The Canadian government provided a lifeline when it distributed the Canada Emergency Response Benefit (CERB) back in April. The goal was simple: get Canadians money as quickly as possible. The hope was to keep the economy afloat during a lockdown across the country.

But today, things have changed. COVID-19 is still very much a part of our lives. In fact, cases continue to rise to new heights every day. But the hope of the government now is that we know how to handle it and ourselves. That means businesses and individuals should figure out a way to get back to work.

So, CERB is no more and it has been replaced by benefits to get Canadians working. You can still receive a benefit similar to CERB, and that’s through the Canada Recovery Benefit (CRB). This payment gives out $500 per week, just like CERB. You have eligibility periods to reapply, just like CERB. But you now have to apply more often, every two weeks, and must prove you are looking for work and can’t at the moment because of COVID-19.

The issue

So, you have this offer of CRB payments that are similar to CERB, but really it isn’t. You must prove beyond that you’re looking for work, but also that you have earned less than $1,000 in the last four weeks before applying. That is certainly not a lot to live on and makes it hard if you’re simply trying to make ends meet.

Also, if you do get CRB payments, you then may have to pay them back. This happens if you make more than $38,000 by tax time. For every dollar over that limit, you will pay back $0.50 to the Canada Revenue Agency (CRA). Again, $38,000 isn’t a lot and includes any benefits from the government. And those CRB payments add up to $13,000, but there is an immediate tax that brings it down to $11,700 before you announce it on your tax return.

What about EI?

Then there’s Employment Insurance (EI). You cannot apply for CRB if you can apply for EI, and there are changes to make it more accessible. Whereas before you had to have hundreds of hours of work to apply for EI, now you only need 120 insurable hours to apply. Then, you can receive $573 per week, a $73 increase from the CRB payments.

So, while this is more, it still doesn’t apply to those who are self-employed, work part-time, students, or otherwise. So, it might be better to take CRB payments in this case.

Save what you can!

If you’re able, putting away 10% of each cheque means you can create a nest egg for when you need it down the road. Clearly, the pandemic proves a downturn can happen overnight. Be prepared by putting 10% aside and investing in strong companies that will continue to grow no matter what happens in the market.

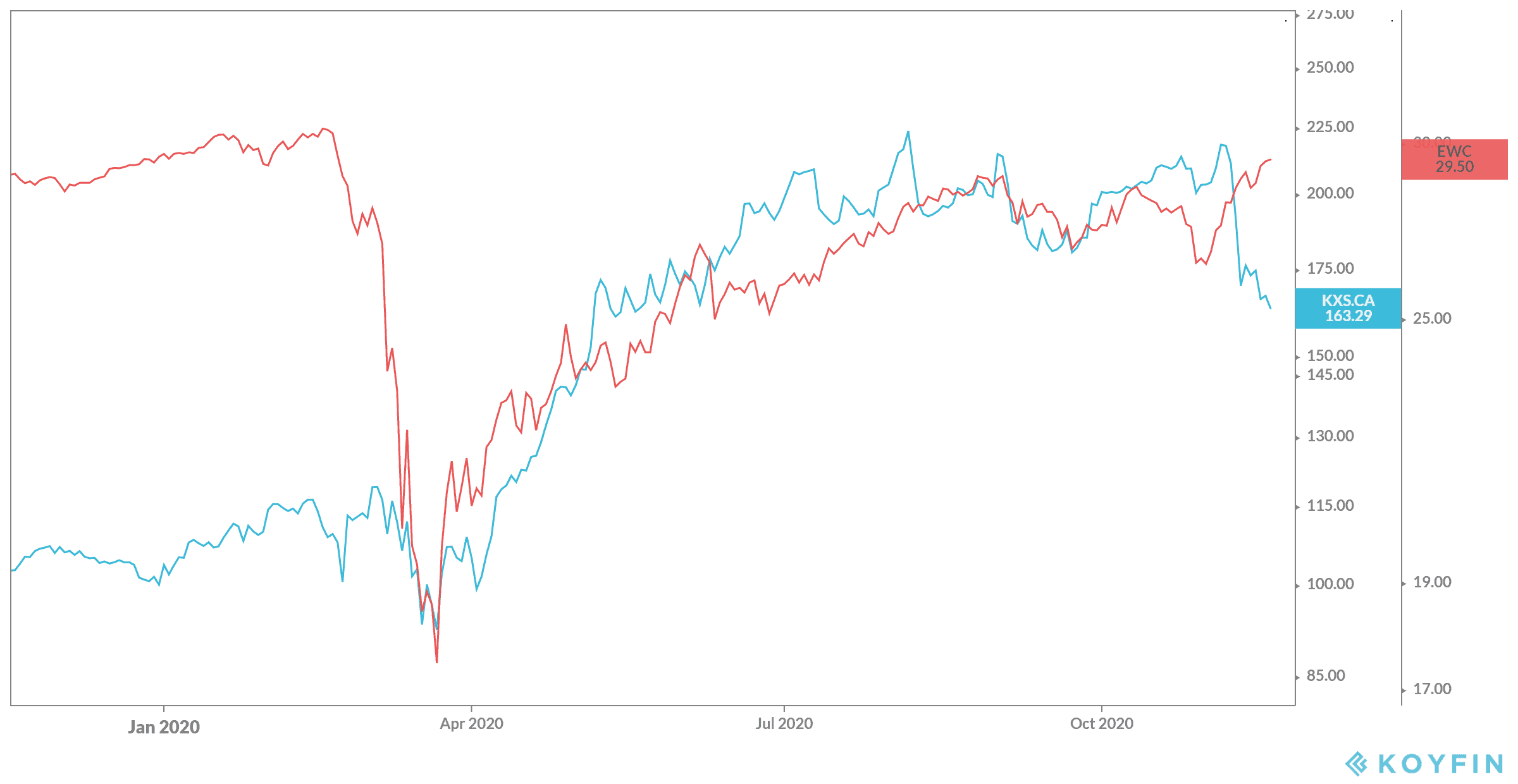

Such a company includes Kinaxis (TSX:KXS). This company provides supply chain management software to enterprise companies around the world. Revenue continues to grow year over year, with the most recent quarter reaching 30%. Meanwhile, shares have grown by 59% as of writing for the year and 268% in the last five years!

Bottom line

No matter what avenue you choose, make sure you are keeping your cash safe in a Tax-Free Savings Account. That way, when you need your money more than ever, it will be available to you tax free. Along with all the returns you would get from a company like Kinaxis.