Warren Buffett famously said that investors need to “be fearful when others are greedy, and greedy when others are fearful.” He also said that “you pay a very high price in the stock market for a cheery consensus.” His words hold even more true in a world where our politics, health, stock markets, and everyday life are being disrupted to the core. Since October 23, 2020, the TSX Index has dropped almost 4.5%, which may have investors running for the door. The fact is, there are a number of “uncertainties” that are creating some bearish market sentiment.

Warren Buffett: Be greedy when others are fearful

Yet, just like Warren Buffett, it is important to remain resolute in your investment strategy. In fact, take these dips to help maximize your long-term portfolio returns. In 10, 20, or 30 years, we may not even remember the market correction in October. Yet you likely won’t forget the wealth you created by buying the market’s fear at a discount.

Just after the March market crash, Warren Buffett made a contrarian bet on energy by buying Dominion Energy’s natural gas pipeline network for $9.7 billion. While this was not necessarily the most popular bet, natural gas still remains an important fuel for heat, cooling, and power generation. The great thing with these gas transmission assets is that they have limited commodity/production risk and are secured by long-term take-or-pay contracts. At a time where natural gas is trading at an all-time low, you could say this is a solid Warren Buffett contrarian bet.

Take a page from Warren Buffett’s playbook

A TSX stock that shows some very similar attributes to Warren Buffett’s recent investment is TC Energy (TSX:TRP)(NYSE:TRP). It owns one of North America’s largest natural gas pipeline networks. It delivers around 25% of North America’s natural gas demand. Its natural gas transport business makes up around 68% of its annual EBITDA. The remainder comes from liquids pipelines (23%) and natural gas power production (9%).

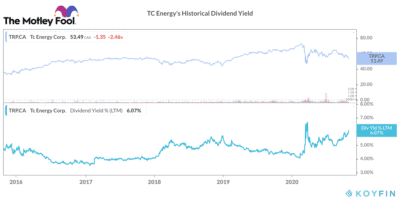

Despite concerns around the energy environment right now, TC still has a very solid business model. It derives 95% of its EBITDA from regulated or contracted assets. Consequently, the company has a very stable operating platform. It is the type of cash-cow business that Warren Buffett loves. Since 2000, TC has delivered average annual total shareholder returns of 13%. Since 2015 alone, it has grown its dividend by between 8% and 10% per year.

Forget a market crash: Buy and hold forever

Yes, Joe Biden said he would cancel the Keystone XL project (TC’s largest project planned to date), which has put pressure on the stock. It is difficult to say if that is just political posturing or whether Mr. Biden can even quash a project that has already been approved.

Regardless, TC still has a $27.9 billion capital program of mostly natural gas transmission projects. Generally, these should have a strong chance of approval and development. Despite even these growth initiatives, management still expects 5-7% annual organic growth for the next few years.

Although TC has faced a challenging year, it is still a great company. It is in an unloved sector, but there is nothing unlovable about its growing (upwards of 8-10% to 2022) approximately 6% dividend. The dividend yield is trading near all-time highs and far above its five-year average of 4.37%. Completion of the Keystone XL, among its other projects, is just additional upside for shareholders. If you take the Warren Buffett approach and buy against the market, I believe you will be amply rewarded with TC Energy over the next decade.