Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is one of Canada’s leading banks. In fact, it’s also one of North America’s leading banks. This status should not escape investors. It brings with it many benefits. And these benefits are the reason why TD Bank stock is a top bank stock to buy today.

Without further ado, let’s look at the reasons to buy TD Bank stock now.

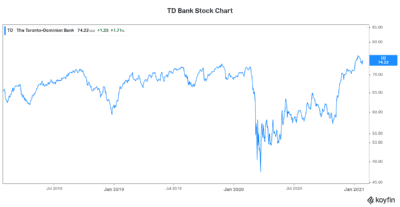

TD Bank stock has shown its resiliency

As TD Bank stock has recovered from March lows, some things became glaringly obvious. For example, TD Bank’s resiliency. 2020 earnings fell dramatically relative to 2019. But the overall impact of this disastrous year was not as bad as one would think it would be. TD’s liquidity remained strong. And its capital ratios remained exemplary. These are the key measures of a bank’s resiliency. TD gets top grades on both of these measures.

TD Bank has the title of being the fifth leading North American bank by total assets. And as the sixth largest North American bank by market cap, giving the bank economies of scale. It gives the bank geographic reach. It allows the bank to remain diversified. And it gives the bank access to countless markets. In a recovery scenario, TD Bank will access plenty of growth.

Canadian banks like TD Bank are cautious on 2021 but optimistic about the recovery

As the second wave has taken hold, many are cautious on 2021. And rightly so. For example, Royal Bank’s management is assuming a quite pessimistic 2021. TD Bank is also quite nervous about the year ahead. They acknowledge that the next few quarters will be tough. They also acknowledge that government stimulus has been the key, which is what made it possible to be in good shape today.

It’s not a nice feeling to know that you’re only managing because you’re being helped by the government. But these are the times we’re in. Thankfully, there is help. The banking system won’t fail. All stakeholders are united in this goal.

Provisions for credit losses will be elevated once again in 2021. As new lockdowns hit the economy, TD Bank will be tested again. But Canadian banks have been through hard times before. The financial crisis of 2008 was difficult for all. But Canadian banks stood out as examples around the world.

Canada’s capital regulations for the banks are even stronger today. Therefore, we expect TD Bank to survive the crisis. And after the crisis, TD Bank will continue to leverage its leading position in the banking industry.

TD Bank stock is yielding 4.3%

Toronto-Dominion Bank stands out for its years of success in driving efficiencies. The bank has an industry leading ROE and has a conservative approach that mitigates risk. For example, TD Bank adheres to strict controls with regard to lending practices. This pays off big, especially in the bad times. And these are bad times.

Today, TD Bank stock is yielding a generous 4.3%. And it’s a dividend that keeps growing. Since 1995, TD Bank has delivered an 11% annualized dividend growth rate. This dividend growth history shows no signs of stopping.

The bottom line

In conclusion, I think we can all agree that 2021 will be a rough year for banks. It will, in fact, be a rough year for most businesses. But TD Bank is well-armed to make it through these hard times. It’s true that the second wave has delayed the economic recovery we’ve all been waiting for. Nevertheless, TD Bank remains a top bank stock to buy today for its dividend and growth prospects.