Suncor Energy Inc. (TSX:SU)(NYSE:SU) stock fell off a cliff in March. It was a reflection of the coronavirus pandemic crisis, as well as the many problems that exist in the Canadian oil and gas sector.

Today, however, Suncor stock looks quite attractive as it emerges from the dust. As the company rebuilds its strategy and its focus for the new world of lower oil prices, can Suncor stock rise again? Is it headed back up to 2019 levels of over $30?

Suncor stock begins its comeback

Looking at the last few days of trading in Suncor stock takes me back to the late 1990’s/early 2000’s. At that time, it was part of a typical day to see oil and gas stocks spiking higher. So for me, the last few days have been a stroll down memory lane.

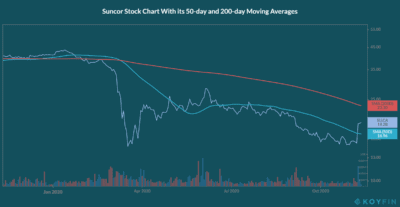

Suncor stock has rallied 25% since Monday — in just two days! Pretty impressive, and reflective of how cheap Suncor stock actually was and is. Because if we look at Suncor’s results in its latest quarter, we have reason for optimism. Cash from operations was $1.2 billion as oil traded in the $40 range and costs were slashed. Refinery utilization averaged 87% in the quarter and exited the quarter at 97%. Suncor’s business is still outperforming despite the extremely difficult macro environment it is operating in.

Suncor aims to not only survive, but also thrive in the new world

Since December 2019, Suncor stock has lost 55% of its value. We all know the culprits in this fall from grace – oil price weakness, and uncertainty related to the economic impact of the coronavirus. It all came to a head when Suncor instituted a 55% cut in its dividend. How far this energy giant had fallen. Years ago, Suncor was touted as a stable dividend stock. And it was in fact exactly that. The epitome of stability, dividend growth, and financial strength.

The oil and gas industry’s woes are deep. Years of political opposition to pipelines and a general lack of investment and respect from investors had taken their toll way before the coronavirus crisis. As an integrated oil and gas company, Suncor had always been pretty sheltered from industry difficulties until earlier this year.

Suncor takes the climate fight seriously

The energy transition that is taking place is a slow and gradual process. We won’t wake up tomorrow to a world without oil and gas. We need these commodities to power our lives and our livelihoods for years to come.

Within the energy industry, there are two ways in which the climate crisis can be addressed. The first is very well known and accepted. Clean energy sources such as solar and wind have seen huge growth in recent years. But this growth has not moved the needle enough. A revolution takes time.

While we walk along this long road, natural gas will play a big part in the transition to cleaner energy sources. Natural gas is significantly cleaner than the coal it is already replacing. And this brings me to the second way the climate crisis will be addressed. Oil and gas companies are investing a lot in actually cleaning up their oil and gas operations. This does not get enough attention, in my view.

For example, Enbridge has announced ambitious targets of becoming a net zero carbon emitter by 2050. For its part, Suncor has set a goal to reduce its greenhouse gas emissions by 30% by 2030. At Suncor’s newest Fort Hills mine, for example, greenhouse gas intensity is more than 50% lower versus the average oil sands.

Technology is changing the world in many different sectors. It can also help with the oil and gas industry’s most pressing problem. Oil and gas companies certainly have the motivation to clean up their operations. It’s a matter of their very survival.

Motley Fool: the bottom line

Suncor stock is in the midst of bouncing hard off of its lows. With a gradual economic recovery under way, Suncor stock can extend these gains. We need Suncor’s energy to power an economic recovery. We need it to simply power our everyday lives.