Want to boost your income without having to worry about paying taxes on it later on? The good news is that if you’re at least 18 years of age and have a social insurance number, you already meet all the requirements for opening a Tax-Free Savings Account (TFSA). Inside a TFSA, you can protect your investments from the taxman, as any income you earn within the account is not taxable. Whether you make $10,000 or $100,000, as long as you’re not day-trading and are steering clear of other TFSA no-nos, your profits (including dividend income) will all be tax-free.

You can open a TFSA at any major brokerage. And if you’ve been eligible every year and have never contributed, you can put up to $69,500 in it. And next year, that limit is going up by another $6,000. In 2021, you can shield potentially up to $75,500 of your investments inside a TFSA.

Which stocks should you put in a TFSA?

If you want recurring income and don’t want to worry about when to buy and when to sell a stock, then investing in dividend stocks can be the way to go. They are typically more stable than growth stocks, since they can afford to pay you on a regular basis, and so they’re generally safer investments to hold. But among the best are bank stocks. That’s because they generally move in the same direction as the economy, and they’ll rise in value over time.

Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM) stock is one of the better-yielding bank stocks you can buy today. The top bank pays a quarterly dividend of $1.46. And with its share price at around $112, it’s yielding 5.2% per year. If you were to invest roughly $39,000 into the stock, that would generate a little over $2,000 a year in dividend income for your portfolio.

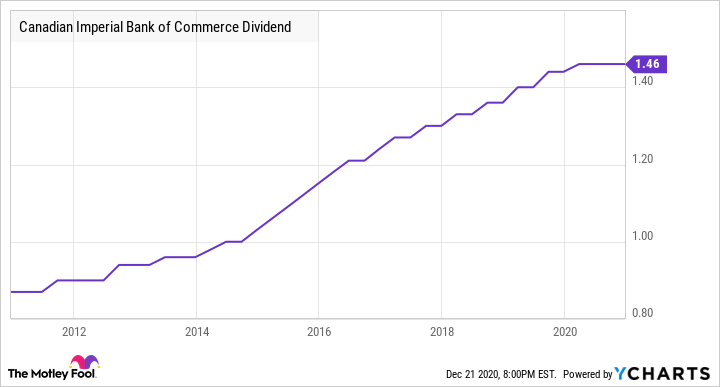

And the longer you hold onto the stock, the higher your dividend income will likely get. CIBC has increased its dividend payments regularly over the years. In 2010, its quarterly payments were $0.87 and the bank has increased those payouts by 67.8% since then, averaging a compounded annual growth rate of 5.3% during that time:

CM Dividend data by YCharts.

If the company were to continue increasing its dividend payments at that rate, it would take about 14 years for the payouts to double in value. And the stock has typically outperformed the TSX over the past decade, giving investors extra incentive to hold on to the investment for the long haul:

CM data by YCharts.

During this timeframe, the stock has increased by an average of 3.7% per year.

Bottom line

If you’re a novice investor or just want a safe stock to tuck away into your TFSA and earn some recurring cash flow, it’s hard to go wrong with CIBC. Not only will it generate dividend income, but it’s a safe bet to at least do as well as the TSX. And if you put that investment in your TFSA, you won’t need to worry about any tax consequences from buying and holding the stock.