Most major Canadian banks reported their latest quarterly results last week. Toronto-based Bank of Nova Scotia (TSX:BNS)(NYSE:BNS) announced its October quarter results on December 1. The bank currently has a market cap of $81.4 billion — much lower than its larger peers such as Royal Bank of Canada and Toronto-Dominion Bank.

Despite reporting minor weakness in its Q4 revenues, BNS could be one of the best Canadian bank stocks for dividend investors to bet on right now. Let’s find out why.

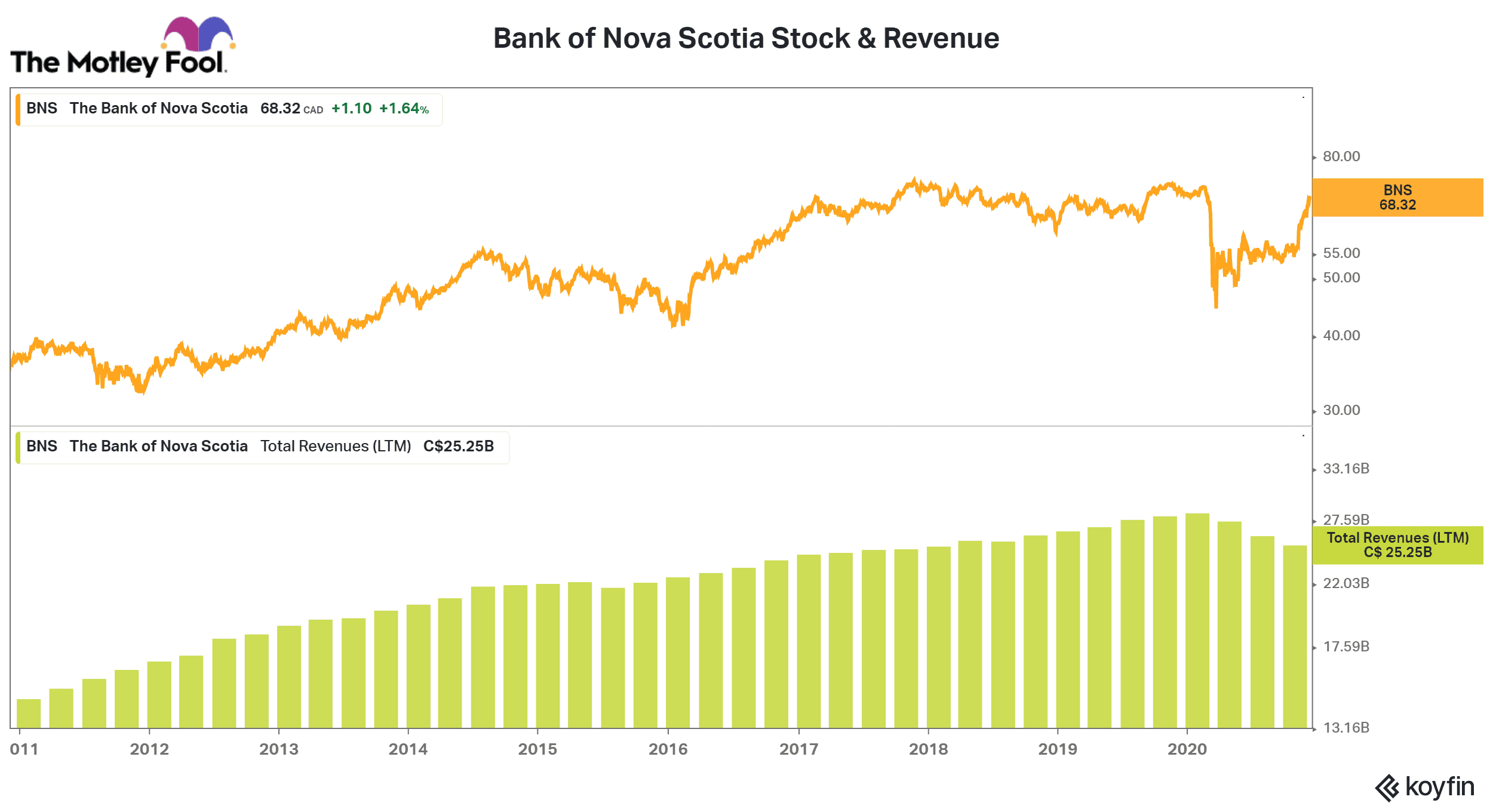

Bank of Nova Scotia stock

In Q4 of fiscal 2020, the Bank of Nova Scotia reported adjusted net earnings of $1.45 per share — down 20.3% from $1.82 per share in the Q4 of fiscal 2019. Nonetheless, the bank exceeded analysts’ expectations of $1.22 per share in the last quarter.

Bank of Nova Scotia’s Q4 earnings growth rate also showed sequential improvements. In the third quarter of fiscal 2020, its earnings fell by about 45% on a YoY (year-over-year) basis compared to a 20.3% drop in the fourth quarter.

The bank’s total revenue fell by 5.8% to $7.5 billion in the last quarter. On the positive side, it reported a sequential rise in its net interest income to $4.26 billion in Q4.

What else improved

In the quarter ended in October 2020, the adjusted net profit margin of Bank of Nova Scotia showcased significant sequential improvement. In Q4, the bank’s bottom-line margin expanded to 24.1% compared to 16.7% and 15.9% in Q3 and Q2, respectively.

While the bank’s net profit from its home market banking operations fell by 13% YoY, it improved by 81% sequentially to $778 million. Its net interest margin remained sequentially unchanged at 2.3% in the last quarter.

In addition to a sharp recovery in its Canadian banking operations, the Bank of Nova Scotia’s international banking adjusted income surged sharply in the fourth quarter. It rose by about 500% to $283 million in the fourth quarter of fiscal 2020. Its international market loan and deposit growth rate both stood at 7%.

Gains continued in global wealth management

BNS registered another solid quarter for its global wealth management business. Its net income from the segment rose by 8% YoY and 1% on a sequential basis. Strong asset management sales, positive private banking volume growth, and higher brokerage fees drove the segment revenue 4% up than a year ago.

What to expect next?

Bank of Nova Scotia’s management expects fiscal 2021 to be much better than fiscal 2020 as the ongoing pandemic gradually subsides. The bank expects a healthy economic recovery in all its key markets — including the United States, Canada, and Mexico.

The bank currently offers an attractive 5.4% dividend yield at its current market price of $67.22 per share. While BNS stock has registered a massive 21.5% recovery in the fourth quarter of the calendar year 2020 so far, it’s still trading with 8.4% year-to-date losses. It could be a good opportunity for dividend investors to buy stocks cheap.