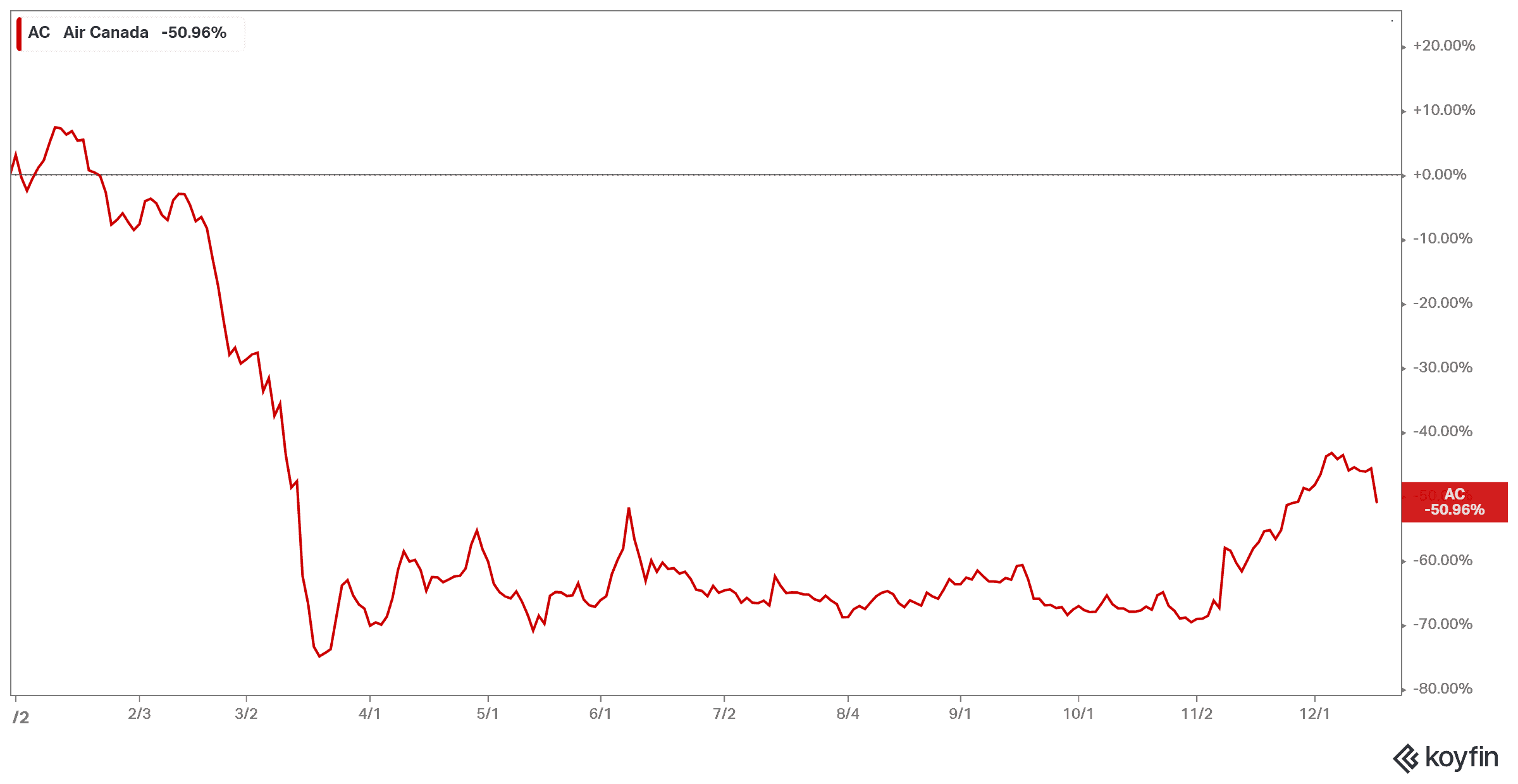

There were a lot of investors who were actually kind of excited when Air Canada (TSX:AC) fell during the market crash. The company soared during the last few years. After bottoming out just under $1 per share back in 2012, it had a rebound like never before. It seemed like there was no telling when the stock would ever come down, if ever.

Then the pandemic happened, and Air Canada stock fell to lows not seen in years. But it meant that now was the opportunity so many investors have been waiting for! It’s a chance to get in on this stock and see it rise again, taking full advantage of this sweet new ride. Right?

The problem is, volatility isn’t over for Air Canada stock — far from it. In fact, if you have profits from Air Canada, it might be time to take them. I’m not saying you have to forget about Air Canada forever, but here are a few things to watch out for.

Vaccine euphoria

The stock market as a whole has seen massive rebound coming from the announcement of a vaccine. Couple that with the start of distribution, and shares have been soaring. That includes Air Canada stock. In the last month, shares have come up a whopping 23%! All from the hope that a vaccine will return the company to some normalcy.

But the vaccine is going to take a long time to reach the average person. People who need it most will get it first. Then there are those in long-term-care facilities and their care givers. Then it will come down to the average person. Analysts believe it will be between September 2021 and June 2022 that Canadians at large will see the vaccine become available.

That means in the meantime, current restrictions and intense measures to keep at least some airplanes in the air will continue. But even beyond the pandemic, there is going to be change. It’s likely we will see change on a scale we haven’t see at airports since 9/11. This will be a huge cost for Air Canada, and all of it will be upfront costs.

Debt increases

Those costs will only add to the enormous pile of debt the company has. Before the pandemic, shares soared, as the company reinvested in fleets of fuel-efficient aircrafts, bought back Aeroplan, and acquired Air Transat. But now with these new measures being added, never mind having to keep planes on land for so long; the company is racked with debt.

In its most recent quarterly report, revenue declined 86% from $4.77 billion to $757 million, with its loss at $785 million compared to income of $956 million the year before. Clearly, it isn’t even making enough to cover its quarterly losses. This is even after losing 20,000 jobs, after adding 10,000 during the last five years. Net debt rose by about $2 billion to $4.97 billion in the quarter.

Bottom line

It is going to take the company years, if not at least a decade to figure all this out. It’s going to be a painful process, and even with bailouts will be a struggle. Yet investors are still buying the stock. When the rose-coloured glasses fall off during another market crash, it’s likely Air Canada will be one of the first to drop. So, if you have a profit from this stock, it could be time to take it now.

But if you’re willing to wait that decade or more, Air Canada isn’t likely to disappear. It’s proven it can come back from the brink, and it likely will again. It’s just going to be a major waiting game. In the meantime, perhaps put on your blinders and forget you even have the stock until there is some major positive news that comes this company’s way.