Dollarama (TSX:DOL) is clearly appealing to consumers during the pandemic, as they spend less on discretionary items but continue to purchase essential food and household items. The dollar store chain reported better-than-expected third-quarter results on Wednesday morning and hiked its dividend. Dollarama stock gained nearly 3% on Wednesday morning.

Dollarama Q3 profit up 17% from a year ago

Sales jumped 12.3% to $1.06 billion in the quarter ended November 1, mainly due to the popularity of summer goods, household products, and cleaning products. Store traffic declined, but this was offset by an increase in the volume of items purchased by consumers when they visited. The number of transactions fell by 15.2%, but the average amount jumped by 26.3%.

Net income, at $161.9 million, increased by almost 17% from the same period last year. Per diluted common share, net income stood at $0.52, up from $0.44 a year ago. Analysts on average expected a result of $0.44.

Comparable sales — a key metric in the industry — increased by 7.1%. This data excludes the impact of new stores opened for less than a year. Dollarama opened 19 stores during the quarter.

The growth in comparable store sales is primarily attributable to higher sales of seasonal items, particularly summer and Halloween items as well as household essentials, hygiene and beauty products, and cleaning. The gross margin was 44% of sales.

A dividend increase and an employee bonus

The Montreal-based company increased its quarterly dividend by 6.8%, from 4.4 cents to 4.7 cents per share. The stock currently has a dividend yield of 0.3%.

Dollarama has also joined other retailers such as Sobeys owner Empire Company and Walmart in announcing a new round of bonuses for store staff now that the second wave of the COVID-19 pandemic is escalating.

Dollarama announced it would give a bonus to more than 26,000 employees for their continued dedication.

“I wish to recognize our people for their efforts and dedication as the pandemic has become our new reality and with COVID-19 safety measures now part of our everyday operating procedures,” Dollarama president and CEO Neil Rossy said in a statement Wednesday morning.

Full-time employees will receive $300, while part-time employees will receive $200. All store employees active as of December 9, 2020, will receive this one-time recognition bonus.

Dollarama is a strong buy

Dollarama is a great stock to own anytime but even more so during a recession or a pandemic. Demand for discounted items and economy packs has been strong due to high unemployment and declining household income in several large economies, with hunkered-down consumers buying more seasonal items at low prices.

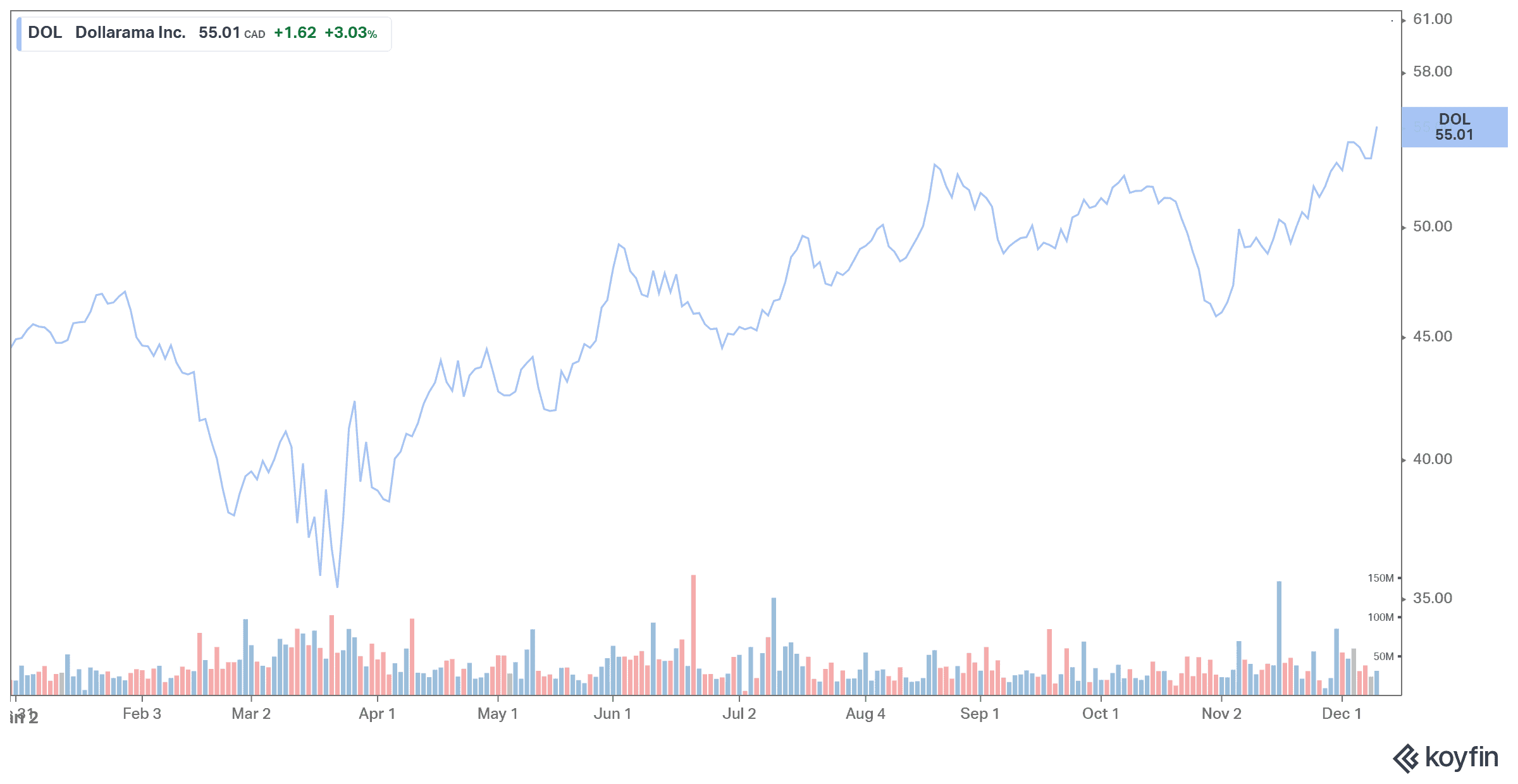

The stock has performed well this year, with a return of more than 22% year to date. This is much better than the return of the TSX, which has gained less than 4% year to date. A defensive stock like Dollarama usually performs better during hard times. And even when the pandemic will be behind us, Dollarama will keep doing well as consumers like low prices.

The retailer still has more upside, as sales and profit are expected to grow even faster next year. Dollarama is one of the best Canadian stocks to buy and deserves a place on your shopping list.