And cannabis stocks have gone from being shunned to embraced to shunned and then embraced once again. Aurora Cannabis posted an adjusted EBITDA loss of $12 million in the quarter. Importantly, management has refused to give a timeline for when the company will be EBITDA break even. This certainly doesn’t sit well with investors.

Motley Fool: The bottom line

In closing, Aurora Cannabis stock is reacting to its less-than-impressive quarterly results. The road to profitability will be long. This understandably makes investors nervous. Cannabis stocks are a volatile bunch. Stick with a basket of leading cannabis stocks. Include Aurora Cannabis in your basket, and you will ride the cannabis wave higher.