Shopify (TSX:SHOP)(NYSE:SHOP) and Amazon became the ultimate beneficiaries of the pandemic, as the world moved from physical stores to online stores. The first flow of pandemic-driven sales boosted their second-quarter earnings and sent their stocks to new highs. It is time for the two companies to release their third-quarter earnings on October 29. Investors’ expectations from Shopify have inflated to levels where anything less than a 50% year-over-year (YoY) revenue growth is unacceptable. This was its annual growth rate before the pandemic.

In the second quarter, Shopify saw Black Friday-level traffic, as consumers rushed to buy everything from groceries to home essentials on the Shopify platform. And retailers rushed to open new online stores to tap these consumers. At that time, the Shopify platform was not as good as it is now. In the third quarter, Shopify added several new features and services that can help retailers reach out to a larger audience and maximize its revenue from Merchant Solutions.

A lot has changed on the Shopify platform in the third quarter

In the third quarter, the Shopify Plus platform gained more traction, as enterprise merchants continued to shift from a physical store to an online store.

Both Shopify and Lightspeed POS imitated each other. The original Shopify platform mainly targeted retailers and online stores. In the third quarter:

- Shopify added an express theme feature, designed especially for cafes and restaurants.

- It also introduced point-of-sale (POS) hardware and omnichannel solution that can integrate online and in-person shopping experience.

- It adopted multi-currency and multiple language features to expand its geographic reach.

- Shopify launched its Fulfillment Network to handle larger order volumes and cater to more merchants.

- The company also enhanced its marketing features by partnering with Walmart, TikTok, and Google’s YouTube. It will allow merchants to select their ad campaigns and reach out to the audience on these platforms.

The list goes on. All these developments will enhance Shopify’s Gross Merchandise Volume (GMV) and its revenue from Merchant Solutions.

How will the new features impact Shopify’s third-quarter earnings?

Shopify’s third-quarter earnings will reflect three things.

In the second quarter, Shopify saw a 71% sequential increase in new stores, as it extended its free trial from 14 days to 90 days until August 31. The third-quarter earnings will show how many of these free trials convert into paid subscriptions. This will reflect in the monthly recurring revenue (MRR) figure, which has been growing at an average rate of 30% YoY.

Shopify earns around 1.5% commission on the transactions that take place on its platform. The new features would increase its commission on transactions and also the transaction volumes. This will reflect in its Merchant Solutions revenue, which surged 148% YoY in the second quarter on the back of a 119% increase in GMV and 1.7% commission.

All these additional features might take a toll on its profitability. But investors are buying Shopify for revenue growth and not profits. In the second quarter, its revenue surged 97% YoY. The reopening of the economy will take a toll on its pandemic-induced traffic, as people return to brick-and-mortar stores. But Shopify’s omnichannel solutions and enhanced features will encourage more retailers to open online stores on its platform.

How will the stock respond to earnings?

Analysts estimate Shopify’s revenue to surge 68% YoY to $653 million in the third quarter. If the company misses this estimate, the stock could tank. But if it beats the estimate by a high margin and reports another 95% YoY revenue growth, the stock could reach its all-time high of $1,502 for a brief moment.

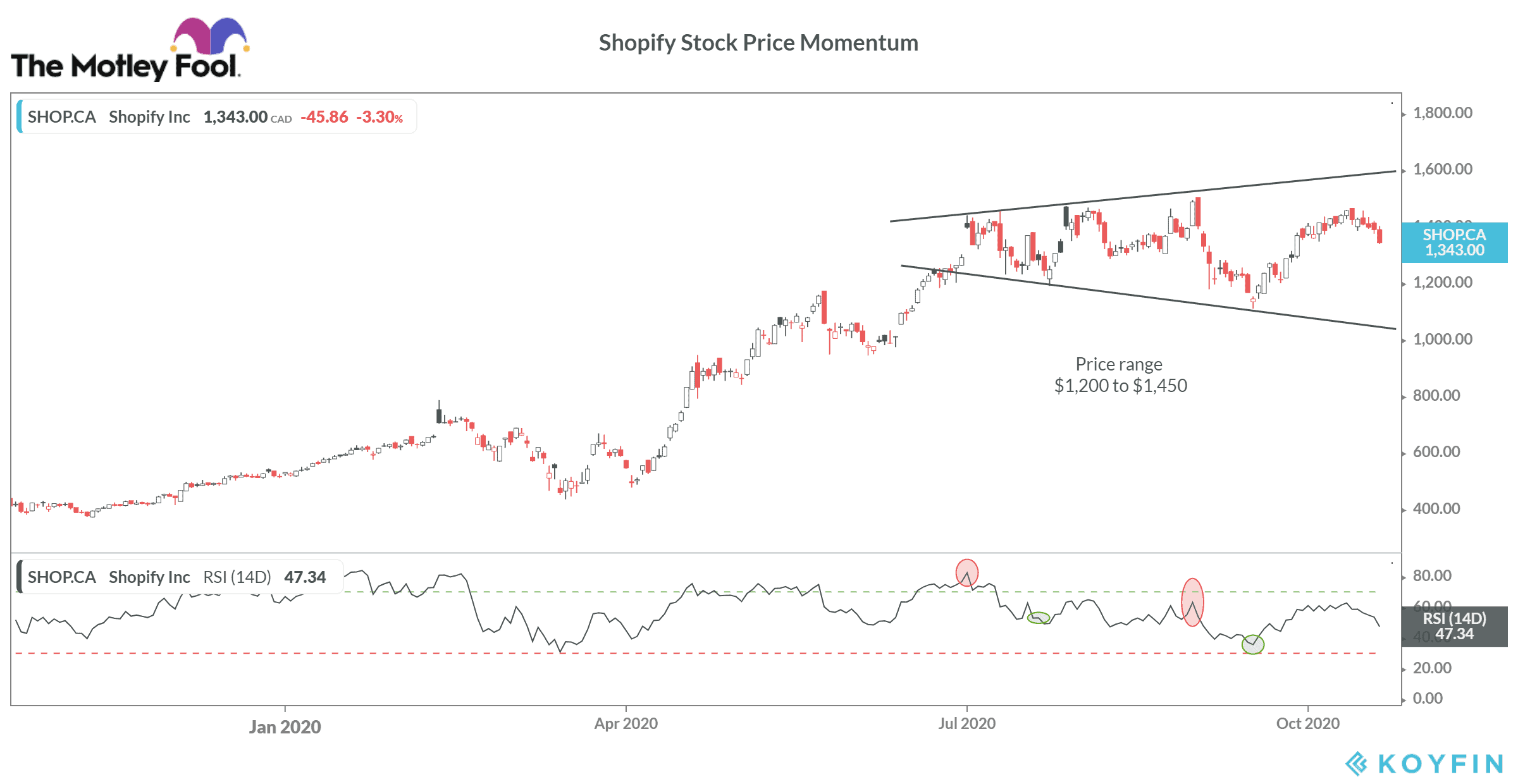

If Shopify stock tanks post-earnings and falls below $1,250, buy the stock, as the company has strong growth potential in the long term. If the stock surges past $1,450, sell the stock, as it won’t stay there for a long time. This is the price range the stock has been trading since July. It has been forming a megaphone trend, and the way to profit from this trend is leveraging the low and high end of the price range.