Riding on high investor demand for its shares, Lightspeed POS (TSX:LSPD)(NYSE:LSPD) upsized its recently announced public stock offering by 20% on Tuesday. The deal, priced at US$70 per share closes soon on Friday, February 12.

The omnichannel commerce-enabling software company has increased the number of shares available in its latest stock offering from 7,000,000 to 8,400,000 common shares. Given a 15% over-allotment option granted to the underwriters, the total number of shares available in the deal could increase to 9,660,000 units.

A high demand for Lightspeed’s stock!

One of the biggest takeaways from Lightspeed’s stock sale is that there’s strong investor demand for the TSX tech stock.

Investment bankers usually allow issuers to upsize an offering if they believe there’s higher than expected investor demand for the offering. Investment bankers uncover such high demand levels as they market the deal to the public.

The Initial Public Offering (IPO) investing “public” is usually dominated by institutional investors and fund managers. Market participants usually regard this dominant investor group as the smart money.

We may therefore speculate that well-informed, rationally thinking and calculative smart investors are bullish on Lightspeed’s future growth and profitability prospects right now. Moreover, they are prepared to pay a hefty premium too.

A hefty premium?

Parties priced the latest LSPD stock offering at US$70 per share. The offer price represents a small 3.9% discount to Tuesday’s closing price of US$72.80 on the New York Stock Exchange. But the discount could be misleading. Shares may be more expensive than before the new offering. Here’s why.

Shares in Lightspeed were priced at a very steep forward price-to-sales (P/S) multiple of 31.4X multiple on Tuesday. This multiple considers an anticipated $350 million in revenue for fiscal 2022 which ends in March 2022 (a 67% year-over-year growth).

Technically, due to the dilutive effect of the new LSPD stock offering, the fair price on the company’s shares is supposed to fall by 6.6% on Wednesday. A price decline to $86.50 a share would maintain the forward P/S multiple constant at 31.4X after dilution. However, this isn’t any other tech stock: it’s a fast-growing Lightspeed!

If the share price holds near Tuesday’s close at $92.63, then LSPD shares will have become more expensive at a 33.6 times forward P/S multiple.

Shares increasingly more expensive

If the market expects the proceeds from the latest stock offering to be accretive to the business, it can ignore dilution and pay a higher premium on the company’s equity.

Such is the case at Lightspeed. The company is following an acquisitions led growth strategy. Investors expect the latest equity raise to grow the business through further acquisition transactions in 2021.

Interestingly, the company concluded its most recent acquisitions of ShopKeep and Upserve at reasonable cheap valuation multiples. LSPD can sell new shares at a trailing price to sales multiple close 60X, and acquire competitors at multiples of between 8.8 and 10. Growth is coming cheap for the firm.

Can you still buy LSPD stock?

The growth trajectory on Lightspeed’s business is enticing, and the TSX tech stock remains a compelling long term hold candidate. However, it’s not without its significant risks.

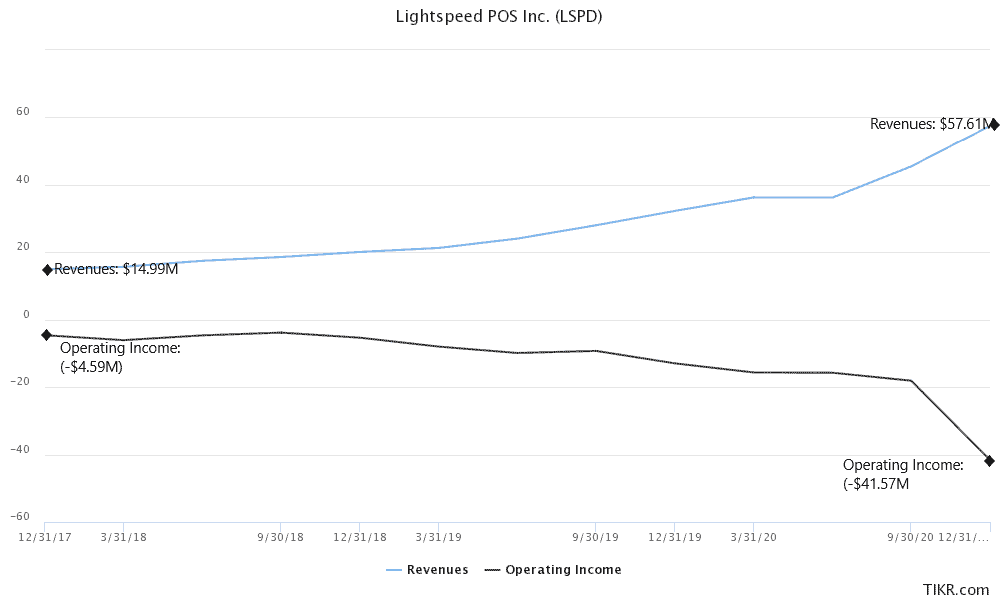

Most noteworthy, the high growth rate in revenue is being accompanied by ever-increasing operating losses. Growth is good — and that’s management’s current focus. That said, investors may want to keep a close eye on how the business evolves as it grows. The company may ultimately undergo painful and disruptive restructuring exercises if the growth model fails to generate positive earnings. Remember to consider this earnings risk, and the steep price when you buy.

Happy investing.