One of the biggest initial public offerings (IPOs) this year came from Palantir Technologies Inc. (NASDAQ:PLTR). The tech company came at exactly the right time during the pandemic. All the information gathered by governments and organizations in person suddenly needed to be virtual. Enter Palantir, which has been collecting data with ties to the government virtually for some time before coming on the market.

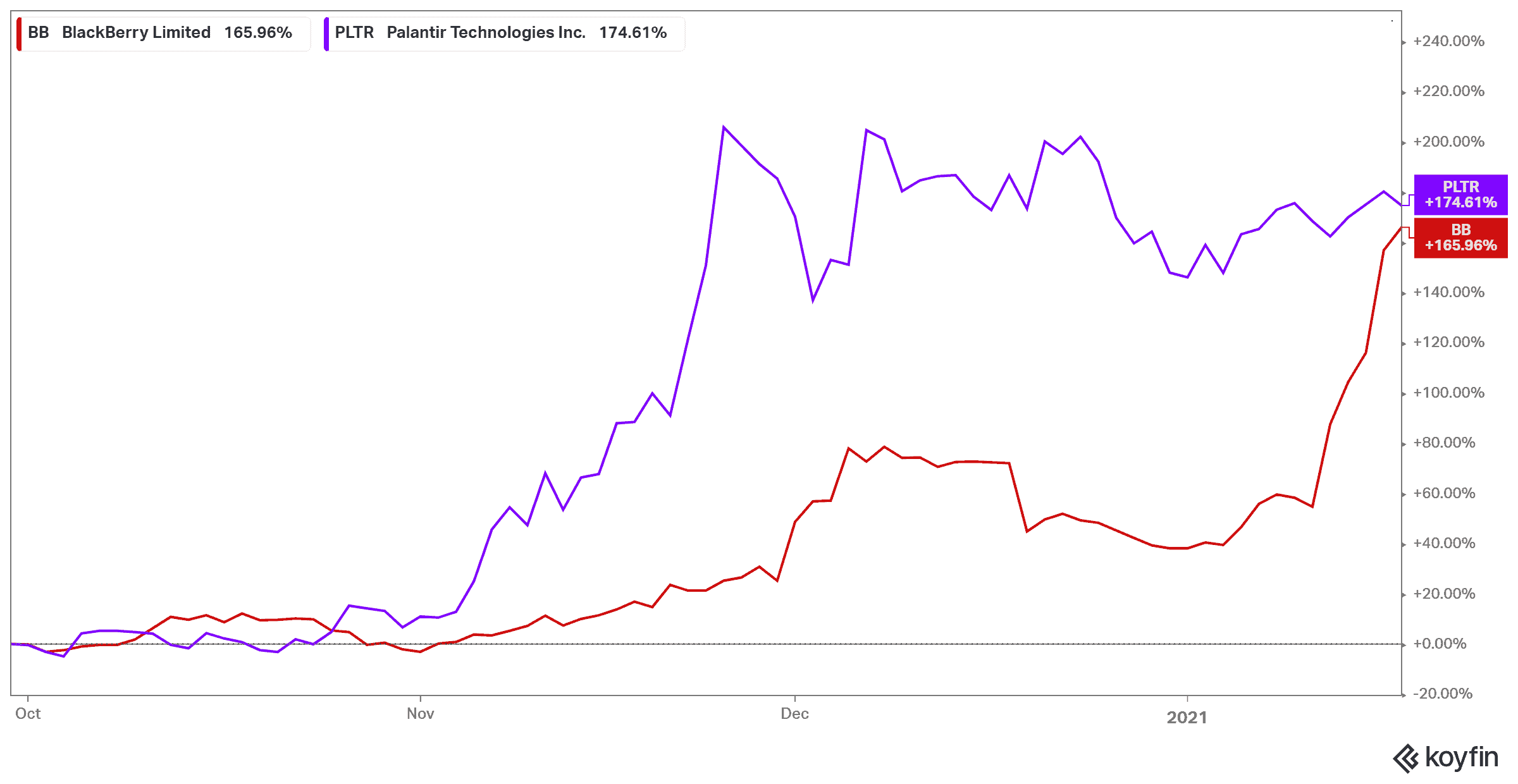

Safety and security is its number one priority, helping keep data safe for the intelligence community within the United States, helping with counterterrorism. But organizations can access secure data as well, using Palantir Foundry, a central operating system for data to be integrated and analyzed. The company came onto the market in September of last year, and to date shares are up 172%!

Should you buy?

On the one hand, Palantir is of course an excellent buy. The company offers security for data, and that is key in a virtual world becoming more virtual by the day. The work-from-home economy offers plenty of opportunities for Palantir to expand. Having a connection to the intelligence community of course gives it a lead amongst competitors.

But the company is also within the tech industry that has been on fire recently. More than that, it’s soared because of its IPO. That means not only could it come down in the next few months, it also means this and other tech stocks are going to come down during the market crash. That could mean it could take some time for Palantir to recover.

So is there a better option?

Enter BlackBerry

What BlackBerry Ltd. (TSX:BB)(NYSE:BB) has going for it is time. The company has been around for decades, and has seen major ups and major downs. Back around 2000, the company traded well into the triple digits. Since that time it’s come down 87%. So it’s forgiven why you might not think to invest in this company right away.

However, BlackBerry has completely changed since then. BlackBerry shifted away from creating smartphones and now creates cybersecurity software. This software is placed in everything from autonomous vehicles to enterprise organizations and governments around the world. So in a way it’s incredibly similar to Palantir.

But it goes beyond that. Palantir still has to prove its worth through earnings to investors. BlackBerry, meanwhile, had to do this to but is already well underway. The company saw year-over-year revenue growth throughout the pandemic, only falling below during the latest earnings report.

But while revenue was down, shares soared during the most recent earnings report. The company made a slew of announcements to upgrade its artificial intelligence software systems, and will soon announce its fiscal year 2021 outlook. Shares in BlackBerry bounced up 90% to date at the news!

Foolish takeaway

Palantir still has to prove itself, but BlackBerry is already proving itself with a huge comeback. Shares continue to soar and it might be a great time to add it to your watch list ahead of a market crash. Tech stocks are likely to dip in the near future, but companies like Palantir and BlackBerry are here to stay.

Software companies that provide security will continue to be needed not just during the pandemic, but well beyond in our virtual world. So while Palantir has excitement going for it, BlackBerry has a bit more stability.