Investing is all about timing. Buying shares at the right time means you could see an enormous return in your initial investment, even during a short period of time. This is the ideal scenario. But how on earth are you supposed to know when exactly that would be?

It all comes down to trade signals. There are practically an infinite number of trade signals that experienced economists have identified. These trade signals can tell you when a stock will jump or fall, and even by how much based on the criteria. But should you be that invested in trade signals? Let’s dig in and take a look.

Common trade signals

As I said, there are a number of trade signals out there, but I’m only going to cover the most common types here — and only briefly. The trade signals you’ve likely heard of are connected to events, such as if a company makes headlines (good or bad), or when earnings reports come out. There’s also trend trading, which links the share price to the industry as a whole. Think cannabis stocks in 2018.

Beyond these indicators, there are five technical indicators traders look for on a very basic level. There are trend indicators that simply look at whether the market is moving up, down or sideways over time. There are mean reversion indicators that look at the mean share price based on recent movement.

There are also relative strength indicators, which looks at the price wave that could put pressure to buy or sell. There’s momentum indicators, evaluating the speed at which a price changes, and finally volume indicators, looking at trades and seeing whether bears or bulls are controlling the price changes.

Which is best?

Honestly? None of them. Not if you aren’t an experienced trader who knows exactly what you’re looking for. You can try to latch on to a trend. You can try and time a market bottom. You can dig into these trend indicators and hope you’ve got it right. But that is filled with incredible risk.

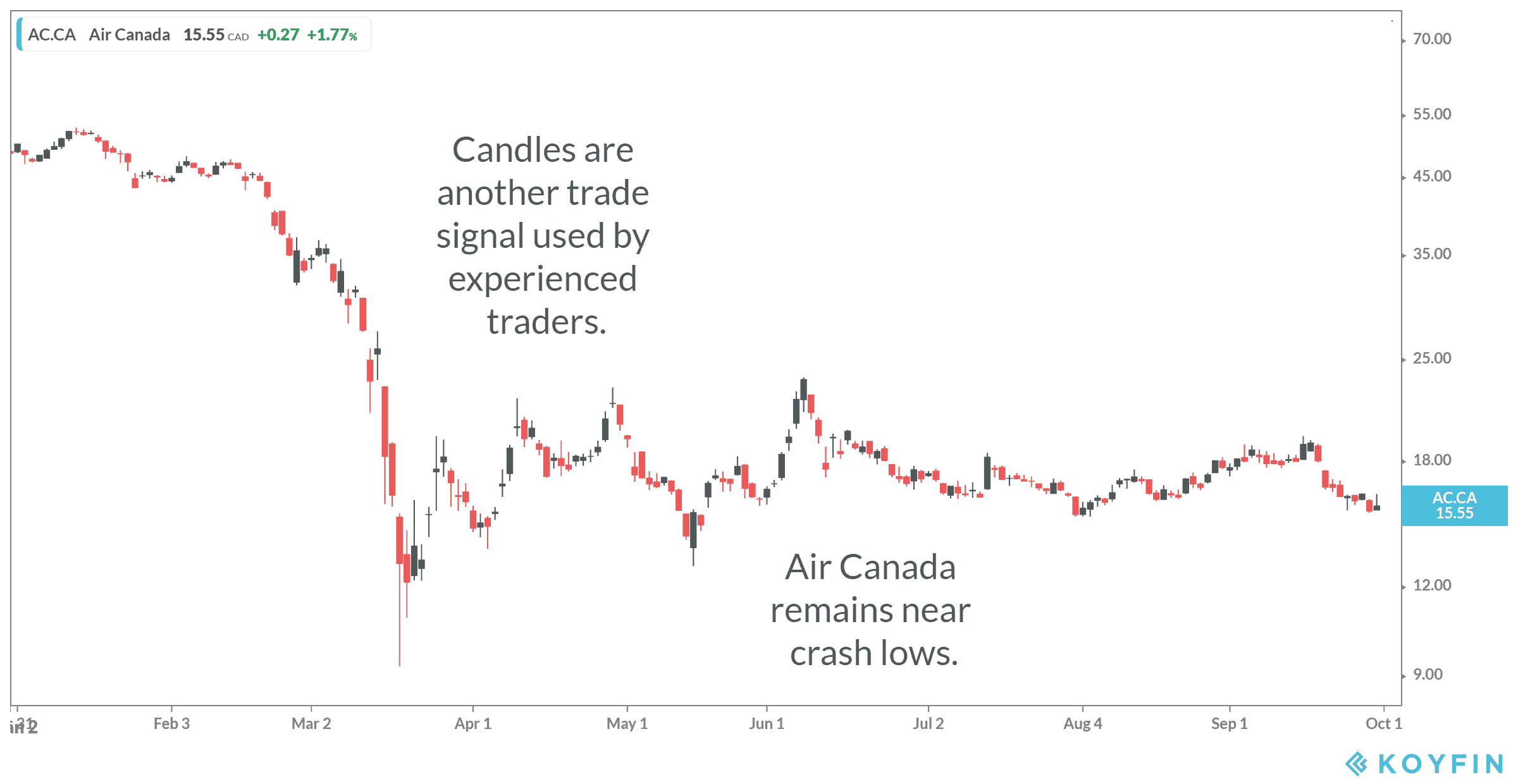

For example, many investors are looking at Air Canada (TSX:AC) thinking it should grow in the next several years by leaps and bounds. That’s because the pandemic (making those bad headlines) has sent shares plummeting. Fair enough. But there is a great deal of technical analysis that goes into deciding whether to buy or sell a stock.

Air Canada will need as long as a decade to rebound from this pandemic — and that’s if a vaccine is created imminently and the company starts making real money again. Unfortunately, that’s doubtful.

Rather, investors should create their own trade signal. There is only one indicator in this case that you need to consider, and that’s price. This can work in two ways. First of all, if you buy up a stock, see it rise steadily, and then notice a dip, it might be time to buy up more of this stock that has performed so well for you.

Another price you want to consider is when you want to sell. If you’ve reached a point where you’ve gotten what you came for from this stock, then take your earnings.

Bottom line

Don’t try and time the markets. Don’t try and think you’ve got it figured out. You don’t. No one does. The market is an unpredictable place (clearly given today’s situation). Instead, the best strategy you can do is buy for a long-term hold, reinvesting when it seems prudent to do so. Beyond that, stick with strong stocks and move steadily towards your ultimate goal.