Suncor Energy Inc (TSX:SU)(NYSE:SU) and Enbridge Inc (TSX:ENB)(NYSE:ENB) are two of the top long-term stocks investors can own. Yet, like almost everything else in 2020, these businesses have seen a major impact from the coronavirus pandemic.

The energy industry as a whole has been one of the worst impacted industries. In addition to always being negatively impacted by recessions, the nature of the pandemic limiting people’s travel and having employees work from home has impacted the demand for oil considerably.

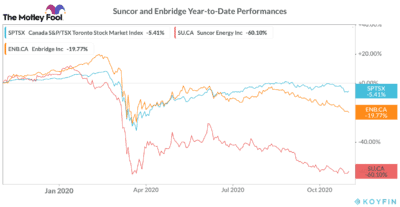

So it’s no surprise that energy stocks are among the worst-performing TSX stocks since the start of the pandemic. And that underperformance has increased lately, as the second wave of coronavirus causes more concerns about the demand for oil.

As you can see, both these top stocks were actually outperforming the market before the pandemic. However, since the selloff in May, it’s been a tough road for the two energy giants.

Although both have underperformed the market, obviously, there is a clear difference in performance. So which stock is the better buy today?

Suncor stock

Suncor Energy is one of the top stocks on the TSX. In fact, it’s one of only two TSX stocks that Warren Buffett owns. Buffett’s long position definitely shows Suncor is a quality business, but that alone doesn’t mean we should invest in Suncor. We first have to decide if it makes sense for our portfolio.

Suncor is attractive because it’s an integrated energy stock. In addition to producing oil, it also has refining assets and retail operations, making it fully integrated. This is key to its resilience.

When oil prices tank like they have in 2020, producers are the most impacted stocks. So the fact that Suncor can mitigate against that with its other business operations is part of what makes it so attractive.

Unfortunately, though, the downside to any commodity business is that there’s nothing these businesses can do to control the price of oil. So until the price of oil rebounds, there won’t be any catalyst for a recovery in Suncor shares.

Enbridge stock

Enbridge, on the other hand, doesn’t produce or sell oil. Rather, its main business is the transportation of oil. So you may be wondering why Enbridge is underperforming so much.

The issue is the one industry that Enbridge serves is being significantly impacted. So, although it doesn’t actually sell oil if less is being transported, that could be an issue. There is also the risk that some of these producers who owe it money may go out of business in the short-term.

The energy industry is always volatile, so it’s no surprise that all these headwinds have been weighing on Enbridge’s stock. However, investors who have a long-term mindset will realise that these short-term headwinds are just that, short-term. So this may be the best opportunity to buy such a high-quality stock at such an attractive bargain.

The company is still the most dominant in its industry, with major competitive advantages. Furthermore, it has a well-diversified business. So although its oil transportation business is being impacted, Enbridge’s gas utility business is still earning strong cash flow for the company.

The company pays an attractive 8.8% dividend and trades less than 10% off its 52-week low, making it absurdly cheap.

Bottom line

Both Suncor and Enbridge are some of the top long-term stocks on the TSX. There’s no question investors could buy both for the long-term and see major returns as a result.

With that said, if I had to choose one stock to buy today, it would be Enbridge. There is still quite a bit of uncertainty with Suncor, and Enbridge’s stock is in a much better position to rally in the short-term.