Canadians are in the midst of another wave of the coronavirus. Businesses may be open, but there are still many struggles to be had. In fact, with another set of quarterly reports coming out this month and into November, investors should be prepared for another stock market crash.

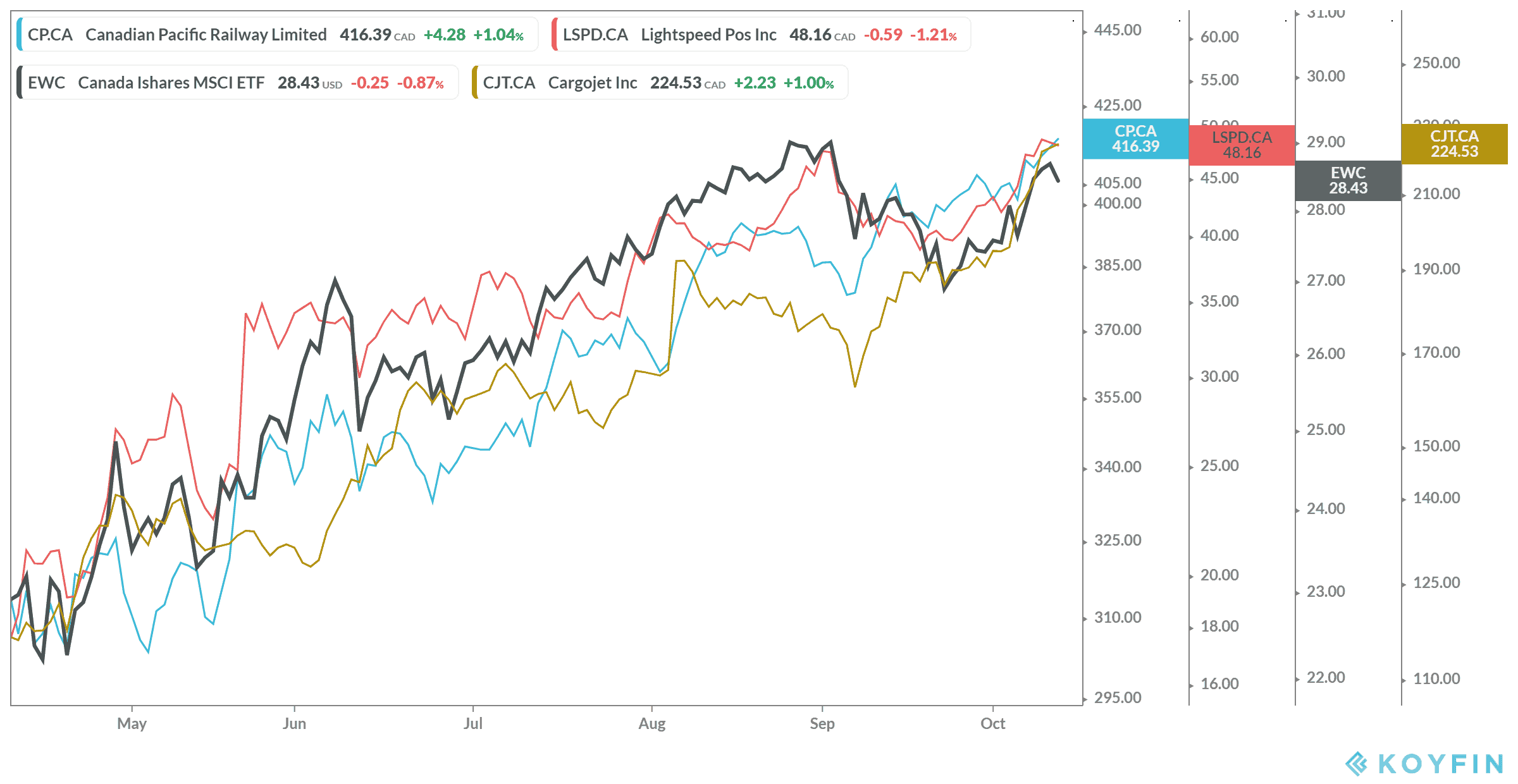

Except, of course if you’ve invested in stocks that seem to continue to outpace the markets. In this case, that’s why I’m looking at Cargojet Inc. (TSX:CJT), Lightspeed POS Inc. (TSX:LSPD)(NYSE:LSPD) and Canadian Pacific Railway Ltd. (TSX:CP)(NYSE:CP). Let’s look at the reason why.

CP Rail

One of the safest and most stable stocks out there, you can best CP Rail will continue tracking upwards. The stock went through a major overhaul in 2012. It reinvested in its infrastructure, and got rid of inefficiencies. Now, its tracks run better than ever. Revenue has been climbing, and you can bet it’ll remain safe.

That’s due to two reasons. First, CP Rail has a diversified portfolio of what can use the rail, from grain to lumber, gas and cars, and everything between. So when one area is down, another picks it up. Second, the company is part of a duopoly in railway for Canada. It would be incredibly costly for another business to enter rail, making CP likely to be around for decades, if not hundreds of years more. Meanwhile, revenue shrank but is now heading in the right direction. So don’t be fooled by this company’s all-time highs, it can keep going higher.

Lightspeed

If there’s any business doing well during the pandemic, it’s point-of-sale services. Lightspeed offers this service around the world, and it still in major growth mode. The company has focused in on retail and restaurants in the small and medium range, but could expand at any time. This would bring in even more revenue, not that that’s a problem.

Lightspeed has seen revenue grow year over year by 58% in the last quarter, over 50% over the last three consecutive quarters. This is likely to continue, especially since coming onto the New York Stock Exchange this quarter. Investors again would be buying all-time highs, but that’s likely to soar even higher in the coming months once the markets turnaround. Especially now that retail and restaurant businesses have opened up once again.

Cargojet

Finally, Cargojet is a winner for any investor looking to take advantage of e-commerce and the work-from-home economy. The company was doing well already, making some big moves in 2018 and 2019 that would mean revenue coming in for years to come. However, the pandemic sent the need for business and personal items into overdrive.

Cargojet may be climbing high now, but it’s unlikely to fall any time soon. Basically, the company has shown what it can do, and will continue to grow because of it. The company went from year-over-year growth in revenue of 7% to a whopping 21% in the last two consecutive quarters. It’s likely to continue making these strides now and years from now with the growth of e-commerce.

Bottom line

If you’re looking for stocks that will continue to outpace the markets even during another crash, look no further. These stocks may be at all-time highs, but that’s not going to end any time soon. They each provide a necessary service, especially in this new world of ours. So I would recommend any of them be added to your watch list.