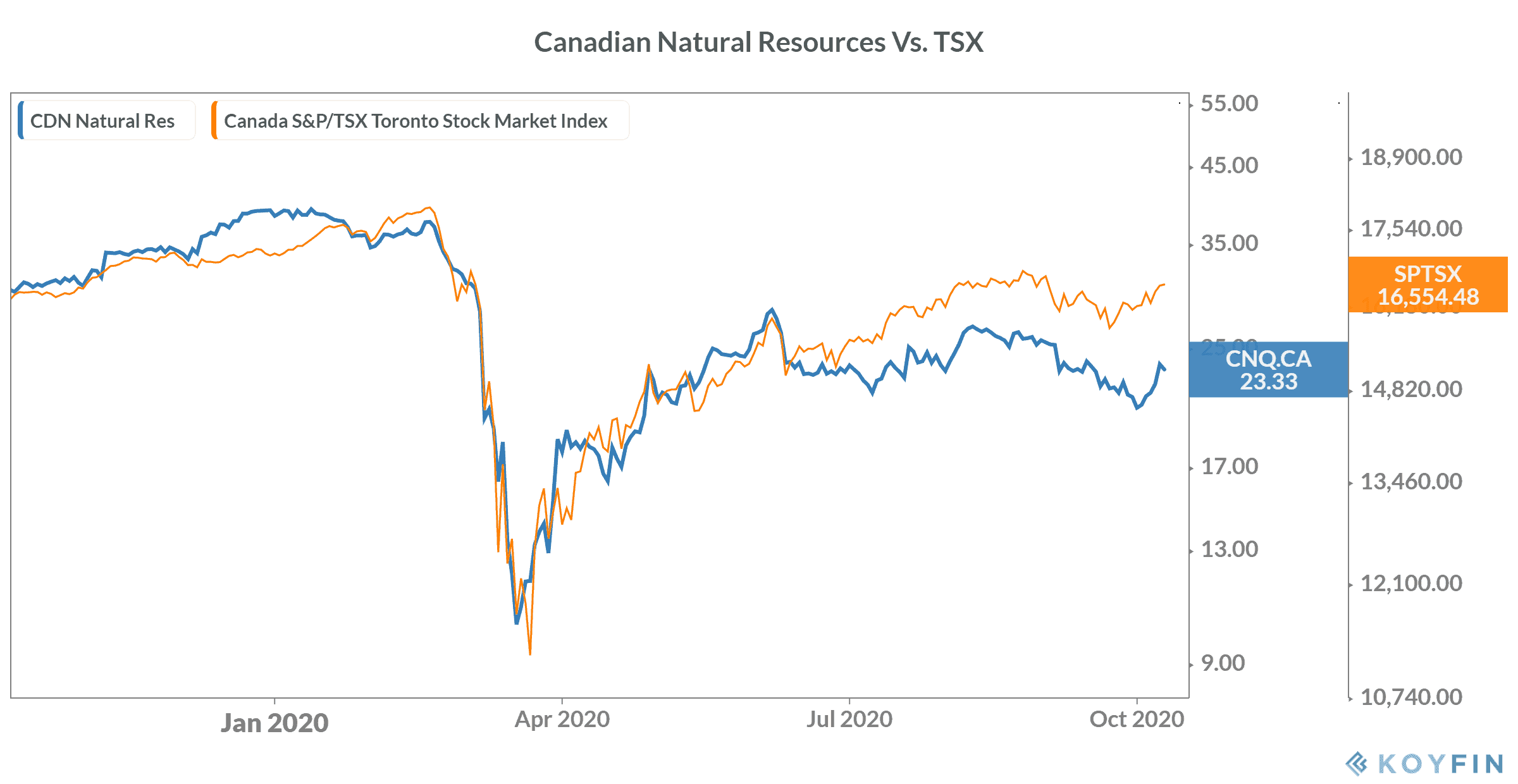

The Canadian stocks continued to inch up for the second consecutive week in October. In the last five days, the shares of Calgary-based energy firm Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) have risen by more than 15%. During the same period, the S&P/TSX60 Index rose by only 2.3%.

Earlier this week, the company completed the acquisition of Painted Pony Energy — the Canadian natural gas producer. This acquisition is likely to help Canadian Natural expand its business operations in the natural gas segment by using Painted Pony’s existing infrastructure and transportation system.

CNQ is one of few TSX companies that offers an over 7% dividend yield to shareholders.

Canadian Natural Resources acquires Painted Pony Energy

Canadian Natural Resources currently operates in Western Canada, the U.K. portion of the North Sea, and offshore Africa. North America is the largest among all the regions where Canadian Natural Resources is engaged in exploration and production.

The company entered a definitive agreement with Painted Pony Energy on August 10, which at the time, had total debt of about $350 million. Back then, CNQ claimed in a press release that the acquisition would not affect its balance sheet’s strength, as the deal is only worth about 1% of its enterprise value.

COVID-19 impact on energy stocks

The COVID-19 pandemic wreaked havoc on the overall energy sector earlier this year as the oil prices nosedived. This triggered a massive sell-off in most of the energy companies’ shares. That’s why energy companies, including Canadian Natural Resources, are trading with massive year-to-date losses. It has lost nearly 43.5% in 2020.

During the same period, other energy companies such as Imperial Oil, Suncor Energy, Enbridge, and Inter Pipeline have seen 51%, 60%, 23%, and 41% value erosion, respectively.

CNQ’s recent financials

In the second quarter, Canadian Natural Resources reported a massive 48% year-over-year decline in its revenue to $2.9 billion after reporting a 14% drop in the previous quarter. In Q2, the company’s adjusted EBITDA margin shrunk to 19.6% from a solid 52.2% a year ago.

Lower energy products’ demand — due to the pandemic — played a key role in hurting its profitability in the first half of 2020.

Could the deal strengthen CNQ’s fundamentals further?

The energy market situation has significantly improved in the last few months as the economic reopening across the world has led to a recovery in the oil and natural gas demand. U.S. West Texas Intermediate oil currently is trading at $41.20 per barrel — much higher than its lowest level is in April 2020. Similarly, natural gas prices have risen by over 80% in the last four months. The rising demand for oil and natural gas is fueling this price rally.

Higher prices for energy products are likely to help Canadian Natural Resources significantly improve its profitability on a sequential basis in the coming quarters.

Foolish takeaway

Currently, Canadian Natural Resources’ EV-to-EBITDA multiple is at 7.8x — much higher than the industry average. Its price to cash flow is 5.0x, also higher than other energy companies.

Nonetheless, rising oil and gas prices are likely to boost investors’ confidence in the near term, I believe. Also, CNQ’s recent acquisition of Painted Pony Energy should add optimism and drive its stock higher in the coming months. These factors make Canadian Natural Resources stock a good buy right now.