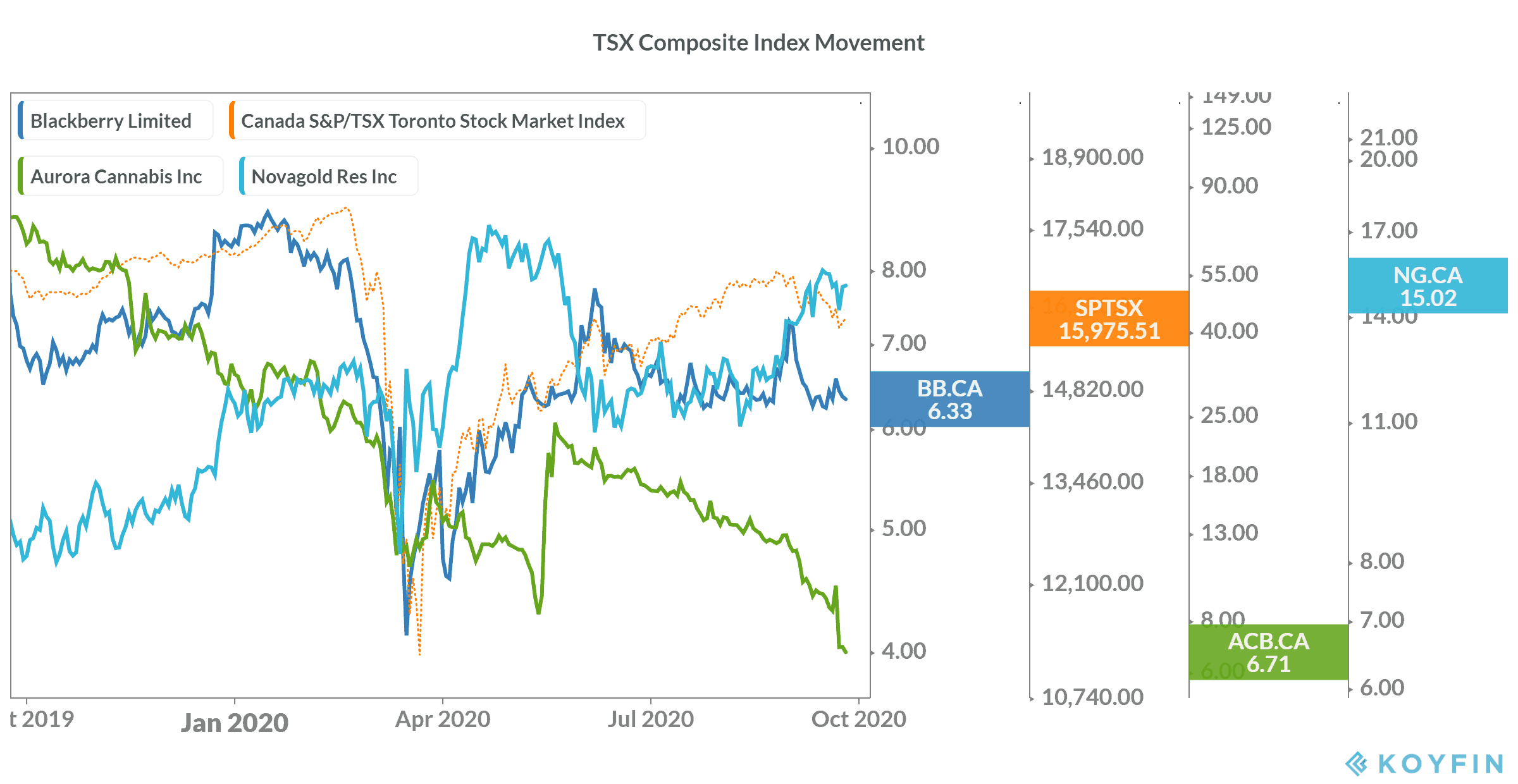

The Toronto Stock Exchange continues to trade on a negative note, as the September sell-off doesn’t seem to be ending. On Friday morning, the TSX Composite Index was down by 0.2%. By Thursday, the index had already shed nearly 2% on a week-to-date basis. The Canadian market benchmark is likely to end the second consecutive week in negative territory.

Earnings released this week

Earlier this week, Aurora Cannabis (TSX:ACB)(NYSE:ACB) reported its disappointing fourth quarter of fiscal 2020 results. During the quarter, the Canadian cannabis producer’s sales tanked by 27% on a year-over-year (YoY) basis to $72.1 million — at par with Bay Street’s expectations.

To add to investors’ worries, Aurora Cannabis missed analysts’ earnings estimates as it reported a record $2.70 net loss per share in Q4. These worries triggered a massive sell-off in its stock on September 23, as it crashed by over 29% for the day.

This year so far, Aurora cannabis stock has lost 79.4%. Some may find its stock to be undervalued. However, I wouldn’t recommend any conservative investor — especially with a low-risk appetite — to buy its stock right now due to the heightened volatility.

On Thursday, BlackBerry (TSX:BB)(NYSE:BB) — the enterprise software and Internet of Things company — announced its second-quarter results. While the company beat analysts’ estimates by a wide margin — its adjusted revenue remained nearly flat on a YoY basis.

Its revenue on a GAAP basis rose by about 6% YoY with rising demand for its security software products and stronger patent licensing business.

A surge in remote work culture drove security software demand higher amid the ongoing pandemic. In contrast, weaker auto production — despite the minor recovery in the recent months — is continuing to hurt its business.

Overall, I still find BlackBerry stock risky due to its heavy reliance on the auto industry and vehicle production.

Upcoming earnings

In the week starting September 28, NovaGold Resources (TSX:NG)(NYSE:NG) will announce its quarterly results. It’s a Vancouver-based company that primarily focuses on the development and exploration of coal mining properties. NovaGold will report its Q3 of fiscal 2020 earnings on October 1.

Estimates suggest that the company would continue to report a net loss of US$8.04 billion in Q3 — nearly flat on a YoY basis.

Recently, investors’ worries about the pandemic-driven economic slowdown have risen. Many gold and silver mining stocks are attracting investors’ attention, as investors consider them safe investment options in difficult times. That’s one of the reasons why NovaGold Resources stock has risen by nearly 30% on a year-to-date basis as compared to about a 7% decline in the TSX Composite Index.

Foolish takeaway

The next couple of months are expected to be highly volatile due to the U.S. general elections and Q3 earnings season. While it’s all right to watch the upcoming earnings carefully, you may want to avoid making any investment decision in a hurry — unless you know exactly what you’re doing.