You may have heard the term bear market thrown around a lot this past year. You also may have read that this has meant there are tons of opportunities to make a lot of money during the economic downturn. But is that really how it works?

Today, I’m going to take a look at what exactly a bear market is. Then, we’ll discuss a bit of how to navigate the bear market. I use the word navigate because you may not be able to take “advantage” of a bear market. You simply need to be careful during this time. As you’ve likely seen, the recent market crashes have created a volatile market place. So, knowing how to navigate this bear market is the best way that you can come out the other end with some money in your portfolio.

So, let’s dig in.

What is a bear market?

You may think that a bear market is just a recession, but that’s not necessarily the case. A bear market is when a market experiences price declines for a prolonged period of time. The main definition is that the markets fall by about 20% in share price or more from its recent highs. This usually comes from negative investor sentiments and pessimism in the market place.

A bear market is also usually accompanied by the same percentage decline in the overall market or index, such as the TSX Composite. However, individual stocks alone can be considered in a bear market if they reach that 20% mark for a prolonged period of two months or more. And, of course, they can also go along with a recession.

So, are we in a bear market right now? Absolutely. There were two events that caused today’s bear market. First, there was the prediction of a recession by economists thanks to governments taking on immense debt, coupled with the oil and gas crisis. Then, there, of course, was the COVID-19 pandemic, which sent markets crashing through future uncertainty.

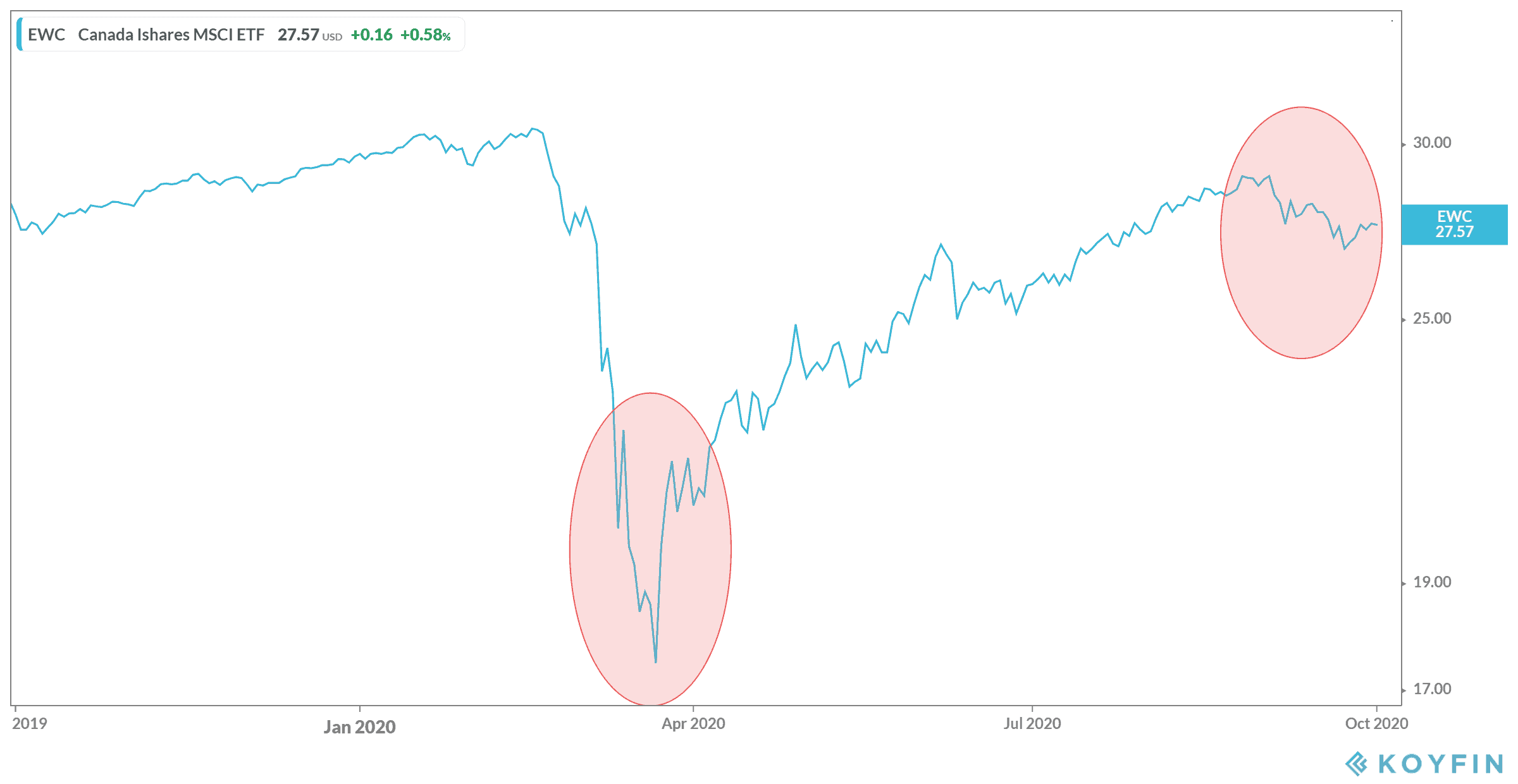

As you can see below, the Canadian market fell by almost 40% during the crash and may be going through another crash yet again in the last month. This could be triggered by another wave of the pandemic. The bear market could continue in this fashion until we find a vaccine, and government debt is reduced. Bear markets have no real end date. They can last a couple months to a couple years or even decades.

Is it worth the risk?

Here’s what you have to consider with bear markets: longevity. You shouldn’t be looking to make an overnight killing during a bear market. As I mentioned, bear markets are volatile. What goes up could come down yet again. So, trying to make quick cash should never be your tactic.

Instead, take a lesson from billionaire investor Warren Buffett and look for securities that offer long-term growth. You want to find companies that will be needed years, even decades from now. So, you could make an incredible amount buying during a bear market if you have the patience to hold onto the stock for years, even decades to come.

A great example are utility companies like Algonquin Power & Utilities (TSX:AQN)(NYSE:AQN). The company stock price is down, but there really isn’t a reason for it besides bear market fear and herding. The company will be necessary now and decades from now, providing the means to keep the lights on. Meanwhile, it’s investing in clean energy solutions for when clean energy projects take the place of oil and gas. It’s definitely a great long-term option.

Just looking at the company’s history gives you an idea of its future. Algonquin has a 10-year compound annual growth rate (CAGR) of 21% as of writing and a five-year return of 159%. You’ll also receive a 4.33% dividend yield you can use to reinvest. So, yes, you can definitely look for opportunities during a bear market. But use those opportunities for a long-term hold, not a quick cash grab.