A consolidation wave is underway in the North American marijuana space. A much-improved Canadian cannabis licensed producer, HEXO (TSX:HEXO)(NYSE:HEXO) saw its stock price rise over 22% on Tuesday after announcing an acquisition of smaller industry peer Zenabis Global (TSX:ZENA).

The announced all-stock merger values Zenabis at a fair $235 million. This valuation puts a 19% premium to ZENA’s 20-day volume-weighted average price as of February 12. However, the premium falls to just 7.8% considering the respective companies’ closing stock prices on Friday last week and a conversion ratio of 0.01772 HEXO shares for every Zenabis share.

Existing HEXO shareholders will own 87.4% of the combined firm, and Zenabis investors will control 12.6% of the larger cannabis company’s stake on a pro-forma, fully diluted basis. The merger is expected to create the third-largest Canadian pot company by recreational cannabis sales.

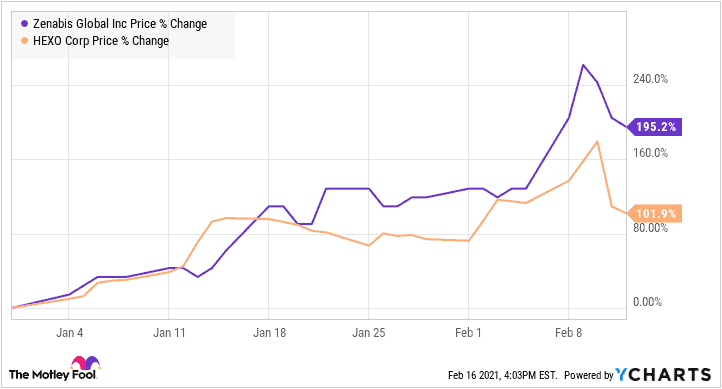

Zenabis’s stock price had outperformed many peers, as it rallied by 195% this year to February 12.

HEXO vs ZENA stock price performance between Jan 1 to Feb 12, 2021.

The target has performed much better than its acquirer so far this year. Zenabis re-calibrated its operations in 2020. It went into a facility sale-and-leaseback arrangement to free up capital, and its balance sheet was looking much better going into this merger transaction.

How does the acquisition benefit HEXO investors?

Zenabis reported three consecutive quarters of positive adjusted EBITDA in 2020. Operational profitability combined with the expected $20 million in expected synergistic benefits post-acquisition should be accretive to HEXO’s near-term profitability target.

Management mentioned the significant boost in the merged firm’s productive capacity after the merger. However, I find it ironic that HEXO, a company that closed and sold some production facilities and equipment recently, would list productive capacity boost as a factor in a transaction consideration. Perhaps Zenabis’s three facilities have better production economics.

Besides lifting the acquirer’s revenue profile in Canada, the acquisition should provide the company with immediate access to a growing European market. This fits very well into the acquirer’s current international expansion focus.

Enhances international expansion

HEXO was indeed in need of an accretive acquisition for its international expansion strategy to work. The company abandoned its Greek affiliate HEXO MED S.A. in 2020. It had to refocus its thinly spread capital resources when equity markets turned bearish on pot last year.

Most noteworthy, the company doesn’t have the required European Union Good Manufacturing Practices (E.U. GMP) certifications on its current facilities. Such certification is a critical requirement when entering the European medical cannabis market. Significant capital expenditures would be needed to make existing facilities E.U. GMP compliant.

Further, the company entered a two-year cannabis export deal targeting the booming Israeli marijuana market last year. Unfortunately, Israel later required that all cannabis imports into its borders be from adequately certified facilities with an equivalent of E.U. GMP certification. The new requirement meant trouble for HEXO.

The new export market could be lost forever, unless the company invested more capital in making facilities E.U. GMP compliant.

Fortunately, international expansion is now easier post the merger. ZENA’s 380,000-square-foot indoor production facility in Atholville, New Brunswick, received its E.U. GMP certification in May last year.

Actually, Zenabis is well placed to export marijuana to Germany, Malta, and Israel. Exports to Europe carry very beautiful gross margins that have boosted Aurora Cannabis’s and Canopy Growth Corp’s medical marijuana segments over the past 12 months.

Foolish takeaway

The latest surge in HEXO’s stock price is well deserved. Investors who scooped shares when the company showed signs of significant improvement by December last year have been richly rewarded. Perhaps there’s a little more wealth growth coming their way.