The TSX Index is starting to give back gains made after the March 2020 market crash. The correction finally provides investors with another chance to buy top dividend stocks at cheap prices.

Should you buy Telus stock during a market crash?

Telus (TSX:T)(NYSE:TU) is one of Canada’s top dividend-growth stocks. The company normally raises the distribution twice per year and typically gives investors and annual raise of 8-10%.

The pandemic will make 2020 an odd year for Telus. The company didn’t hike the payout in the first six months and it is yet unknown if a dividend increase is on the way before 2021. That said, next year should see a return to distribution hikes.

Telus regularly reports the lowest post-paid mobile churn rate in the Canadian communications sector. This is important as it costs a lot of money to attract new subscribers. Telus offers mobile, internet, and TV services to customers across the country. Phone sales dropped in Q2 due to closed retail locations, but that should rebound through the end of the year.

Telus doesn’t own a media business, so it avoided the hit on advertising revenue sustained by its peers.

The pandemic benefitted the health division. Telus Health is Canada’s leading provider of digital solutions to doctors, hospitals, and insurance firms. The group saw a large uptake in its products and services in recent months and the trend should continue well into 2021.

Telus trades near $23 per share at the time of writing and offers a 5% dividend yield. The stock fared better than most during the worst of the market crash and is down from $27 per share in February, so there is decent upside opportunity on a market rebound.

Is Bank of Nova Scotia stock too cheap to ignore?

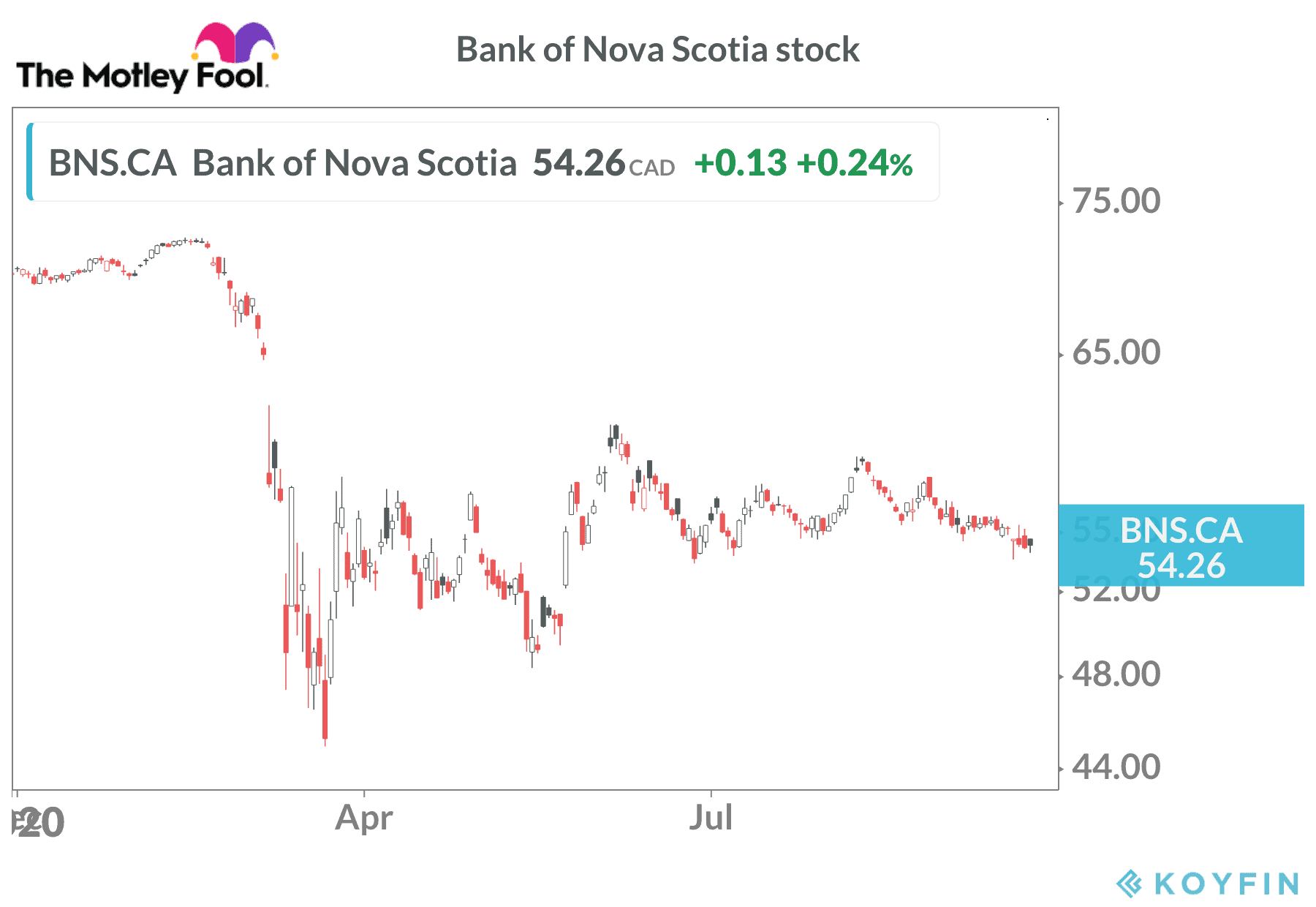

Bank of Nova Scotia (TSX:BNS)(NYSE:BNS) trades at less than 10 times earnings compared to multiples of 11-12 for its peers among the top five Canadian banks.

The discount appears overdone, even if Bank of Nova Scotia’s international operations face steep challenges in the near term.

Bank of Nova Scotia invested billions of dollars in the past decade to build a large presence in Mexico, Chile, Colombia, and Peru. The pandemic continues to hit Latin America hard and the impact to Bank of Nova Scotia’s results are evident in the fiscal Q3 financial results. Bank of Nova Scotia set aside $1.28 billion in provisions for credit losses (PCL) in the international banking operations — a 27% increase over the previous quarter.

Despite the challenges, Bank of Nova Scotia remains a profitable company. The bank generated adjusted net income of $1.3 billion in the quarter, even after the PCL numbers. It is possible the PCL might be overstated and the eventual defaults could turn out to be lower than anticipated.

Bank of Nova Scotia faces turbulence in the near-term, but the stock price likely reflects most of the risk today. Investors can buy the shares for close $54 right now and pick up a 6.65% dividend yield. The stock started the year above $73, so there is attractive potential for gains once the global economy gets back on track.

The bottom line on market crash investments

Telus and Bank of Nova Scotia are top-quality companies with long track records of earnings growth and rising dividends. The stocks appear oversold today and offer above-average yields for buy-and-hold TFSA or RRSP portfolios.