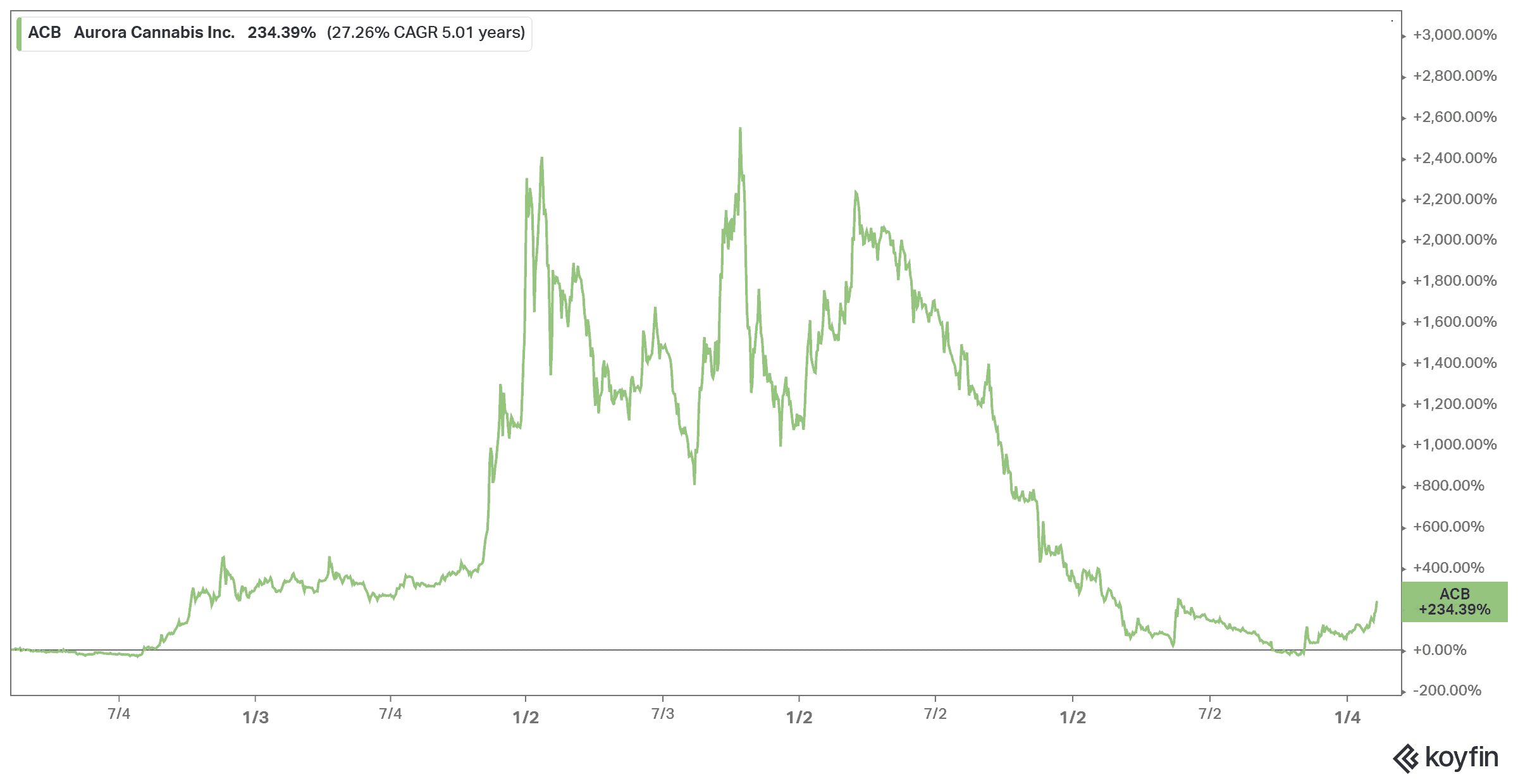

Investors continue to be wary about Aurora Cannabis (TSX:ACB)(NYSE:ACB), and I don’t blame them. After reaching all-time highs back in 2018, with a market capitalization of US$4.5 billion, there were fears the company would be taken over, and shares were diluted again and again.

Now, Aurora is a shadow of its former self. After several management shakeups and acquisitions that mainly just got investors more upset, shares continued to plummet — until this year. So, is Aurora a dud or actually a huge deal?

U.S. market

The catalyst, of course, is a new president of the United States that wants to decriminalize marijuana. While this is not legalization on a federal level, it’s a step in the right direction. There are only a handful of states that have legalized recreational marijuana, but there are more to come.

The problem is, Aurora isn’t set up in the United States like its peers. However, its recent purchase of Reviva definitely has analysts interested. The company’s cannabidiol (CBD) products could be a solid path into the United States. And while the company isn’t looking as much into recreational use, it’s looking more on the “non-sexy” side, as Chief Executive Officer Miguel Martin put it.

What Aurora hopes to do in the U.S. is be the lead in genetics, trademarks, and intellectual property. While other companies may eventually catch up to Aurora for these items, Aurora will be in the lead for quite some time. That’s the case already for its production, where the company has managed to bring down production to under $1 per gram.

Medical is not a waste

Recreational sales now make up about 50% of Aurora’s sales. However, the company’s medicinal marijuana sales continue to dominate its peers. While recreational use will likely begin to take over medicinal use, analysts still project an increase of 10% in medicinal sales per year through to 2030 for the company. That comes from the company’s enormous footprint, shipping to more than 20 countries.

That’s a huge point. It takes a lot of red tape to enter other countries, and Aurora is already there and with numerous pharmacy deals. It now has a foothold in countries its peers don’t even have access to. It also means the company can produce pot in these countries, where labour is much cheaper, such as Portugal and Uruguay. Growth in production should come in at 20% per year through 2030.

Bottom line

The stock is cheap — that’s the truth. It has a current price-to-book ratio of 1.2 at writing. It has a relative strength index of 14, making it well oversold. The company shed a lot during the last few years, but it’s building up again. As it does, the company’s shares really have nowhere to go but up.

With cheap costs of production, massive production increases in low-cost countries, and a foothold in the medical market that no one can touch, Aurora is a great buy. Yet it’s volatile, but with a new president, this stock could see all-time highs in the next few years with the Reviva acquisition underway.

As always, keep in mind your goals. Now that the cannabis bubble has burst, investors should think years and even decades down the line with these companies. So, be mindful and make the best choice for your portfolio.