The whole purpose of a Tax-Free Savings Account (TFSA) is to earn income, tax free. You might be wondering how it’s even possible to earn income that, through a TFSA, would be subject to taxes?

Unfortunately, there are a number of easy mistakes that Canadians can make that would mean they need to pay up. I’ll go over just a few common ones. For instance, if you invest in a foreign stock, that automatically makes you subject to tax on any of the returns. This goes against the spirit of the TFSA; the government wants Canadians to invest in local businesses. As those businesses grow, the taxes from those companies would far exceed the taxes you’d pay on returns. However, when you invest in the United States, for example, nobody wins.

Another common mistake is using your TFSA like a business. This can come down to two problems. Let’s say you use your TFSA contribution room of $69,500 and manage to grow your portfolio to over $250,000 since the TFSA’s creation in 2009. That $250,000 point seems to be when the Canada Revenue Agency (CRA) gets interested. Suddenly, you seem to know more than you let on, and this could cause the CRA to tax you as a business.

Another way you could be taxed as a business is if you trade too often. There are those that think they can figure out something like day trading, but this isn’t how a TFSA should be used. Instead, it should be long-term holds that help out Canadian businesses.

So, how can you use the TFSA to create massive income? I’ll tell you.

Dividends and e-commerce

What you need to do is find a company that is outpacing the markets and that offers solid dividends that should continue to grow. In that case, you need to find during the current volatile market a dividend producer involved in e-commerce. E-commerce was predicted to grow by leaps and bounds before the pandemic. However, the pandemic supercharged the industry. Companies that were slowly growing soared overnight.

While you could look for large returns from these e-commerce companies, those that offer dividends have a more stable approach. E-commerce companies also need to store and ship products. So, that means any place that operates properties involved with e-commerce look especially appealing.

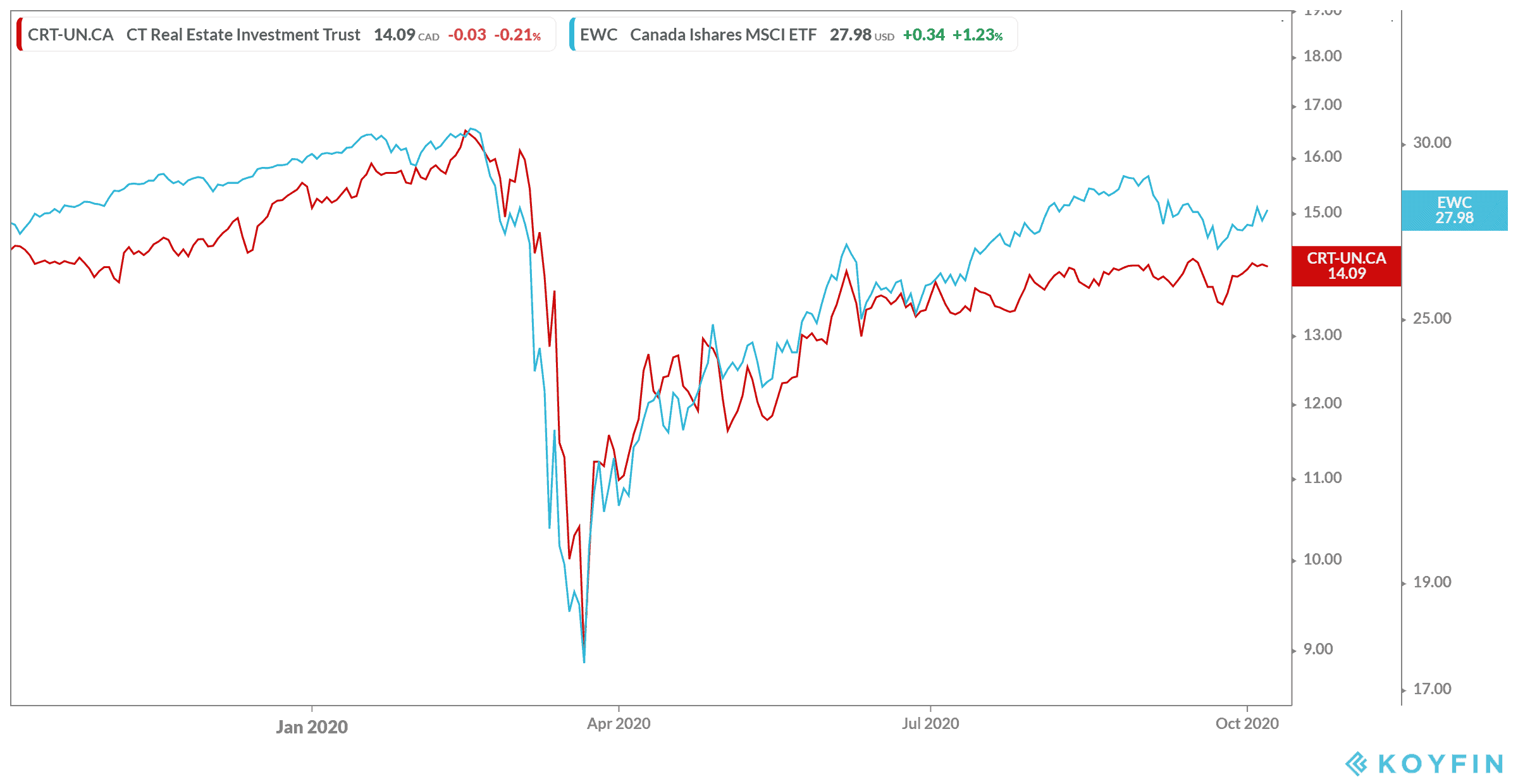

Such an example is the CT REIT (TSX:CRT.UN). This real estate investment trust gets most of its lease and rental revenue from its Canadian Tire (TSX:CTC.A) properties. Canadian Tire was one of the first large businesses to offer curbside delivery for its products at its 350 locations. It has also seen an increase in revenue, thanks to its booming e-commerce business. While there was a dip in the first quarter, the second quarter saw an increase in revenue. In fact, year-over-year revenue growth remained stable at 3.6% for the last several quarters. Meanwhile, CT REIT continues to outpace the markets, as you can see below.

Since Canadian Tire remains strong, it means its property owners can continue to pay rent. In fact, CT REIT announced during its latest earnings report that occupancy remained at an incredible 99.3%. Given that its next earnings come out Nov. 2, 2020, you might want to grab this stock before it grows yet again. It’s currently only down 1.84% from last year and has a five-year return of almost 40% as of writing.

Since Canadian Tire remains strong, it means its property owners can continue to pay rent. In fact, CT REIT announced during its latest earnings report that occupancy remained at an incredible 99.3%. Given that its next earnings come out Nov. 2, 2020, you might want to grab this stock before it grows yet again. It’s currently only down 1.84% from last year and has a five-year return of almost 40% as of writing.

Bottom line

So, how do you bring in that huge income? As of writing, CT REIT has a share price of $14. If you were to use just half of your TFSA contribution room to diversify with the remainder, you could bring in $1,985.71 in annual dividends from this stock alone. That dividend should continue to increase, as the company has a compound annual growth rate of 3.4% during the last five years.