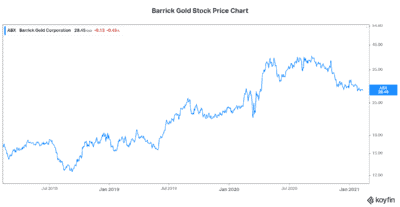

Gold stocks like Barrick Gold (TSX:ABX)(NYSE:GOLD) have fallen from their 2020 highs. This makes sense, as gold prices have also fallen and as the pandemic crisis fears have been replaced with hope — hope for vaccines, for a return to normalcy, and for economic growth in 2021. But is this optimism sustainable? Let’s look at Barrick Gold and Agnico-Eagle Mines (TSX:AEM)(NYSE:AEM) stock.

What can we expect from their fourth-quarter reports? What should we listen for?

Gold prices: Still much higher than year-ago levels and expected to rise further

The stock market is trading at all-time highs. This is reflective of all the optimism that is out there right now. And there is reason for optimism. For example, the COVID vaccine is making its way to the population. There are therefore hopes for strong economic growth in 2021. But there are also warning signs and red flags. The new COVID variants may pose a real problem. They may prolong this pandemic and wreak further havoc on the economy.

Furthermore, even if our hopes are fulfilled, we may find surprises. For example, we may find that recovery won’t happen as quickly or smoothly as the market is pricing in. We might also see that all of the stimulus comes with a price — namely, inflation. And we might see that the economic pain of the pandemic will linger for longer than we’d like. Essentially, there are usually no quick fixes. But the market is largely shrugging off much of the economic pain and structural damage that the pandemic has instilled.

All of this informs my opinion that gold prices are still heading higher. In fact, many analysts share this opinion. Some are calling for gold prices to hit $2,100 per ounce. That’s 15% higher than current levels.

Agnico-Eagle stock: A first-rate gold stock

Last quarter, Agnico-Eagle beat earnings expectations by a lot — almost 20%. And not only did it beat expectations, but the growth rates were fantastic. Third-quarter EPS increased by 140%. And third-quarter cash flow increased 32%. Finally, Agnico’s dividend saw a 75% increase. These are big numbers. Hence, Agnico-Eagle stock soared.

So, now we’ll look ahead to the fourth-quarter earnings report. It will be released on Friday. For the fourth quarter, Agnico-Eagle is expected to show an 80% increase in EPS. The price of gold held firm in the quarter. It didn’t really rise, but it didn’t really fall either relative to Q3. But it has fallen from its Q3 highs. Despite this, Agnico is still firmly on its way to continued strong cash flows and dividend increases. Because Agnico continues to reduce costs and increase efficiencies at its operations. Fourth-quarter earnings will once again be accompanied by strong cash flows.

Barrick Gold stock: Strong growth to continue in Q4

Barrick Gold is also coming off a record third quarter. Earnings rose 80% and free cash flow increased 150%. Furthermore, Barrick increased its dividend 12.5%. Gold companies and gold stocks are really having their day in the sun.

And the fourth quarter will still see continued strong growth. Earnings are expected to increase 90%. For the full year, Barrick is expected to report a more than doubling of earnings. These are phenomenal numbers. Barrick reports on February 18.

Motley Fool: The bottom line

Gold stocks have been some of the winners in these very difficult times. Just look at the price charts for Barrick Gold stock and Agnico-Eagle stock. Record revenue, earnings, and cash flows have taken them much higher. Although optimism has returned to the markets, I believe that these safe-haven stocks are still headed for more gains. 2021 will not be without hiccups. And the risks of this pandemic and to the economy remain. Gold prices are likely headed higher again.