Soon after the marijuana firm implemented a revised share consolidation on December 18, HEXO’s (TSX:HEXO)(NYSE:HEXO) stock price rose 3.9% on Tuesday after the cannabis firm released a more reassuring press release on December 22.

The latest news is that the cannabis grower has allowed its base shelf prospectus to lapse this month. Investors in HEXO stock may welcome the news for two solid and bullish reasons. Firstly, the company has halted shareholder dilution. Secondly, management is confident about suppressed cash burn and future profitability outlook.

HEXO halts shareholder dilution

In December 2018, the company filed a prospectus to raise up to $800 million in new equity financing during a 25-month period between November 2018 and December 2020.

HEXO utilized just under a third of the planned equity raising capacity. The company only raised $254.3 million between January 2019 and August 2020. After a successful turnaround strategy, “the company has determined not to file another short-form base shelf prospectus at this time,” the latest press release pointed out.

The company once flirted with the possibility of bankruptcy at one point. Lenders gave management a deadline by which to raise new equity. The stock price was in free fall, and there was no guarantee that the markets will continue to fund the firm. Fortunately, funding was secured just in time.

Management doesn’t see a need for new and dilutive equity financing anymore. At least not in the near term. The executive team is positive on the firm’s balance sheet and cash flow outlook. As noted earlier, the numbers are coming right at HEXO.

The company is on course to generate positive cash flow

Management noted a growing oversupply of marijuana in the Canadian market earlier than peers in 2019. It decided to halt further investment in operations and expansion projects. The company shut down operations at selected production sites, disposed of some, and laid off several employees, as it sought to downsize operations given obtaining market conditions.

The plan to right-size operations has been a successful turnaround strategy so far.

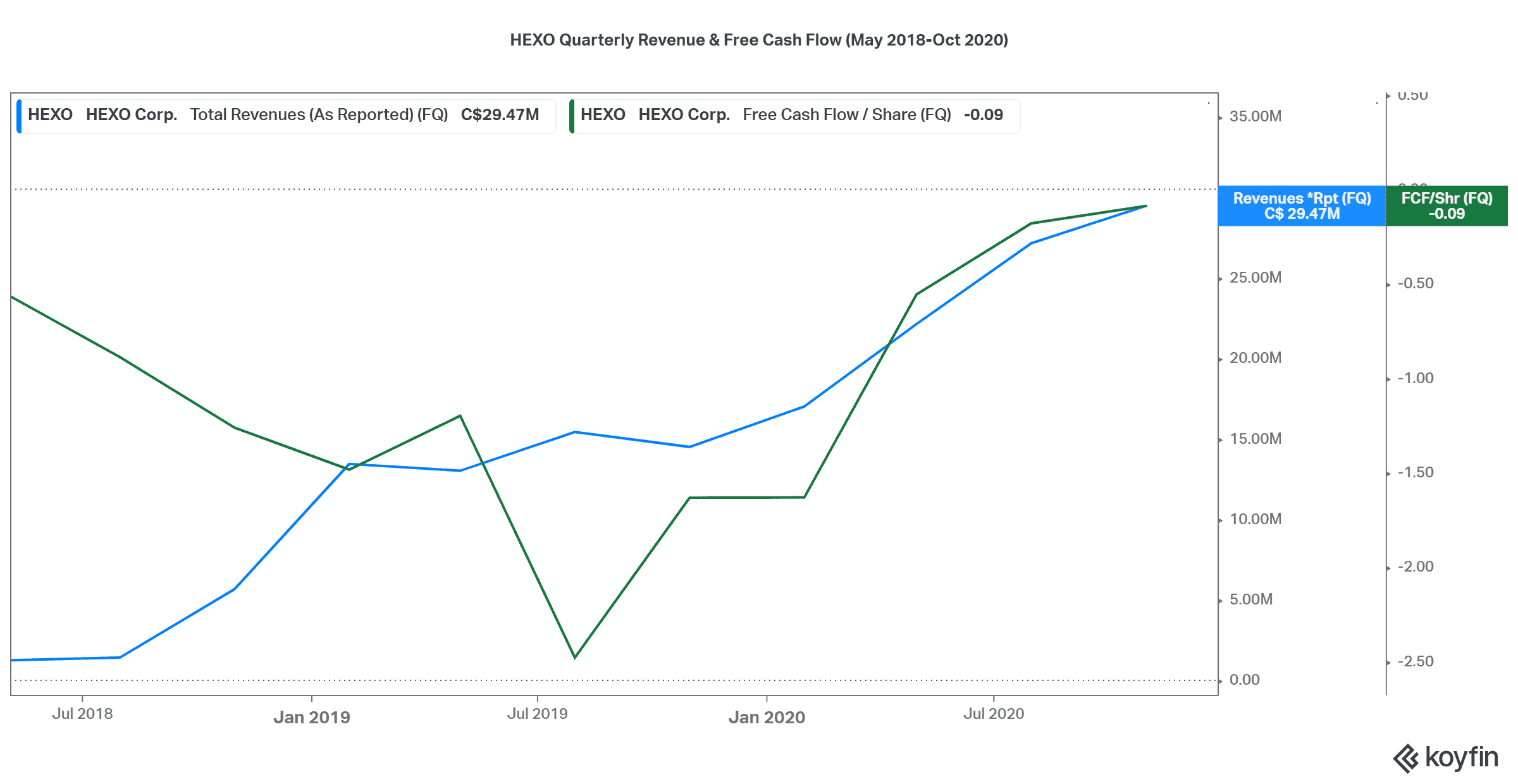

Revenue continues to grow while operating expenses remain contained. Cash flow from operations has been improving throughout 2020, as the company reported ever-improving adjusted EBITDA numbers sequentially for six consecutive quarters. We have seen free cash flow generation improve sequentially over five quarters now.

The company has made tremendous progress in positioning its brands in Canada. It signed international supply deals and launched new, successful products while retaining market leadership in Quebec.

Analysts expect HEXO to report its first positive cash flow from operations in the third quarter of fiscal 2021. The first positive adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) reading is also expected for fiscal second-quarter 2021 ending January 31, next year.

“We are also progressing on the path of becoming cash-flow positive from our operations,” said HEXO CFO, Trent MacDonald in the December 22nd press release. “In light of our solid financial position, and most notably our excellent liquidity and cash flow position, we do not see the need to conduct further rounds of financing in the near future,” he concluded.

Investor takeaway

Investors are noticing HEXO’s tangible progress made during the year 2020. The numbers look much better, and the outlook is encouraging. However, its stock price hasn’t responded much — yet.