Canadians are already likely aware of the new benefits released by the Canada Revenue Agency (CRA) this year to help with the pandemic. The Canada Emergency Response Benefit (CERB), Canada Recovery Benefit (CRB), and others all provide payments to Canadians who still struggle to make ends meet during this time.

But if you’re struggling, you are also quite likely able to claim the GST/HST tax credit. This one-time payment could make all the difference if you have a low to modest income. While the payment was made months back, don’t worry! You can still claim it, but not for long.

The details

The GST/HST tax credit was issued back on Apr. 9, 2020 to low- and modest-income households. These households received the one-time payment in addition to the normal GST/HST credit they were already likely receiving by mail or direct deposit. However, if you didn’t receive it there’s a simple reason.

Did you file taxes in 2018? If not, it’s likely the CRA didn’t have the information available to see that you are from a low- or modest-income home. If you were, it would provide payments automatically. While it’s true that we’re in 2020, the CRA is using the 2018 tax return as the basis for credits. That’s because of the extension given for the 2019 tax return of September 2020.

Still, about 12 million households received this one-time tax credit. If you’re single, it was likely around $400. If you’re a couple, it was likely closer to $600 per household. And if you didn’t receive it? Easy. File your taxes! It’s never too late to file taxes, and you’ll only take on more penalties by waiting. So, act fast, and you can still receive this tax credit before the next tax year begins!

Until then?

Obviously, it’s going to take awhile for the CRA to file your return and for you to file it, for that matter. So, why not make the most of your cash now while you wait for that extra $400? In fact, it’s never too late to come up with a strong investing solution that will last you the rest of your life.

An excellent way to stay financially afloat (and then some) is to take 10% from each paycheque you receive and put it into a Tax-Free Savings Account (TFSA). The TFSA provides a tax-free way to invest in Canadian companies, adding on thousands in investment contribution room each year. So, when January hits, you’ll have a nest egg of cash ready to invest when the contribution room is announced.

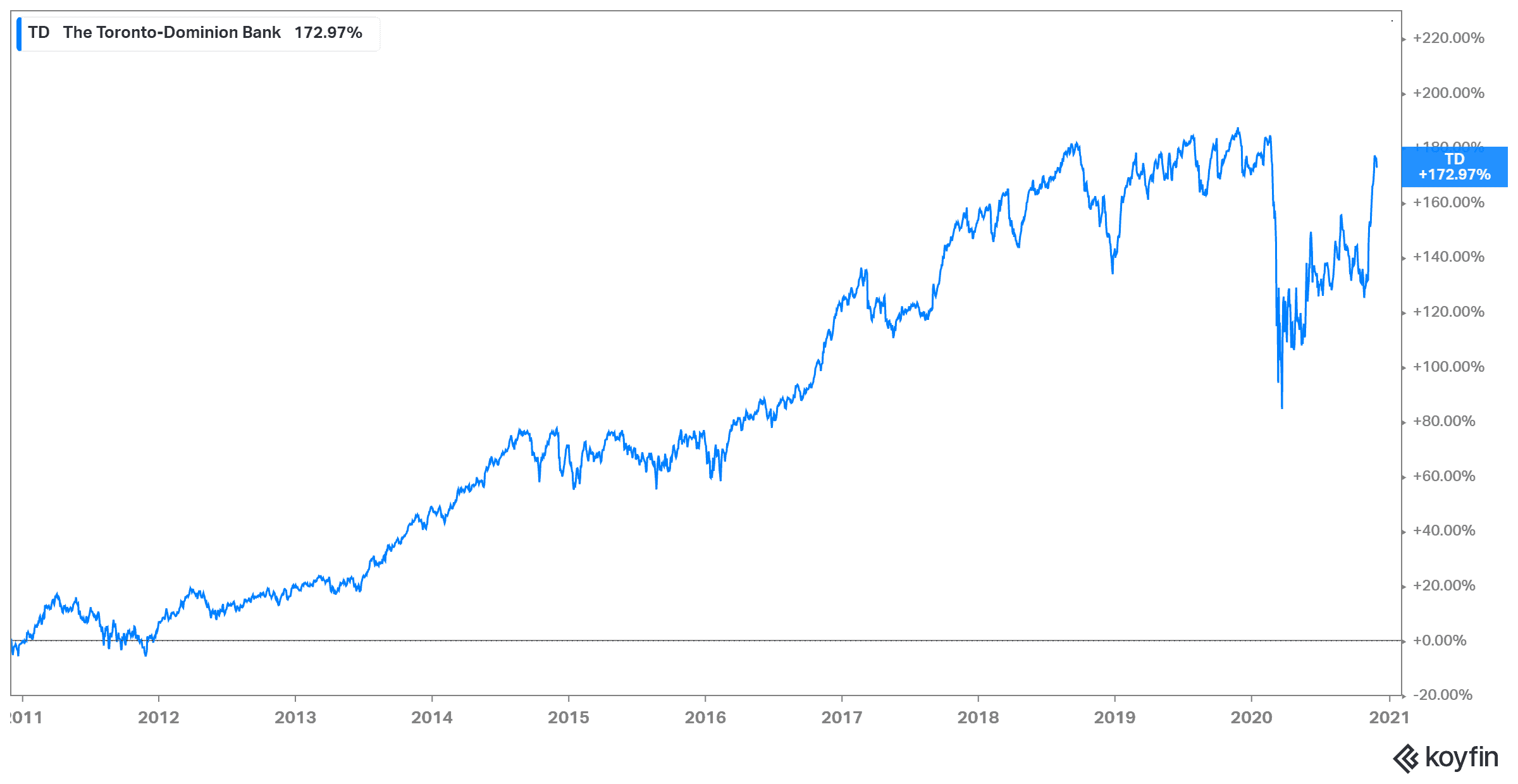

Let’s say you make a modest income of $35,000. That would mean you have $3,500 to invest each year. With stocks likely to take another downturn in January, it’s the perfect time to invest. Just add some winners to your watch list. It doesn’t have to be risky. Take into consideration Toronto-Dominion Bank (TSX:TD)(NYSE:TD). TD Bank is growing the fastest of the Big Six Banks, with strong revenue coming from the United States and wealth and commercial management sectors. It’s likely to continue remaining strong for decades, and provides a solid 4.46% dividend yield as of writing.

Bottom line

Investing in a bank stock like TD Bank gives you strength and stability during a downturn for decades. You would receive $158 in passive income each year from this stock, along with potential returns of 173% in the next decade, if we can look at the last decade as an example. That’s a compound annual growth rate (CAGR) of 17.3%! If you reinvested those dividends, in another decade you could turn that $3,500 into $22,570.09!