Today’s volatile market has a lot of stocks trading well below pre-crash levels. At first glance, it looks like the market is flooded with deals! But beware. While there are a lot of stocks that could rebound in the next few months, those same stocks could crash in a number of scenarios.

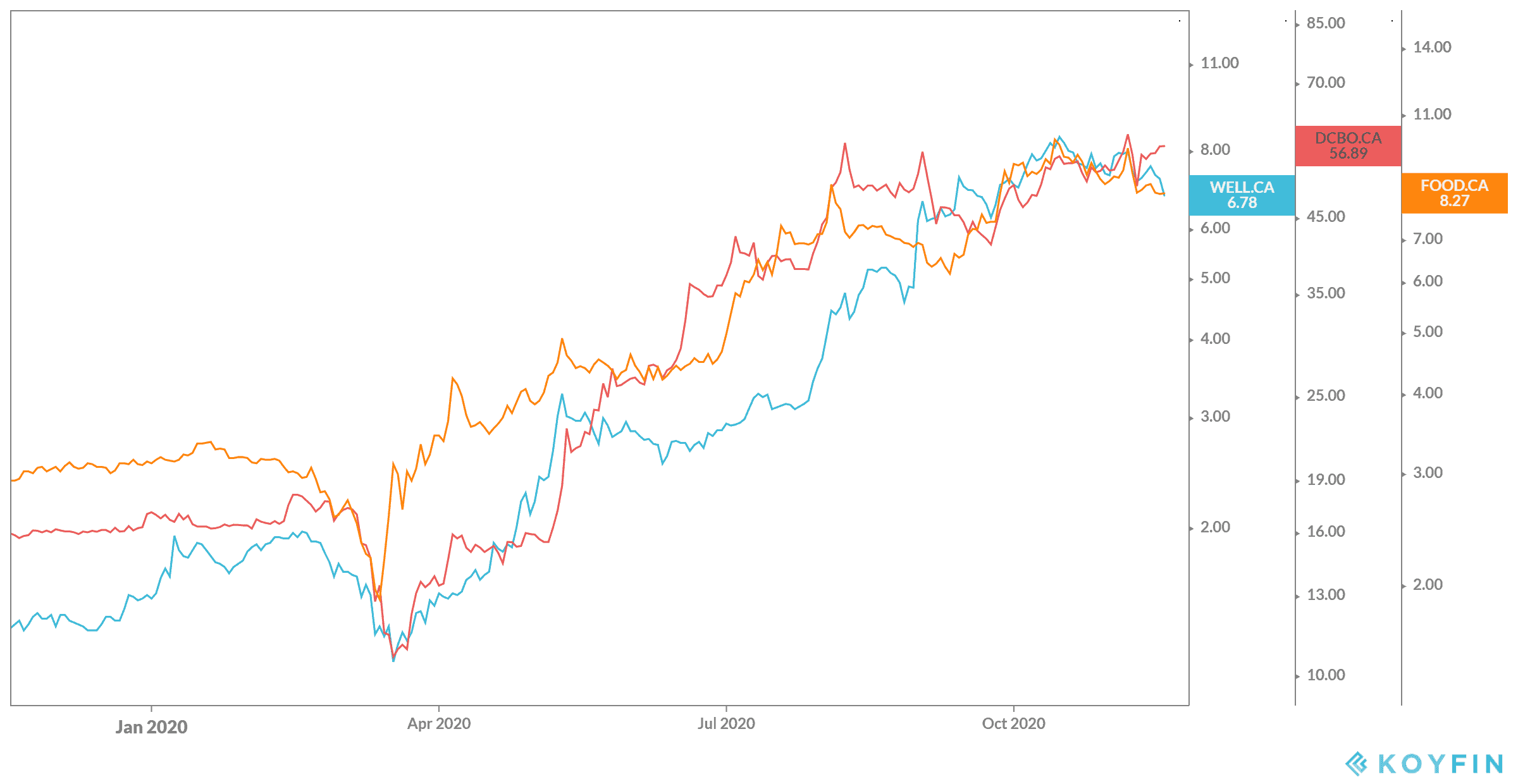

The pandemic is still raging, the housing market is still inflated, a new presidency is coming in January. All of these things could send most stocks into a tail spin in the coming months. That is, unless you invest in growth stocks like Docebo (TSX:DCBO), Goodfood Market (TSXFOOD), and WELL Health Technologies (TSX:WELL).

Docebo

Docebo provides a learning management system to companies around the world. It came onto the market last year and has soared with the pandemic. The company provided users with the means of training people any where in the world. Now, it doesn’t matter if your employees work from home or in Australia; you can train them all the same.

During the latest quarter, annual recurring revenue increased 55% year over year. The company expects earnings to continue in this way for years as the work-from-home economy remains strong. Shareholders seem to agree, with shares growing 256% in the last year alone. The company still has lot of room to grow, with a $1.65 billion market cap. So, watch out for this stock to soar in the next few years.

Goodfood

Another company making headway in the pandemic has been Goodfood. This company saw demand soar during the beginning of the pandemic, opening up facilities across Canada to meet the need of the meal-kit service. Even as people venture out once again, the company still sees demand on the rise.

Revenue increased year over year by a whopping 256% during the beginning of the pandemic, but even during the latest quarter, it’s still up by 142.8% year over year. Economists believe the company should continue to rise in demand, as the market capitalization is still only at $554 million of a multi-billion-dollar industry. All Goodfood has to do is see the successes of others around the world and do its own thing to keep growing. It’s already working, with shares up 183% in the last year alone!

WELL Health

Finally, WELL Health has been on everyone’s radar given its use of the virtual healthcare. The company brings together doctors, therapists, physiotherapists, and nurses — you name it — and gives patients a way to connect virtually. Clearly, this has been a lifesaver during the pandemic, quite literally. You no longer have to risk going out, a doctor can meet you in your home as you stay safe.

The company had a record quarter recently, with revenue increase of 50% year over year for the quarter, and a 70% increase year over year in gross profit. Shares grew right along with it at a whopping 392% for the last year alone! This is a company that absolutely will continue to increase in use for the foreseeable future and beyond. So, if there’s only one stock you’re picking up today, I would choose WELL Health.