As a shareholder of both Air Canada (TSX:AC) stock and Suncor Energy (TSX:SU)(NYSE:SU) stock, I can tell you that it hasn’t been easy being invested in either this year.

This is despite the fact that my average prices per share are relatively low against the stocks’ highs.

The stocks have above-average volatility. Air Canada stock’s recent beta is 1.99, while Suncor stock’s recent beta is 1.63, which implies they’re roughly two times and 1.6 times more volatile than the market.

Year to date, since the onset of the pandemic, both stocks have fallen more than 60% — greatly underperforming the 4% decline in the Canadian market.

Data by YCharts. The year-to-date price action comparison of the Canadian stock market, Air Canada stock, and Suncor stock.

Outperform with Air Canada stock and Suncor stock

If you just observe the price action of the stocks this year, it’s impossible to imagine that they can outperform.

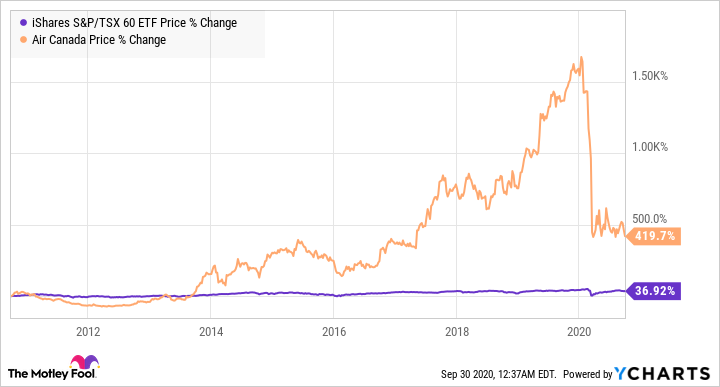

Airline stocks can do really well in a booming economy. Air Canada stock can be a super winner, as shown in the 10-year chart below. Particularly, from 2015 to 2019, the stock was a four-bagger, delivering annualized returns of about 32.5% per year.

Data by YCharts. Air Canada stock’s 10-year price chart compared to the Canadian market.

Suncor stock has had its ups and downs. In the last 10 years, you can see that the stock has been much more volatile than the Canadian market with higher highs and lower lows that correspond to the movements of the market.

Data by YCharts. Suncor stock’s 10-year price chart compared to the Canadian market.

Investors must follow Suncor stock closely to aim to buy low and sell high. If investors got really lucky, they could have traded the stock a few times in the past 10 years for price gains of 50-75% each time while, in the interim, collecting dividend income from Suncor.

Suncor stock cut its quarterly dividend by 55% in May. However, the stock price has also gone down a lot. So, the stock yields almost 5.1% currently.

Since the long-term average market rate of return is about 7%, investors can potentially outperform by investing in Air Canada stock and Suncor stock. However, the macro environment must cooperate, investors need to know what they’re doing as well as have the patience and risk tolerance to hold the stocks for the length needed.

Which stock is a better buy in October 2020?

Suncor has a stronger balance sheet than Air Canada. Suncor has an investment-grade S&P credit rating of BBB+ versus Air Canada’s non-investment-grade B+ rating.

That said, in its second-quarter report, Air Canada projected net cash burn of $1.35-$1.6 billion in the third quarter. If this cash-burn pattern continues, the company has the liquidity to keep the business going through Q3 2021.

In any case, both stocks would do much better when the weight from the pandemic situation lightens.

Over the next 12 months, analysts have an average price target that represents 43% upside for Air Canada stock and 85% upside for Suncor stock. Considering the key factors, Suncor is likely a better buy.

The Foolish takeaway

Air Canada stock and Suncor stock can be incredible investments given they survive and ride on future economic growth. In other words, both stocks can make a much stronger comeback than the stock market as the economy recovers.

However, investors must have a high risk tolerance and take an active-investing approach, if they decide to take a position in these cyclical stocks, to aim for outsized returns.

Between the two, Suncor is a safer bet. It has a stronger balance, pays a dividend, and has greater near-term upside potential.