Canadians need every penny they can gather these days. A volatile market and enormous economic downturn were enough to cause Canadians to want to dig through the couch cushions. But add on a pandemic, one that has put the unemployment rate at 10.2%, and you’ve got serious trouble.

Even though tax season is now behind us, it’s a good idea to look for any way that you can bring down your tax burden. You don’t want to bring in cash that you’ll be subject to pay taxes on later down the line. You need that cash now! Here’s what you do.

Open a TFSA

Look, I’m sure many of you have heard of the Tax-Free Savings Account (TFSA), but it’s amazing how many of you don’t actually have one. In fact, just under half of Canadians don’t have a TFSA, and that needs to change. There are about 69% of Canadians who have a TFSA, or about 20 million. Even among those that do, they aren’t taking full advantage of this amazing savings account.

The main benefit, of course, is that it’s tax free. The Canadian government started the program back in 2009 to get Canadians investing in Canadian companies. While they could tax you for your investment portfolio, it’s way better for the government to tax a large company. The more investors that company has, the larger it grows, and the more tax it has to pay. Win, win, win.

The original contribution room has grown by leaps and bounds, where today the total tax-free contribution room you’re allowed is $69,500. Yet most Canadians use almost a third of that room! The average Canadian only keeps about $22,000 in that TFSA.

Why do you want to max out your TFSA? Well, if you invest properly, even conservative growth could create an enormous portfolio. Let’s say you maxed out every year on your contribution limit and you saw a very conservative 6% growth per year. That would mean your $69,500 portfolio would be worth over $85,000 today!

So, what stock?

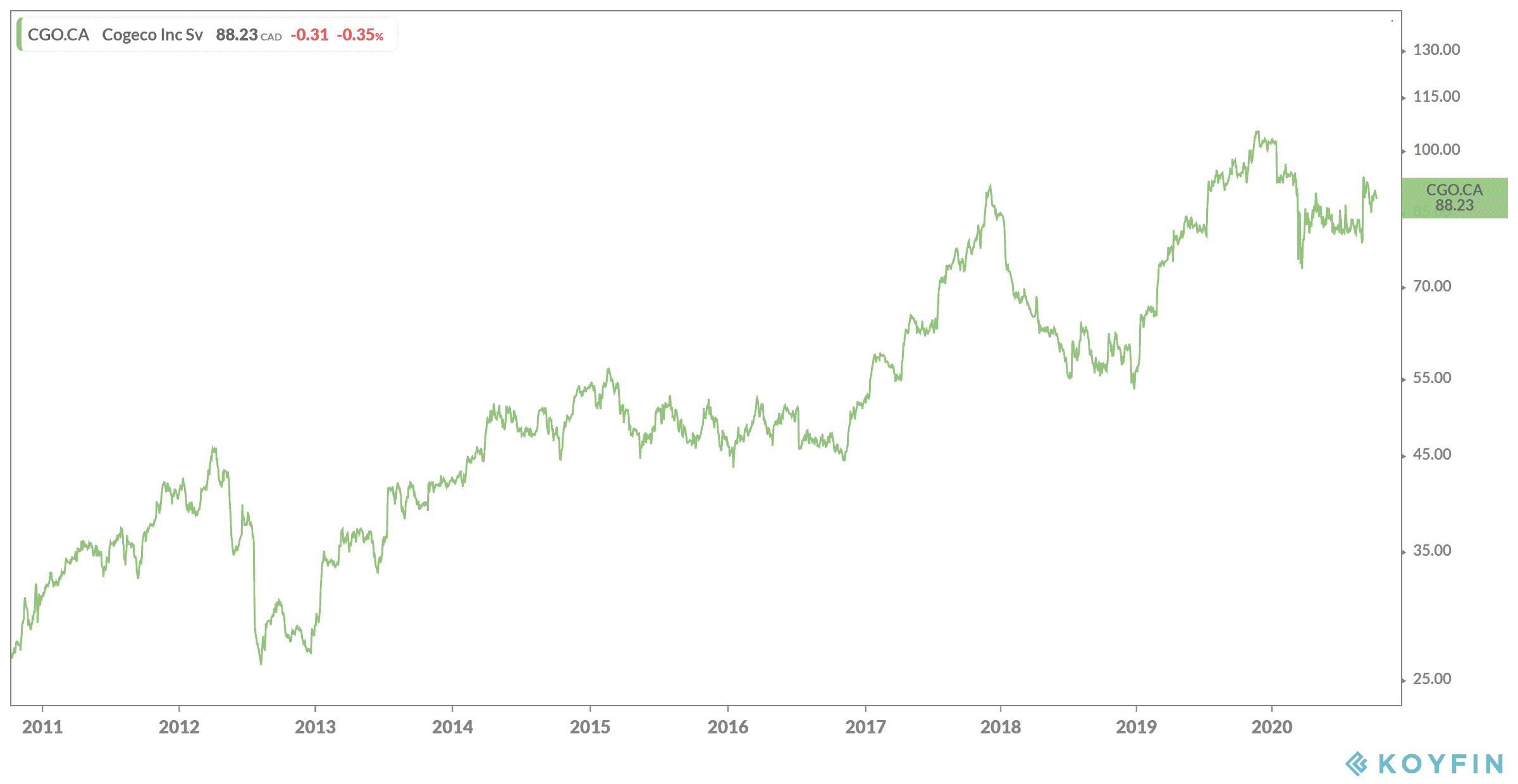

As I mentioned, if you’re new to opening a TFSA, then it may be worth going conservative to start. There are a few companies in Canada that provide conservative growth but also stability. One such stock is Cogeco (TSX:CGO). The company operates communications and media in Canada and the United States. It provides telecommunication services along with news and radio agencies.

Unlike many other places in the world, there are far fewer telecommunications businesses doing well in Canada. Cogeco is one of them. The company remains strong, seeing stable year-over-year revenue growth of 1.6% during the last quarter, even during the downturn. Its compound annual growth rate (CAGR) for the last decade has been an incredible 12.59%! Double the conservative estimate I gave you.

So, if you were to invest just half of your TFSA today and leave it for another decade, your original investment of $34.750 could be worth an incredible $147,657.81 with funds reinvested at today’s numbers! And all of that is completely tax free.

Bottom line

I know you have to pay bills and put money aside. But before you just leave your cash at the hands of the government, you should consider putting away whatever you can into your TFSA. That money will be kept completely safe from the tax man and ready for your use whenever you need it.