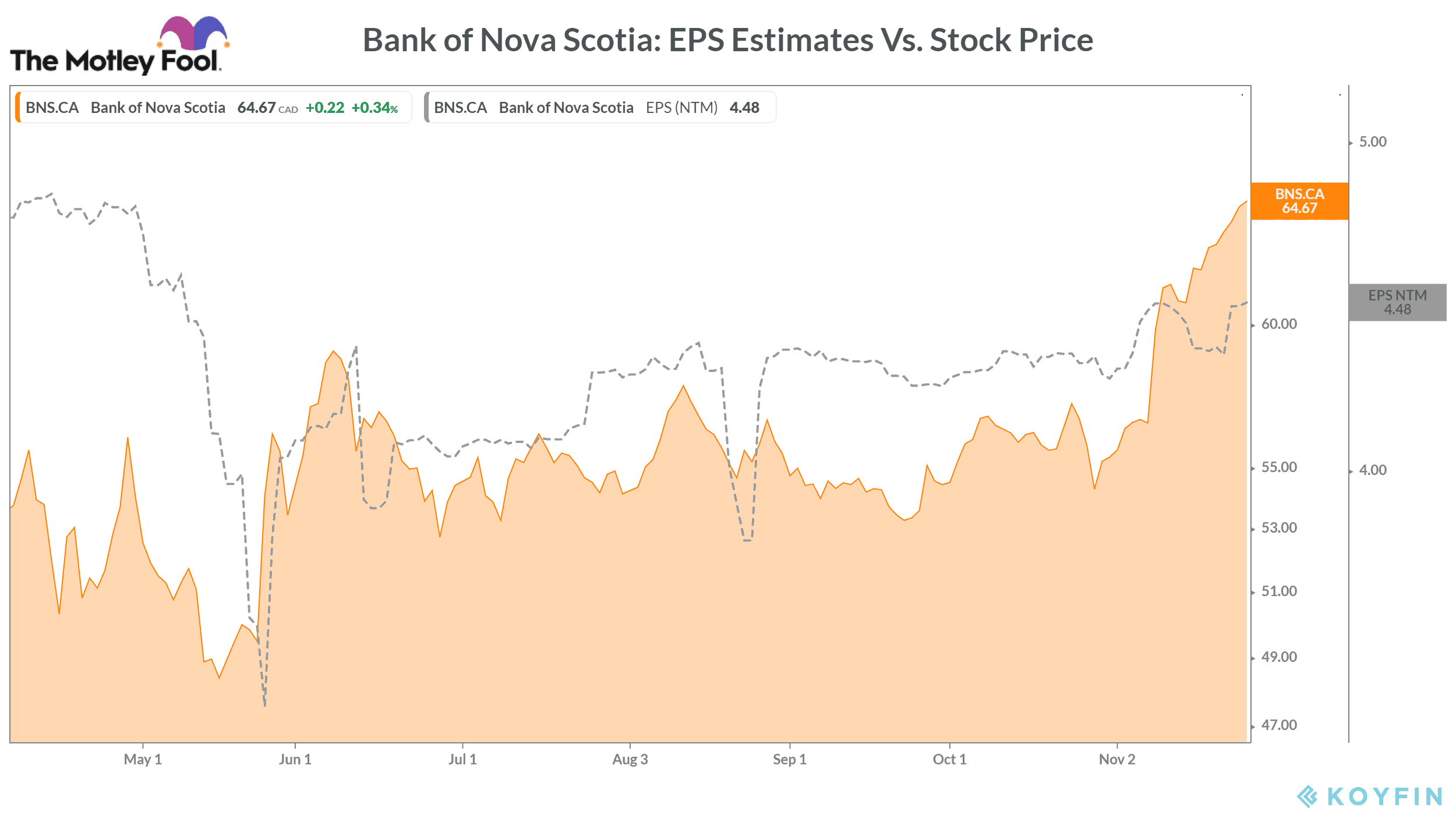

Bank of Nova Scotia (TSX:BNS)(NYSE:BNS) will announce its fourth-quarter earnings on December 1. Like most other bank stocks, the shares of Bank of Nova Scotia are rallying this month after facing pessimism in a previous couple of months.

Investors’ high expectations

Investors’ high expectations from the Canadian banking sector’s latest results could be one reason for this rally in baking stocks. Also, recent positive developments related to multiple COVID-19 vaccine candidates have added to this optimism. As of Tuesday, its stock has gained 16.5% in November so far. By comparison, the S&P/TSX Composite Index has inched up by 9.7% this month.

What to expect from Bank of Nova Scotia’s Q4 earnings

The existing trend in Bank of Nova Scotia’s earnings is negative as the ongoing pandemic has badly hurt its core banking operations. In the second quarter, the bank reported a 39% year-over-year (YoY) drop in its adjusted earnings to $1.04 per share. In the third quarter, its earnings YoY growth worsened as it fell by 45% — also missing analysts’ consensus estimates by 7%.

For Q4 of fiscal 2020, analysts expect the negative trend in Bank of Nova Scotia’s financials to continue with a 33% YoY drop in its earnings to $1.22 per share.

Falling interest income

In the quarter ended July 2020, the Bank of Nova Scotia’s net interest income fell to $4.3 billion, lower than the $4.4 billion seen in the previous quarter as well as in the quarter ended in July 2019.

As a result, the bank’s adjusted net profit fell to $1.3 billion in Q3 from $2.3 billion in the same quarter of the previous year. According to Bay Street’s consensus estimates, the bank is expected to report a $1.6 billion net profit in the fourth quarter.

Even if the Bank of Nova Scotia manages to meet this quarterly bottom-line estimate, it will translate into a 28.4% drop in its fiscal 2020 profits.

In the fourth-quarter earnings, investors should be watching the latest trend in the Bank of Nova Scotia’s net interest income as positive sequential growth in it could boost confidence and drive its stock higher.

Other factors to watch for

In recent quarters, the Bank of Nova Scotia’s core banking margin has shrunk due to a drop in net interest income and other COVID-19 driven operating challenges. In Q3 of fiscal 2020, its core banking net interest margin stood at 2.1% — down 35 basis points from a year ago and down 25 basis points from the previous quarter.

The bank’s management blamed its corporate and commercial loan growth, outpacing retail loan growth during the quarter for a lower margin. This factor alone stole about 22 basis points from BNS’s core banking NIM.

Foolish takeaway

Like most other Canadian banks, the Bank of Nova Scotia’s core banking segment massively suffered due to the COVID-19 related restrictions as well as higher costs. However, investors should watch closely for signs of a recovery in its core baking operations during the bank’s Q4 earnings event next week.