Canada celebrated the Thanksgiving Day on October 12. But the ongoing pandemic and rising unemployment rate made Thanksgiving Day 2020 not worth celebrating for many. If you’re one of those lucky ones who didn’t lose your job, the fear of losing it still looms, as the second wave of COVID-19 is raising the uncertainties for businesses. These uncertainties may force companies to cut jobs further. And there’s not much you can do about it.

However, investing in some good stocks right now is one step you can take to ensure that you have a great Thanksgiving Day next year. Let’s take a closer look at one such really cheap stock to buy right now.

Buy this TSX stock on Thanksgiving Day 2020

The pandemic that started in China’s Hubei province changed the lifestyle of almost everyone across the world earlier this year. The virus forced nations to impose strict shutdowns as a measure to slow its spread in March. But a large number of businesses had to pay dearly for these safety measures. Some of these businesses are on the verge of collapsing.

Cineplex (TSX:CGX) — the largest movie theatre operator in Canada — has been one of the worst affected businesses by the coronavirus. On March 16, the entertainment company had to temporarily close its nationwide network of theatres and location-based entertainment venues. It wasn’t until mid-August that Cineplex managed to reopen all its theatres in the country.

After looking at these negative impacts of the COVID-19 on Cineplex’s business, you wouldn’t want to invest your money in its stock. But let me give you some key reasons why you must consider buying its stock right now.

Cineplex stock is heavily undervalued

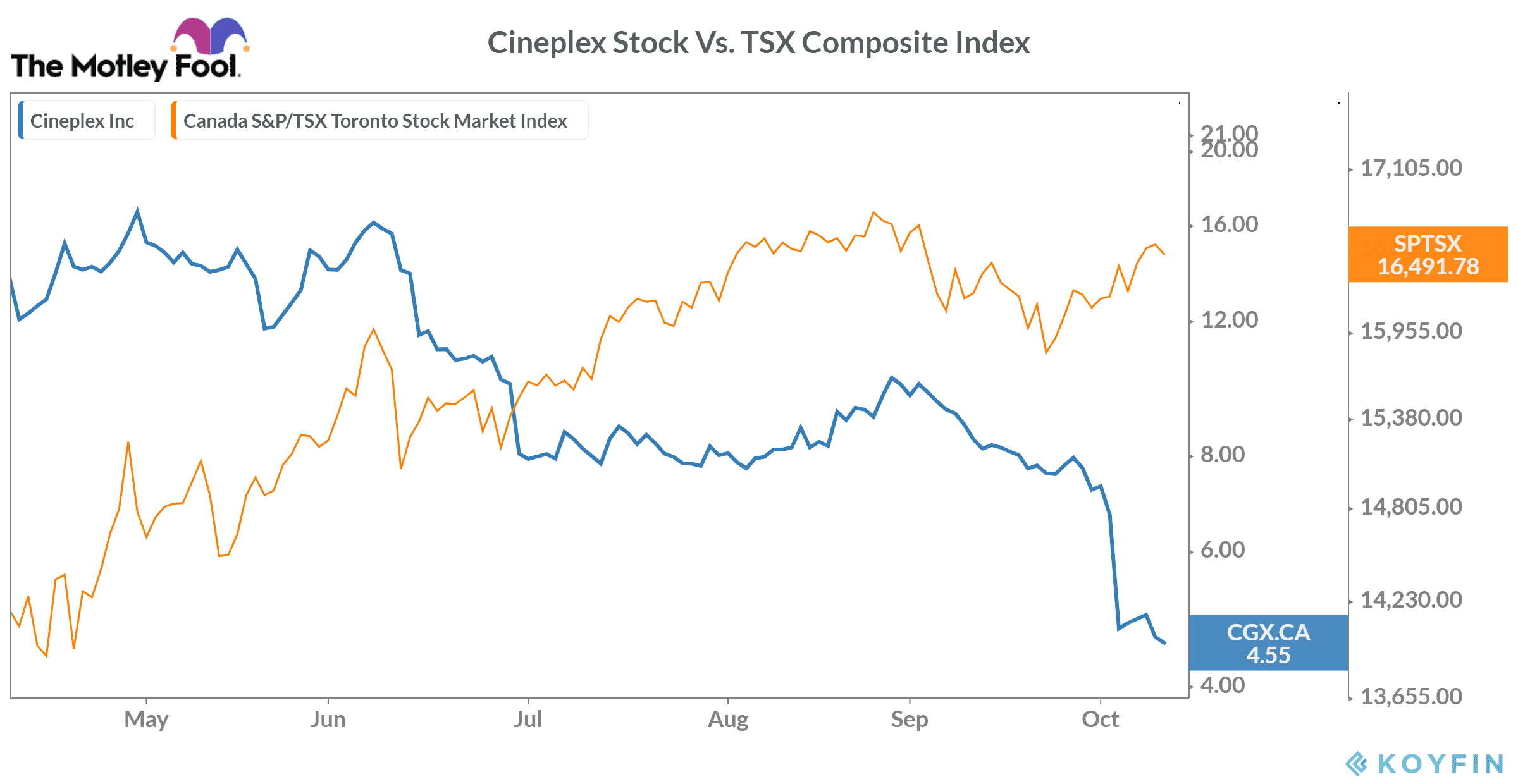

Last week, Cineplex stock tanked by 31%. These massive weekly losses came after the London-based cinema chain Cineworld announced its theaters’ temporary closure in the U.K., the U.S., and Ireland. Cineworld, which is the world’s second-largest cinema chain, blamed “ongoing theatrical calendar delays and the continued closure of New York and other key U.S. markets” for its decision to close theatres. The news sent a shockwave through leisure industry investors — triggering a sell-off in Cineplex stock.

As of October 13, Cineplex has lost over 86% in 2020 so far. The pandemic-related uncertainties have taken a heavy toll on investors’ sentiments — resulting in these massive losses.

Nonetheless, investors currently seem to be ignoring the fact that people’s love for cinema hasn’t died due to the pandemic. By September 23, 1.5 million people returned to Cineplex theatres and entertainment venues since its coast-to-coast reopening. Since July 1, moviegoers consumed over 460 million kernels of popcorn, 16 million fluid ounces of fountain pop, and about 60,000 hotdogs at Cineplex, the company said in a press release.

This data reflects the potential for a sharp recovery in Cineplex’s business as soon as the ongoing pandemic subsides in the coming months or quarters. A coronavirus vaccine arrival in the market could trigger a buying spree in Cineplex stock. That’s one reason why I believe if you buy Cineplex stock around Thanksgiving Day this year; it has the potential to double or even triple your invested capital by Thanksgiving Day in 2021.