Is there a stock market crash coming in 2021? If there is, what do we at the Motley Fool believe are the best stocks to buy?

Well, the TSX index is trading as if everything in the country is great. It’s not trading like we’re stuck in a second lockdown, or like the government is dishing out hundreds of millions of dollars in aid just to keep people afloat. And it’s certainly not trading as if people and businesses are struggling to pay their bills.

It is, in contrast, trading as if everything is going really well. I know that the coronavirus vaccine is here. But I also know that the economic pain that has been inflicted will not just magically go away. There will be a rebuilding process that will take time. Things might not bounce back as quickly as the market seems to expect. In fact, I am quite sure that it will not.

The market is expecting a strong recovery: A stock market crash awaits if this does not happen

The stock market trading at highs today is not actually a big mystery. This is because the market is a reflection of expectations. It’s not always a reflection of what is actually going on. Let’s consider past market movements. Most of them happened based on expectations. Markets often rise or fall before events occur to actually justify the movements. It’s our job here at the Motley Fool to help guide investors. It’s my job to share what I’ve learned in my years of investing. The goal is to help everyone make sound investing decisions.

So, when this inevitable market crash 2021 happens, where will you be? Will you be shocked or in a panic? Or will you be prepared. Because if you’re prepared, emotionally and mentally, this is when things get really interesting.

Stocks to buy in the stock market crash of 2021

A market crash is always upsetting. But if we can rise above this upset, we can profit from it. Because when it does happen, many stocks will go on sale. They will be trading at bargain prices. And those of us with cash on the side can benefit, but only if we remain calm, and only if we have the courage to buy when everyone else is selling.

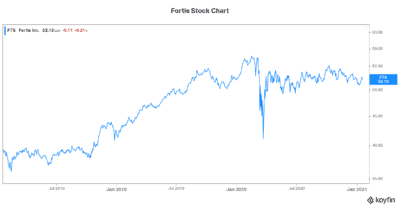

With that in mind, I have two stocks that I am ready to buy at bargain prices. I’ll wait for the stock market crash to pull the trigger. The first stock to buy is Fortis. Fortis is a North American leader in the regulated gas and electric utility industry. It’s a utility, which means that its revenue base is highly defensive. But its defensive business won’t save it from a stock market crash. And this is good news for those of looking for bargains. I will buy Fortis stock as it approaches $40. That’s almost 25% lower than Fortis stock today.

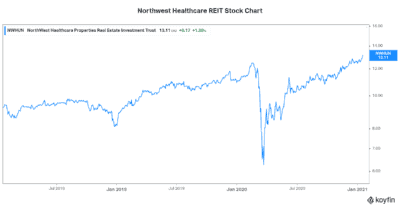

The second stock to buy when the stock market crashes is Northwest Healthcare Properties REIT. Northwest is a real estate investment trust (REIT) that focuses on healthcare real estate. It’s another defensive stock that I’ll look to buy in the stock market crash 2021. I’ll pull the trigger as Northwest Healthcare stock falls below $10. That’s 25% lower than where it trades today.

Motley Fool: The bottom line

Investors should be prepared for a stock market crash in 2021. It’s become obvious to me that the market is pricing in a great recovery. But I’m not convinced that it will be so easy. In my view, the market will crash as data disappoints this year. This will bring many bargains for those of us ready to buy on weakness.