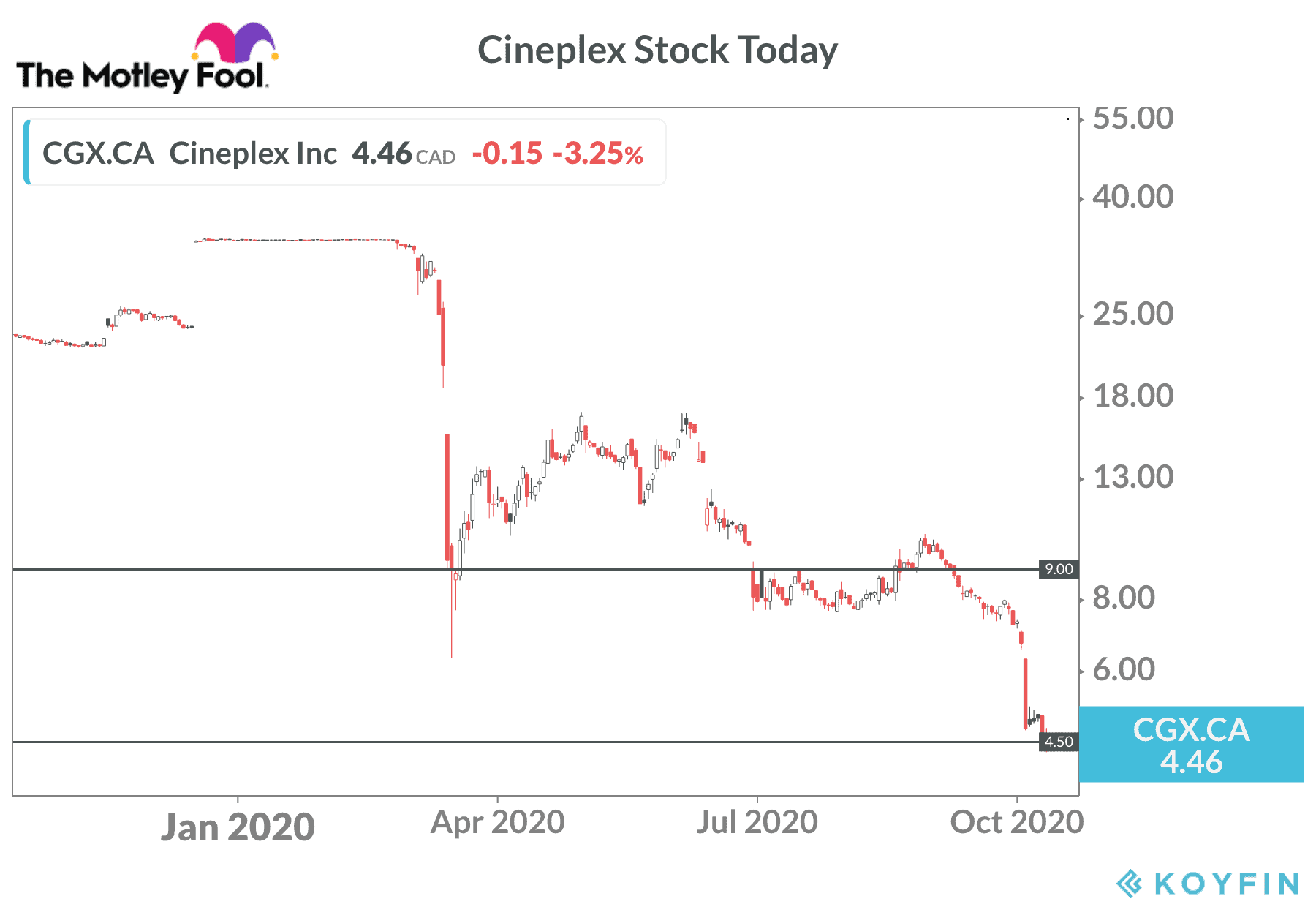

Cineplex (TSX:CGX) started 2020 above $30 per share. Today, the stock trades close to $4.50. The crash is one of the worst in the TSX Index due to COVID-19, and investors are wondering if Cineplex stock is cheap today.

Cineplex stock risks

Holders of Cineplex stock got a nasty reminder last week that cheap stocks can get much cheaper. Cineplex dropped nearly 30% on October 5 after U.K.-based Cineworld said it would temporarily close all of its movie theatres in the United States and the U.K.

Interestingly, Cineworld had agreed to buy Cineplex late last year. The announcement in December sent Cineplex stock soaring from $24 to $34 per share. Unfortunately, the pandemic lockdowns and subsequent social-distancing measures hammered revenues across the industry.

Cineworld backed out of the deal in June.

Empty seats and new lockdowns continue to hurt Cineplex and its stock price. The company has 164 theatres across the country. Cineplex had just reopened all of its locations when the latest wave of COVID-19 started. In the past two weeks, Ontario and Quebec ordered the closure of theatres in large cities, including Montreal, Ottawa, and Toronto.

Film studios are pouring gasoline on the fire. Several have delayed major film releases due to the pandemic. Others decided to skip theatres and went straight to a release on streaming services. Without blockbuster movies to attract film fans, it doesn’t really matter if the theatres are open.

Disney sent shock waves across the industry when it released Mulan directly on its streaming service. The film giant says streaming is a priority going forward and intends to boost investment in the service.

Cinemas will still give the studios a way to get in front of global audiences that don’t have access to adequate internet or choose not to subscribe. However, the prospects for cutting out the middleman are appealing, especially if companies like Disney scale up the streaming business to the point where it makes more sense to simply bypass the theatres with certain films.

Opportunity

Predictions of the death of the theatre experience might be overdone. People like getting out of their homes and going to see a film on the big screen. It is also an excuse to treat the family to a night out and munch away on popcorn, oversized chocolate bars, and sodas.

COVID-19 vaccines should arrive by the middle of 2021. This could set up a strong summer season for theatres and big movie releases. Streaming remains a threat, but the studios still have an incentive to work with Cineplex and its peers.

A new takeover offer could emerge for Cineplex in the coming months. Venture capital could swoop in to take the company private for a few years and then go public again once the industry recovers.

One of the streaming giants could also decide the stock offers good long-term returns. Concessions offer high-margin sales and a studio with significant content offerings and millions of Canadian subscribers could use the theatres to showcase popular movies or other TV content and drive additional revenue.

In that scenario, it wouldn’t be a surprise to see Cineplex stock double off the current price.

Should you buy Cineplex now?

The October 5th plunge shows the risks of trying to catch a falling knife.

However, the upside potential is significant if Cineplex can get through the pandemic. If you think a rebound is on the way next year, it might be worthwhile to start nibbling on Cineplex stock near today’s price.