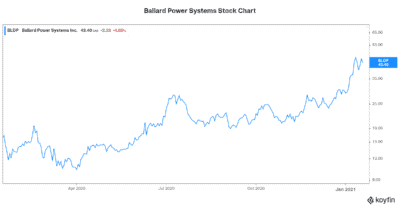

Ballard Power Systems (TSX:BLDP)NASDAQ:BLDP) stock is a renewable energy stock. It’s also one of the best performers on the TSX. It’s up more than 20% in 2021 and well over 200% in the last year. These returns have caught some investors’ eyes. But I think too many investors still don’t have Ballard Power Systems stock on their radars.

So, let’s review why, after decades of going nowhere, Ballard Power Systems stock is now skyrocketing

The time is right for Ballard and its fuel cells

Even 20 years ago, global warming was an issue. Scientists knew this. But many mainstream businesses were making a case as to why their actions didn’t harm the earth. The discussions were had. The debates raged on. But they were few and far between. Those concerned with the environment seemed left outside on the fringes.

But things are different. The world has gone through a sea change when it comes to global warming in the last few years. These days, it is to your own detriment if you ignore the issue. The world is rallying behind this cause. And this is very apparent in renewable energy stocks. For example, Ballard Power Systems stock has been soaring non-stop in the last few years.

The company continues to secure contracts. And the company continues to make its mark around the world. Its leading market share and unmatched expertise will allow Ballard to continue to conquer the fuel cell industry for the foreseeable future. Renewable energy is the future.

Ballard Power Systems stock gains as the company cements its leadership position

Ballard has its fuel cells stacks inside many buses around the world. For example, China is ramping up its roll out of fuel cell buses. Also, Europe is an innovator in this area as well. It has ambitious clean energy targets. Its efforts toward decarbonization include fuel cell vehicles. The continent has already deployed many fuel cell buses on its roads.

The latest contract in Europe comes from Scotland. It’s a further step for fuel cells in penetrating the railway industry. Scotland is working towards its first fuel cell-powered train. Ballard’s fuel cell modules will power this passenger train, which is planned for demonstration in November 2021. Similar to other European countries, Scotland has a new zero emissions goal by 2035. Fuel cell-powered trains will help get it there.

This contract follows other contracts that were received in December 2020. These were also important contracts that worked to solidify fuel cells and Ballard Power. For example, Ballard received an order for 10 of its fuel cells. These fuel cells will power buses in Holland. Ballard also made progress in the communications industry. Teaming with a power conversion company in Norway, Ballard is tasked with providing fuel cell backup power. The company’s fuel cells will provide backup solutions for telecom networks and other critical communication infrastructure.

Motley Fool: The bottom line

So little by little, we can see increasing adoption of Ballard’s fuel cells. They are penetrating different heavy-duty vehicle markets. They’re fast becoming the clean energy solution to the world’s environmental problem. It is therefore no surprise to see how high Ballard Power Systems stock is soaring. The time has come for Ballard and other renewable energy stocks.