Planning for retirement is one of, if not the most important decisions of your life and everyone wants to retire wealthier.

This includes planning how much money to save and what your budget is going to be. It’s also about building the right portfolio for you. Building high-quality portfolios ultimately comes down to having a diversified asset mix and buying stocks that are the best of the best.

These stocks should be defensive cash cows that pay a significant dividend and offer excellent long-term growth potential. There are several stocks that have a lot of the qualities of a top stock, but only some that have everything.

Here are two of those top TSX dividend stocks to help you retire wealthier.

Telecom stocks: top investments for retirement portfolios

Telecom stocks are perfect businesses to own if you want to retire wealthier. My recommendation for investors would be BCE Inc (TSX:BCE)(NYSE:BCE).

First and foremost, BCE, as well as all the major telecoms, are highly resilient businesses and great dividend stocks. So you can be confident owning these stocks in a retirement portfolio. In fact, they are so big and stable that the stocks are not very volatile at all.

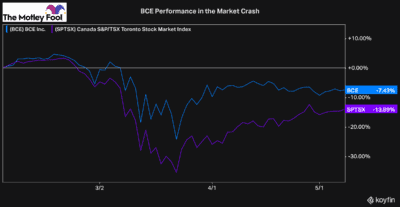

As you can see in the market crash earlier this year, BCE was a lot more stable than the TSX as a whole. In fact, by May, even after a strong recovery for the TSX, BCE was still down only about half as much as the broader index.

This resiliency, coupled with an attractive dividend that’s extremely safe, is another major reason why BCE is such a great stock for investors looking to retire wealthier. The company has increased its dividend by nearly 30% in the last five years. Plus, today, that dividend yields 5.9%.

So you can gain exposure to that attractive yield today and then continue to watch your passive income grow each year as it raises the dividend.

And those dividend increases could get even bigger in the future as BCE’s long-term growth potential looks very attractive. With an underpenetrated Canadian wireless sector and 5G technology being rolled out, the sky is the limit for BCE.

Retire wealthier on passive income from utilities stocks

Another great option for investors building a retirement portfolio are utility stocks. Utility stocks are some of the most resilient investments you can make. Plus, they are well known for being great investments for passive income seekers.

One of the best utilities stocks on the TSX is Emera Inc (TSX:EMA). Emera is a massive company with operations in many jurisdictions across North America. This is extremely important as it helps to reduce risk for investors substantially.

Plus, because nearly all of its business operations are regulated, Emera is a great stock for investors looking to retire wealthier. You can count on the stock to be low volatility and the operations to be resilient.

That’s why it’s the perfect stock to buy not only in this environment but all the time. It will grow with consistency and protect you from any unexpected market crashes.

Plus, its consistent growth goes right to the dividend, which is why in addition to yielding roughly 4.7% today, the dividend has been increased by more than 33% over the last five years.

Bottom line

Building a portfolio that will help you retire wealthier will come down to two main things. First and foremost, the stocks have to be of the highest quality, with low volatility. And, of course, it’s essential these stocks pay a growing dividend.

As long as you look for these qualities and invest for the long term, any other attractive features are just a bonus.