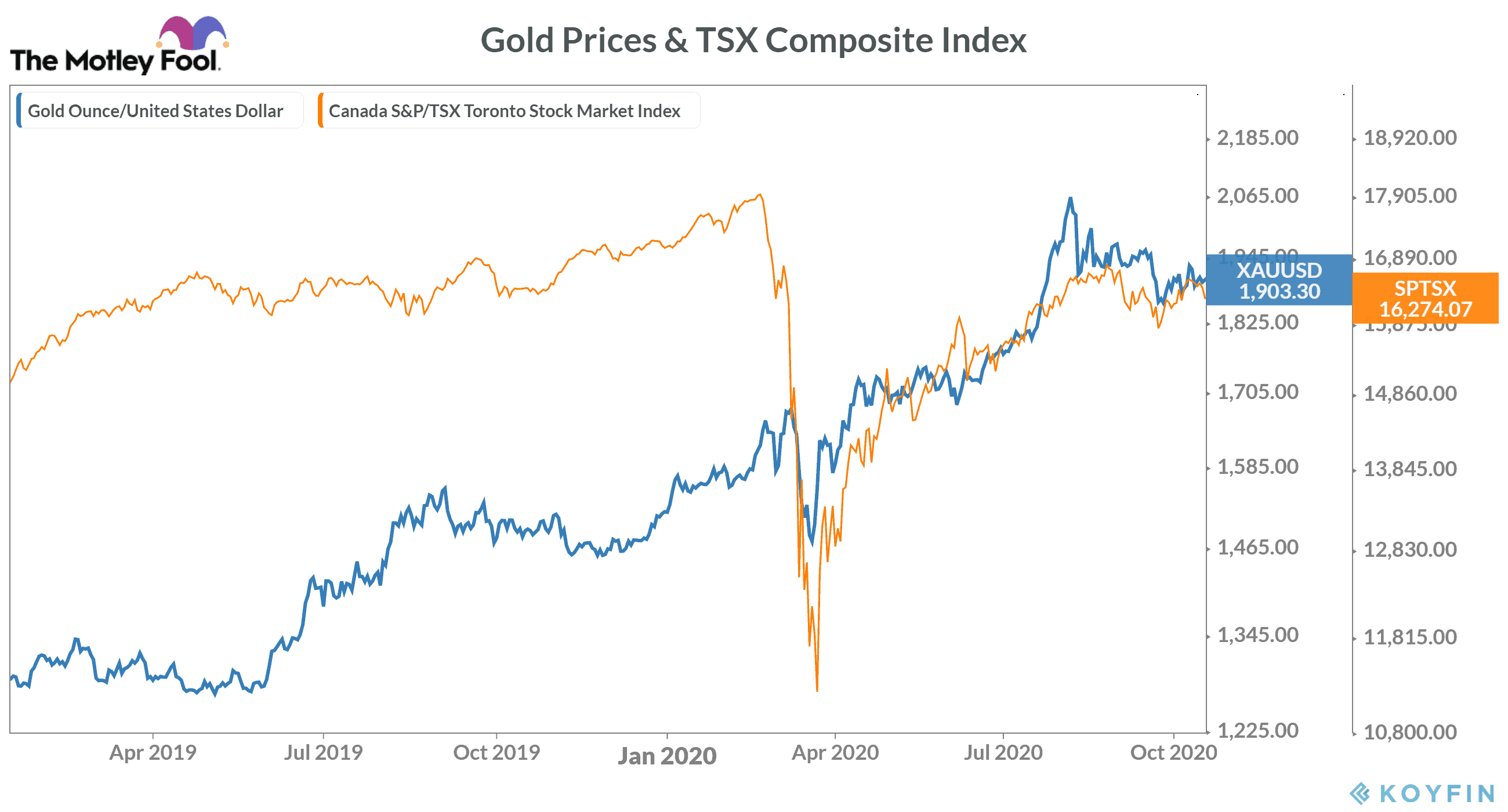

The first half of 2020 was great for gold investors, as the COVID-19 spread across the world prompted investors to invest in the precious metal. In general, investors treat gold and gold-related assets as safe havens in times of uncertainties. That is the key reason why so many investors seemingly found it wise to take refuge in gold earlier this year.

Why Gold prices have fallen

A sudden increase in gold demand kept its price soaring until August. The yellow metal touched its all-time high on August 7. However, the prices have been falling since then. As of October 28, it was trading at $1,870 — about 10% off its record-high levels.

Gold prices could remain weak

In the last few months, many major economies worldwide — including the United States, China, Germany, and Japan — have given major relaxation in the pandemic-related restrictions. While the daily infection rate in many countries like the U.S. is still on the rise, most countries now appear to believe that a complete shutdown could cause irreversible damage to their economies.

Easing restrictions have allowed businesses in these countries to function — contributing to overall economic growth and paving the way for a gradual recovery. Although it’s questionable that these measures would lead to sharp economic recovery, they’re certainly causing a decline in the gold demand that rose suddenly during the lockdown period.

Strengthening U.S. dollar

In the last week, the Dollar Index has risen by about 1.5%. In general, gold prices are inversely correlated with the U.S. dollar. Gold tends to fall if the U.S. dollar strengthens against a basket of major currencies.

The U.S. dollar has recently strengthened, as the Trump administration has failed to approve the much-needed stimulus economic package so far. Now, the expected relief package might even get postponed until the results for the 2020 U.S. presidential elections are out. And as we know, the election results might get a little delayed this time to the counting of mail-in ballots.

Moreover, the expected stimulus package announcement could only give minor and temporary support to already falling gold prices in the coming weeks — I believe.

Here’s what you could do

On October 28, many gold miners such as Kinross Gold (TSX:K)(NYSE:KGC), Iamgold, Teranga Gold, and Eldorado Gold were among the top losers on the TSX. A sell-off in their share triggered a market-wide crash.

Some of these companies, like Kinross Gold, are already in the overbought territory. In the second quarter, its stock rose by 73.5% and extended these gains by adding another 20% in the third quarter. A major decline in gold prices is likely to hurt gold investors’ sentiments and drive gold stocks like Kinross Gold stock lower. On Wednesday alone, Kinross lost about 9.6%.

While we all hope for a sharp economic recovery in the near term, it would still be wise to start preparing for a market crash driven by gold stocks in the near term. The first step in this regard would be to make changes to your stock portfolio by reducing your exposure to gold stocks like Kinross Gold and its peers. Secondly, add some good undervalued stocks from other sectors in your portfolio right now. Doing so would help you to remain largely unaffected by the expected next market crash.