Energy stocks have been yesterday’s losers. As we know, nobody likes to talk about the losers. Most of us try to forget about them. We figuratively tuck them away into a box. We don’t like to bring them up. Well, today I’m bringing them up. In fact, I’ve been talking about energy stocks more and more. Because today, these stocks are cheap. They’re rock bottom cheap. And the fundamentals finally seem to be turning around.

Without further ado, here are three energy stocks to buy today. They are all experts in their field. They’re all beginning to make their parabolic moves higher. Investors should consider buying them today to participate in these moves.

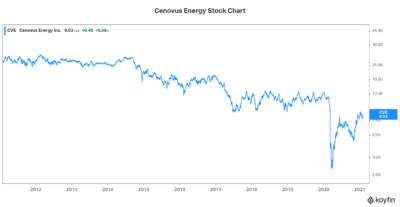

Cenovus Energy

Cenovus Energy Inc. (TSX:CVE)(NYSE:CVE) is already bouncing off of its January lows. As the oil and gas industry begins to strengthen, Cenovus stock will continue its upward climb. There are many factors that contribute to my expectations. For example, investment in the oil and gas industry has been low for many years now. The new Biden administration in the U.S. will only serve to amplify this trend. Drilling and production will continue to decline. Hence, supply will be affected. And when supply falls, commodity prices rise.

Also, Cenovus stock is trading well below book value. This stock is incorporating only bad news. But Cenovus’ recent acquisition of Husky Energy stock is really good news. It brings with it a more diversified business. It brings significant synergies. And it transforms Cenovus into an integrated energy company. Finally, Cenovus acquired Husky Energy stock at rock bottom valuations. This is a long-term value generator!

This is a time when supply is falling and demand is expected to rise. Cenovus will benefit greatly.

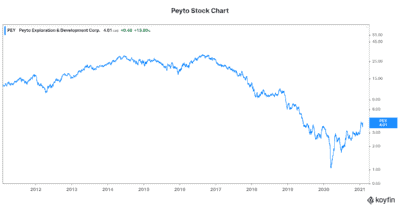

Peyto Exploration

Peyto Exploration and Development Corp. (TSX:PEY) is a top tier natural gas producer. Natural gas is one of those commodities that doesn’t get the recognition it deserves. It’s comparatively cleaner than many energy sources. It’s abundant. And it’s cheap. It can help fuel an economic recovery. It will also help transition us to clean energy. Peyto has held its own during these last few years of rock bottom natural gas prices. It’ll be ready for stronger prices next year.

Peyto is one of the lowest cost natural gas producers. It has a repeatable and predictable asset base. And it has been focused on profitability since before this was the norm. All of this demonstrates how Peyto is the perfect natural gas stock to buy. So if you believe, as I do, that natural prices are heading higher, consider Peyto stock.

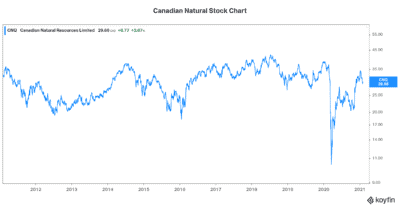

Canadian Natural Resources stock

Canadian Natural Resources Ltd. (TSX:CNQ)(NYSE:CNQ) is another top quality energy company. CNQ is Canada’s best-in-class oil and gas stock. Its long-life, low-decline assets mean that there are comparatively low capital expenditures. It also means a high degree of predictability. Its asset base is resilient, diversified, and flexible.

Because of this, the company churns out massive amounts of cash flow. Even in hard times. Recent third quarter cash flow came in at $1.7 billion and year-to-date cash flow came in at $3.4 billion. Similarly, free cash flow after dividends came in at a healthy $467 million.

The bottom line

There’s a growing consensus that oil and gas demand is starting to outstrip production. This will send oil and gas stocks soaring higher. Cenovus stock, Peyto stock, and Canadian Natural Resources stock are the top energy stocks to buy in this scenario.