George Weston Limited (TSX:WN) is one of the largest food processing and distribution companies in Canada. The company, which operates through Loblaw (TSX:L), Choice Properties, and Weston Foods, reported its third-quarter results on Tuesday morning, which were quite strong. This dividend stock is very cheap.

Businesses each showed improved financial performance

Chairman and Chief Executive Officer of George Weston Limited Galen G. Weston said in a statement, “Our financial results in the third quarter underscore the resiliency of our businesses, with each showing improved financial performance over the second quarter of 2020. Loblaw generated strong same-store sales and furthered key strategic initiatives.

Choice Properties collected close to 98% of rents in the quarter and made significant progress in its capital recycling program to further improve the quality of its portfolio. And after a very challenging second quarter, Weston Foods experienced an improvement in food service sales and better service levels and manufacturing efficiency, all while continuing to advance its transformation program.”

In its quarterly report, George Weston says it achieved earnings available to common shareholders of $303 million or $1.96 per diluted share for its last quarter, up from $69 million or $0.44 per diluted share a year earlier.

The company says the increase is due to the favourable year-over-year net impact of adjusting items totalling $263 million.

On an adjusted basis, George Weston claims to have earned earnings available to common shareholders of $362 million or $2.35 per diluted share, compared to $391 million or $2.54 per diluted share in the same quarter a year earlier.

Revenue for the 16-week period ended October 3 totaled $16.21 billion, up from $15.23 billion a year ago.

Loblaw earned revenues of $15.67 billion, an increase of 6.9% over the previous year and above analysts’ estimate of $15.61 billion. The company’s online sales more than doubled in the third quarter as consumers stuck at home spend more on groceries during the COVID-19 pandemic.

Loblaw, which sells everything from cosmetics to mobile connections, said it will invest more to expand pickup and delivery operations while aiming to cut costs amid the coronavirus crisis.

An undervalued dividend stock

George Weston increased its dividend when publishing its latest quarterly results.

The company said its quarterly dividend will be raised by 4.8% to $0.55 per share, from $0.525 per share.

Its forward dividend yield is 2.13% and its payout rate is 39.11%. George Weston is also a Canadian dividend aristocrat. The company has increased its dividend over the past eight years.

Finally, it should be noted that this dividend stock is extremely undervalued. The company’s current price-to-sell (P/S) ratio is 0.30, while the usual indicator of an undervalued stock is a P/S of two or less. Similarly, a good value stock should have a price-to-book (P/B) ratio of three or less. George Weston currently has a P/B of 2.22. The forward P/E, at 13.3, is also quite low.

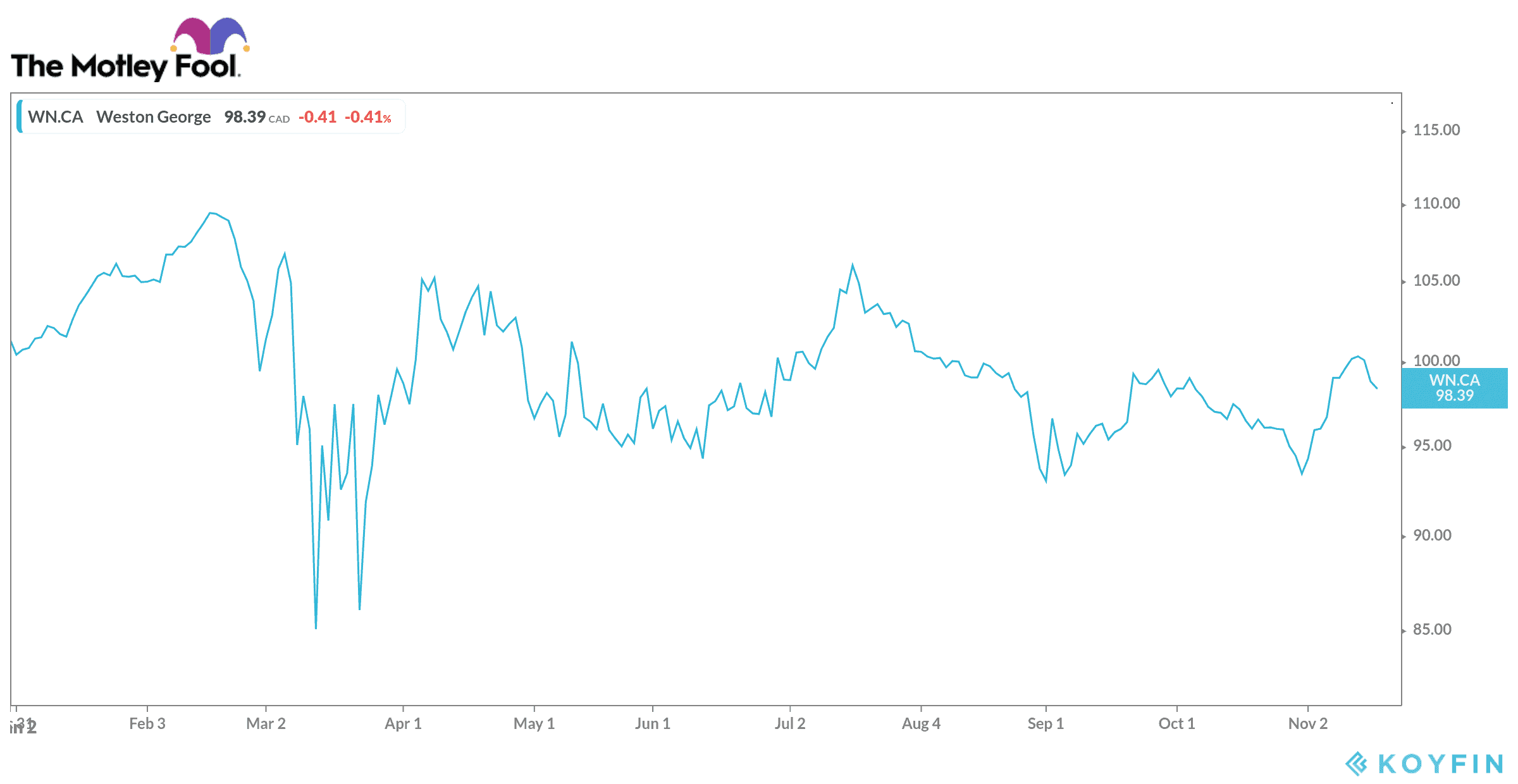

The stock hasn’t performed well since the beginning of the year, but we can hope this will change soon as investors rotate from growth stocks to value stocks.

With a beta of only 0.27, George Weston’s stock isn’t very volatile. If the market crashes, this dividend stock should perform better than more volatile stocks.